BULL or BEAR ??

| Short term (1 week) | Notes |

|

| -- It is quite surprising that German has to give way to the rest of the European country to agree with their bond purchase. -- All 3 index charts have healthy long term charts, but all three of them are facing with their weekly 20MA line resistance. -- GLD and SLV is again coming down to their support line at their 20MA line or trendline. -- USO and JJC are still weak, but UUP and UNG react on uptrend. -- FXI is still showing more downtrend than uptrend. -- Shipment is still slowly in its uptick. -- All sectors are approaching their resistance lines. -- More scary economic data for the entire week. -- It is interesting that VXX keeps making new low. How low can it go some more? |

SPY (30 years monthly) chart:

Input:

- Long term SPY chart looks healthy.

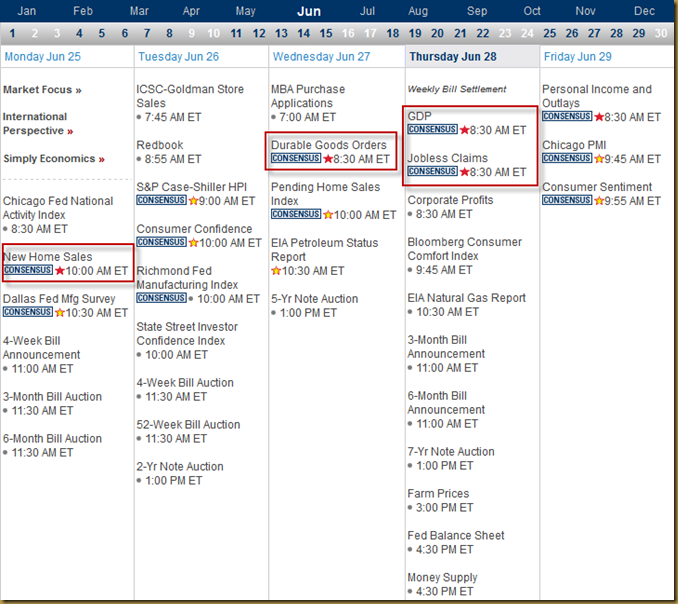

Next Week Economic Data (1 week):

Input:

- Economic data coming out almost everyday. Looks like it is going to be a volatile week.

VXX chart:

Input:

- VXX keeps making new low. Are we going towards a real big bull market?

SPY chart:

Input:

- SPY has again came back up to its weekly 20MA line.

- It may not be able to break this resistance line at this moment.

- Friday's one night rally was big and interesting.

DJIA chart:

Input:

- Similar to SPY, long term DJIA is still healthy, but weekly chart shows that temporary it may not have the power to overtake the weekly 20MA line resistance despite Friday's big rally.

NASDAQ chart:

Input:

- Similar to SPY and DJIA both long and short term.

UUP chart:

Input:

- UUP uptrend still intact.

Sector Analysis:

Input:

- Many sectors are approaching their resistance line.

Copper JJC chart:

Input:

- JJC may not have reverse its downtrend. Secondary indicators are still weak.

GLD and SLV charts:

Input:

- GLD is sitting on its monthly 20MA line. All secondary indicators are showing more downtrend.

- Similarly, SLV is showing bearish trend. All secondary indicators indicating more downtrend is in the pipeline. Price now siting on the trendline.

Petrol and Natural Gas charts:

Input:

- USO is still relatively weak.

- UNG is still acting strong. Weekly chart shows that price is trying to break the resistance line of $20.00. All secondary indicators pointing for more upside movement. Volume is very encouraging.

- UNG could have bottomed at $15.00.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still weak. All secondary indicators are indicating more down trend is in the pipeline.

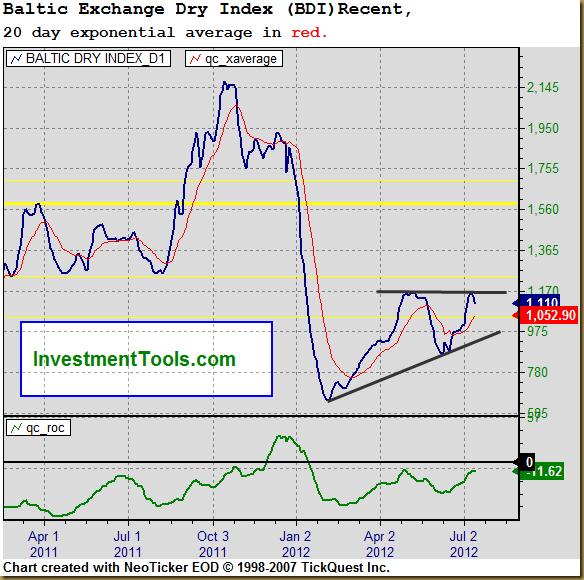

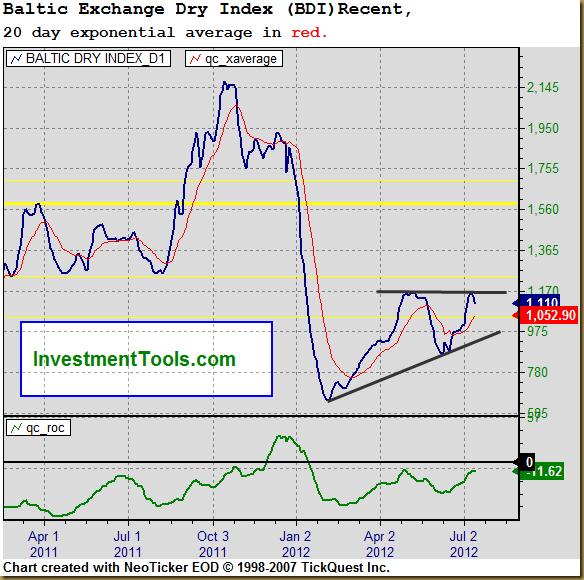

Baltic Dry Index chart:

Input:

- Uptrend is still intact.