- ENER

Topic:

- Is ENER gaining back his ENERgy?!

Lesson Learnt:

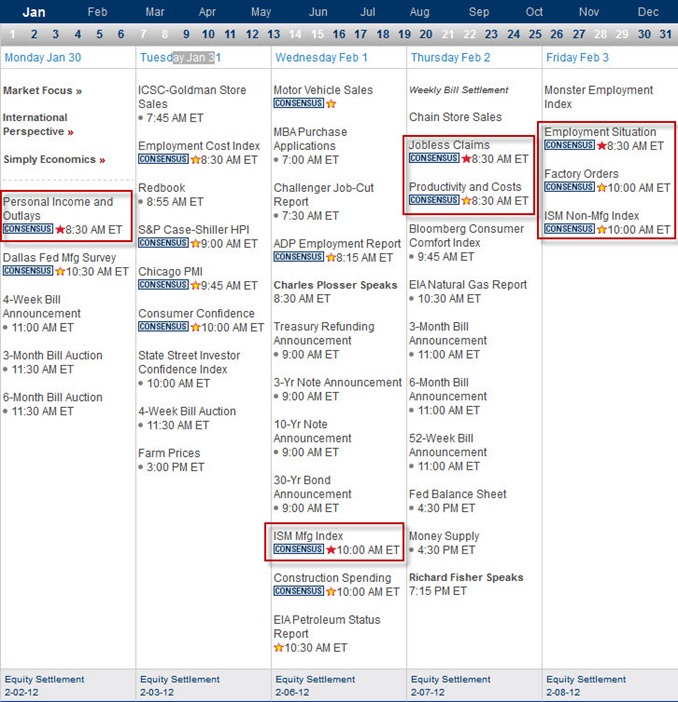

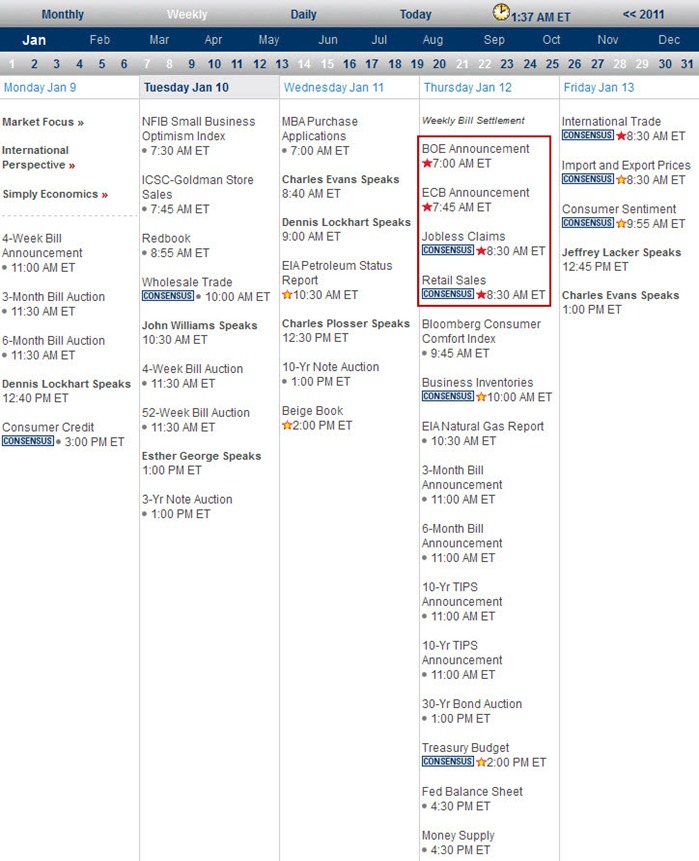

- Intraday shows that it is getting back to up trend.

- Daily chart shows that it has now successfully overtake the 20MA line and now resting at its 50MA line.

- Volume was tremendously great. Even more impressive looking at the monthly chart.

- This can be a very speculative trade. So trade with your own risk. A good entry price is very important.