| U.S. environmental regulators accused Fiat Chrysler Automobiles NV of using software that allowed illegal emissions in diesel-powered vehicles, the latest broadside in an unprecedented government crackdown on auto makers for alleged pollution transgressions. The Environmental Protection Agency, days before the end of the Obama administration, delivered a violation notice to Fiat Chrysler accusing the auto maker of using illegal software that allowed 104,000 recent diesel-powered Jeep Grand Cherokee sport utilities and Ram pickup trucks to spew toxic emissions beyond legal limits. The affected vehicles have model years ranging between 2014 and 2016. Shares of the auto maker were down 13% in recent trading. The EPA's move came a day after six current and former Volkswagen AG executives were criminally charged in the German auto giant's long-running emissions cheating on nearly 600,000 diesel-powered vehicles in the U.S. Volkswagen separately pleaded guilty to criminal wrongdoing and agreed to pay $4.3 billion in penalties stemming from the long- running deception, which involved installing so-called defeat-device software on cars that allowed them to pollute less during government emissions tests than on the road. That was on top of up to $17.5 billion Volkswagen agreed to pay in previous civil settlements. Officials stopped short of calling Fiat Chrysler's software defeat devices, saying they were continuing to investigate. But they nevertheless accused Fiat Chrysler of illegal activity and said it could cost the company $4.63 billion, based on a $44,539 penalty for each affected vehicle. "This is a clear and serious violation of the Clean Air Act," said EPA Assistant Administrator Cynthia Giles, adding Fiat Chrysler failed to disclose eight so-called auxiliary emission control devices on the vehicles when getting them certified. "AECDs that are not disclosed are illegal." Fiat Chrysler "is disappointed that the EPA has chosen to issue a notice of violation," the auto maker said in a statement. The company "intends to work with the incoming administration to present its case and resolve this matter fairly and equitable and to assure the EPA and FCA US customers that the company's diesel-powered vehicles meet all applicable regulatory requirements." Write to Chester Dawson at chester.dawson@wsj.com and Mike Spector at mike.spector@wsj.com

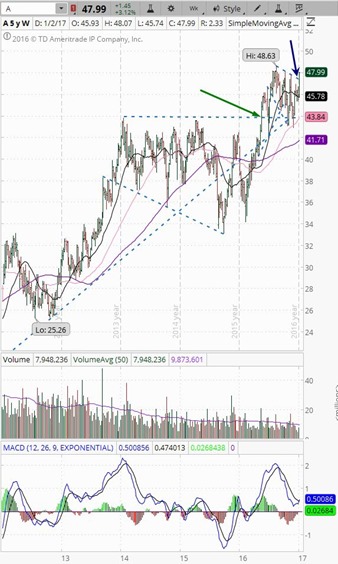

|  Reason for Buy / Sell / Short / Cover:

Reason for Buy / Sell / Short / Cover:

![clip_image001[4] clip_image001[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhs3T70DD7ZdAfp2ikA2f4WYj872tMhBoNk1aMWEfWQUD8IqsdLiT7EvacPQSQxgGBNr4dbhphEzRDxLLNm_6qwqiVeTvhijLBiDAkuYMFbsgKLVTW_ta-8HBMvGewO-VcV0afgqIKx9Xk//?imgmax=800)

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhUK882G4Gcvlcs3okg-OVUDkKKB1OYXqf81VWHZ6yqK0CO-XUMtFdYIwXfhlCoTxmOBU1FyAmJVpYT_bhUBgj-fARru1nznWXcqA4nDfvr_QxPQx0y9wHxXAr5iZ0ZVK24r5EOzhx4k70//?imgmax=800)

![clip_image003[4] clip_image003[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjEjg5U6cj644dILvvRBHIaM52-invmhvG8LPSLMosDm71N7ktXXz2fPHx84uA7XQ1x0akp3XZAyBpF-N17NxNCbRYqdH5i7pJqS-vCgB60BmpJ5_wgxom4Hl7gZ5WSWPtztIkAd9q2TeA//?imgmax=800)

![clip_image004[4] clip_image004[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiNQdfvHt3fP3hPvVTguhrmPAjHO8Ox7JESMHmi3ioFZGTYZGmmHNbs8uPyaCFRKUxEx0IqCXlA4y1q7wocHoi6YWUk8EbEb8QTBfMPEgVjGt9OTawyoU90BTk45o3LQEmOa4faC77P0R0//?imgmax=800)

![clip_image005[4] clip_image005[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEggHRWm4koMzcrXWReD9nY-4SdNJUJJI59iFKxYD54Yy-8FCBjg9yASm7iEHW0NCGbm5gEatZUx1uHvVMQy_xiriJ8ddCft3R6NTZYlNk7bKjOGomeOg9MyLexo4Wdh2XjmgcaVbCxurik//?imgmax=800)

![[clip_image001%255B6%255D.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjT3RdhRickM9bI6rIjuxDQwVnjWC-TVMg7qT49CF3ygIaukbVdMkskVFuz9ODdUhtDywgP4gsQKs3Ydca9H4P1AAQGL8v0UuRk2odlIC_5sdf5Y2q3pAI3d08aOKjKytQnt_lkJ8Xxb_w/s1600/clip_image001%25255B6%25255D.jpg)

Reason for

Reason for

![clip_image001[4] clip_image001[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj-kO_9_gSkRzbL4Os9xdUKewtJ38eOiXwaXGVlZcrEGwH7m6OvJa0Vc5xjVbWBL6FYnMpyIlGUdPnOZjned2mRA-shoqh89G5VBgXkUs4-K0BmU3grg80a34zCvSbP6Js0NNmC_fcQD8s//?imgmax=800)

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjpXlujlKsf3tP6iew0FzoI_-E3PeznsrCcJgv2SSSbuKexHiYsS36Kh27sAE_PLU7t-7t5zgllZFxZYGzmdfc288GGaNjU5Yy9X3f9k7ajTIXOF1_EMjQQScr8tHd5HobN0Gh1eurzn_k//?imgmax=800)