BULL or BEAR ??

| Short term (1 week) | Notes |

|

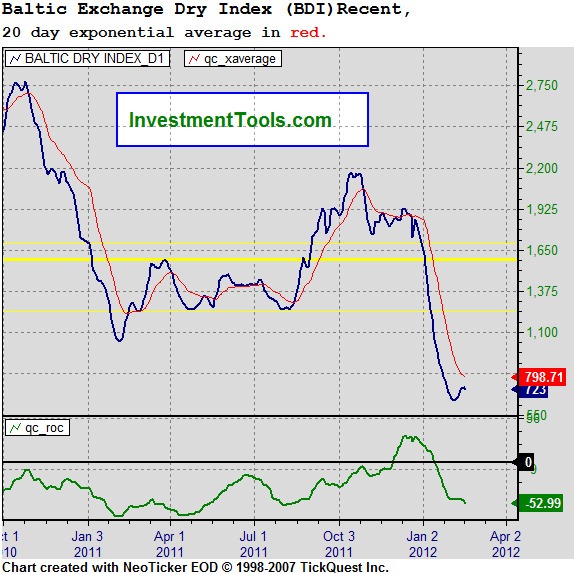

| -- DJIA has managed to take out its May 2011 high. Now SPY is the only index that is still challenging its May 2011 high. All 3 indexes have very healthy long term and short term charts. -- VXX daily chart came to a daily double bottom pattern. Pay attention to it. Long term VXX chart is also coming to a multiple bottom formation. Pay more attention to this multiple bottom long term formation. -- UUP still shows that it is still in the downtrend path. -- All sectors are showing healthy chart development. -- GLD and SLV both had good and strong rally last week. -- FXI is cautiously optimistic approaching its long term 20MA line. Same apply to the copper chart. -- Shipment baltic chart is still extremely weak. Most shipping stocks are making correction after a strong rally last week. -- The rally is USO is not a good thing for the market since it is driven more by the Iran issue than because of improvement in economy. |

SPY (30 years monthly) chart:

Input:

- Long term SPY chart looking good and healthy.

- Bull market continues.

