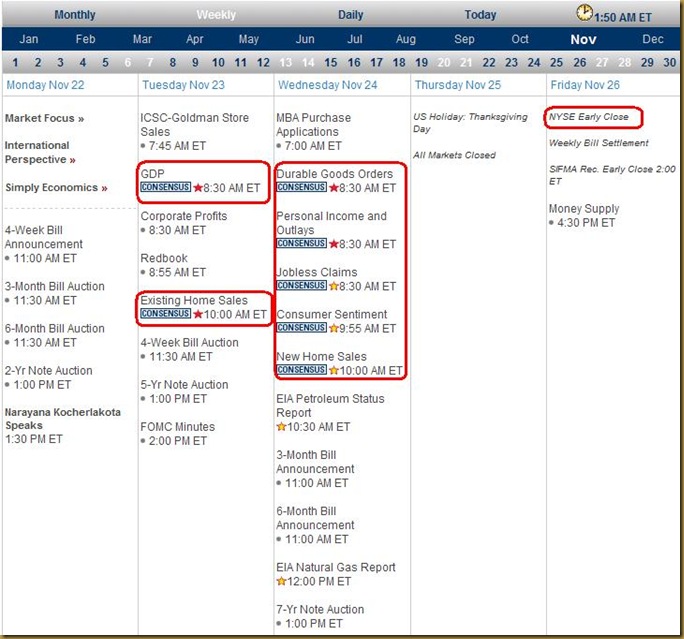

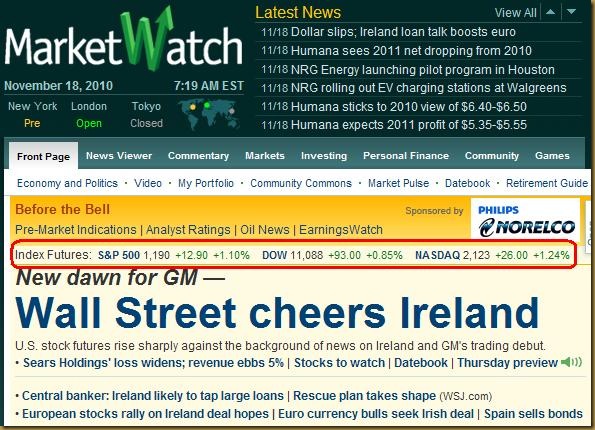

Ticker:

- UUP

Topic:

- Pay attention to this guy - especially NOW.

Lesson Learnt:

- The double bottom formation has already warn you that the crash will come last week. I did not pay attention to it at all.

- The double bottom was obvious.

- Watch out the daily chart when the 20MA line comes in and give support to the UUP.

- I could have just got in UUP at $22.00. Everything was so obvious.