Ticker:

- STEM

Topic:

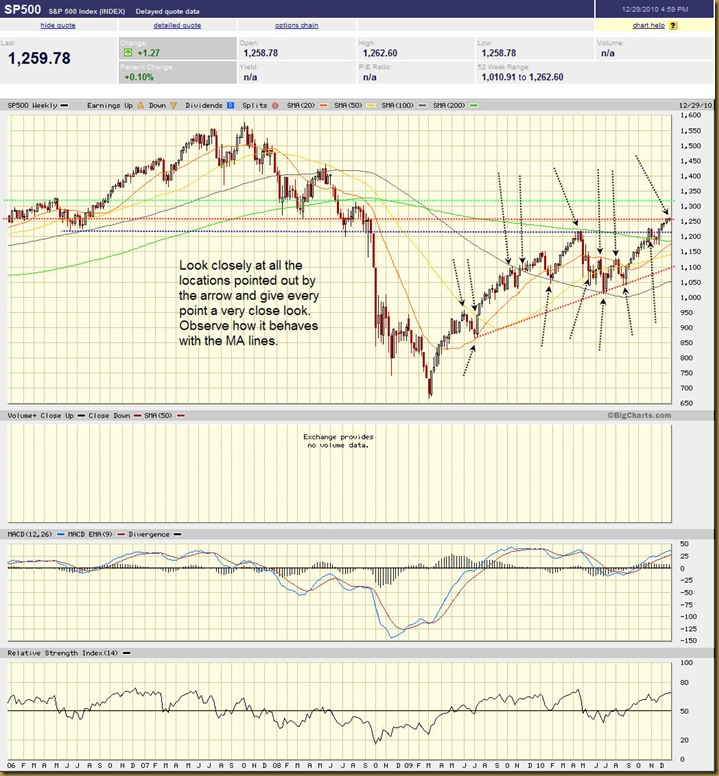

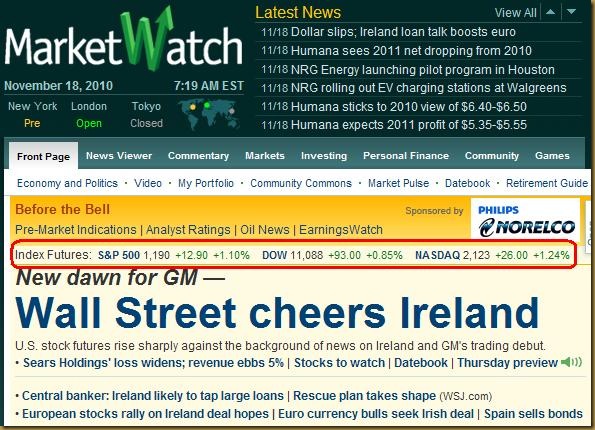

- This example shows that all patterns are valid either they are stock that > USD100.00 or < USD1.00

Lesson Learnt:

- There are many "obvious" and "safe" entry points if one pays very close attention.

- Check out the "KILLER spot". This one can get a trader kill pretty easily. This is quite common in this kind of BIO stock.

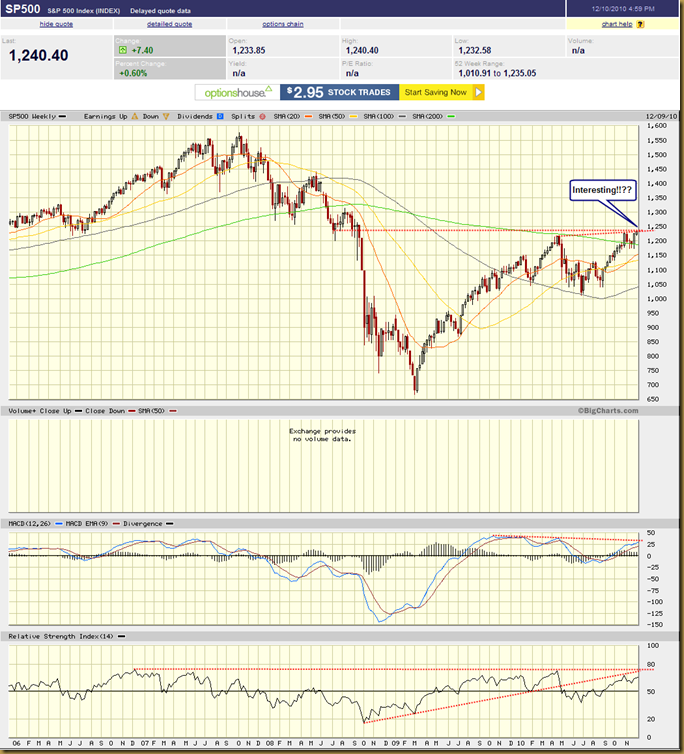

- The chart is forming a very interesting triangle NOW. Question now is --- Will it form the 1Million $ entry point for you to get in? And will you dare to get in? And if you get in, where should you set your stop loss point?