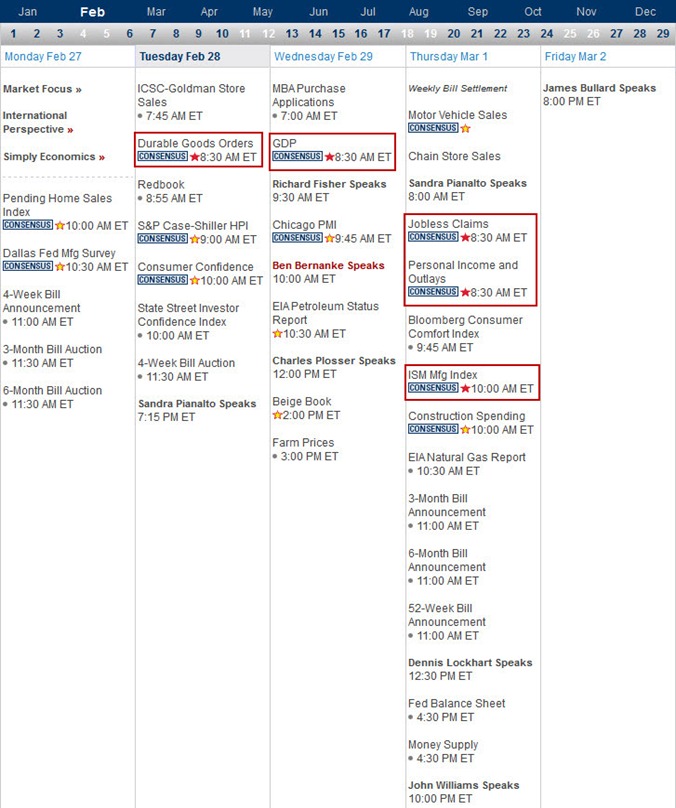

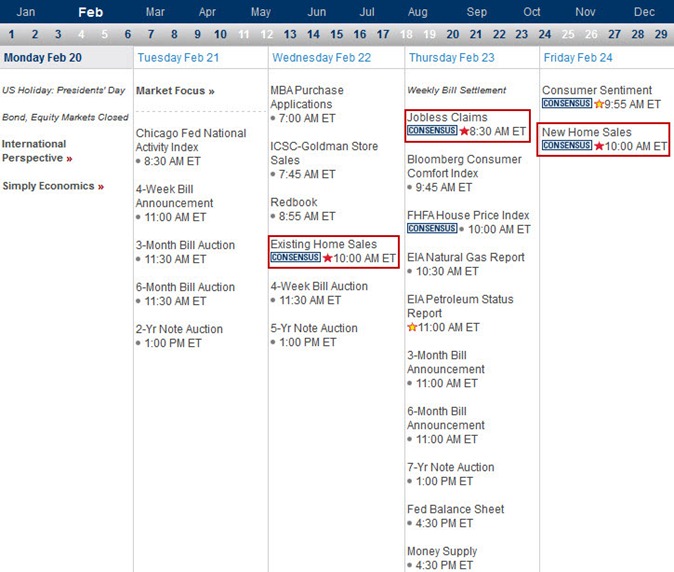

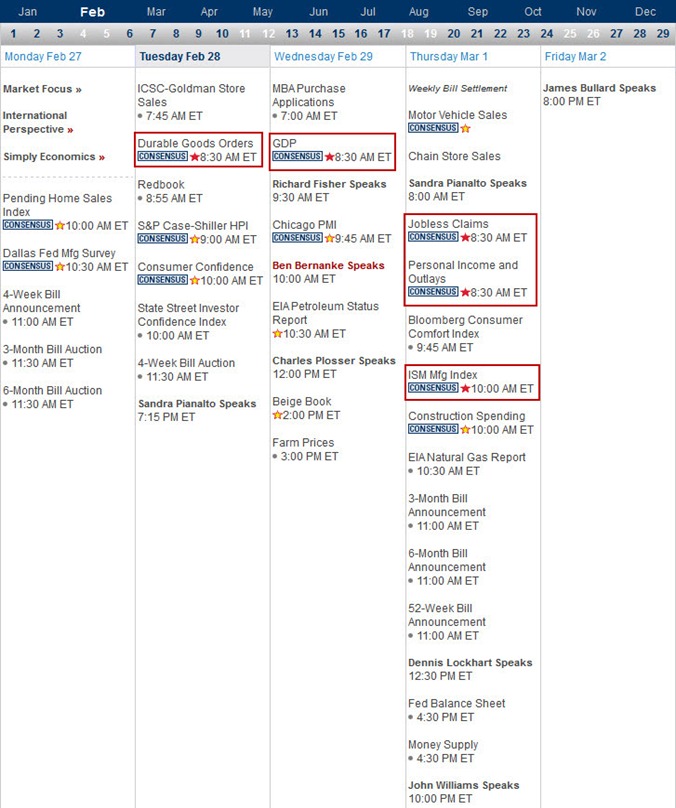

Next Week Economic Data (1 week):

Input:

- Not much data will be out next week except GDP. Volatility should not be a big concern.

VXX chart:

Input:

- A short term daily double bottom for VXX is observed.

SPY chart:

Input:

- Daily SPY chart shows that it is still challenging its previous May 2011 top.

DJIA chart:

Input:

- Daily DJIA chart successfully overtake the previous May 2011 high. This is a very bullish signal.

NASDAQ chart:

Input:

- Long term NASDAQ chart shows very healthy and bullish trend.

- It is still the leading index among the 3 indexes.

UUP chart:

Input:

- As expected, UUP is still under the pressure of its long term 20MA line pressure. Continue its slide.

Sector Analysis:

Input:

- All sectors are in nice and healthy uptrend.

Copper JJC chart:

Input:

- Copper long term chart still under the pressure of the 20MA line. However, the direction is still in the uptrend. This should be a good indicator for the market.

GLD and SLV charts:

Input:

- Both GLD and SLV has some fantastic rally last week.

Petrol and Natural Gas charts:

Input:

- The Iran issue is creating panic in oil price.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Long term FXI still under the pressure of its 20MA line. However, its direction is still in the uptrend. The chart is pretty similar to the long term chart of copper.

- Cautiously Optimistic could be a better description.

Baltic Dry Index chart:

Input:

- Shipping Baltic index is still very weak.

- All the shipping stocks are making correction after so much of big run past week.