BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

|

-- SPY and NASDAQ have shown strong rebound. -- DJIA has shown rebound even though its daily chart still under the 20MA line. -- All 3 indexes still stay above its uptrend lines. -- All sectors have shown rebound on their 50MA lines. XLE goes even much higher. -- Not much economy data coming week. -- Libya problem will only benefit USA. |

-- FXI daily chart still in the downtrend. -- FXI weekly chart shows a very critical point now and downward thrust is more likely. -- 20MA line is acting more like a resistance line for DJIA now. -- After about 4 months time, this is the first time VXX daily chart poke through the 50MA line and came back. -- UUP is extremely close to the multiple bottom line. |

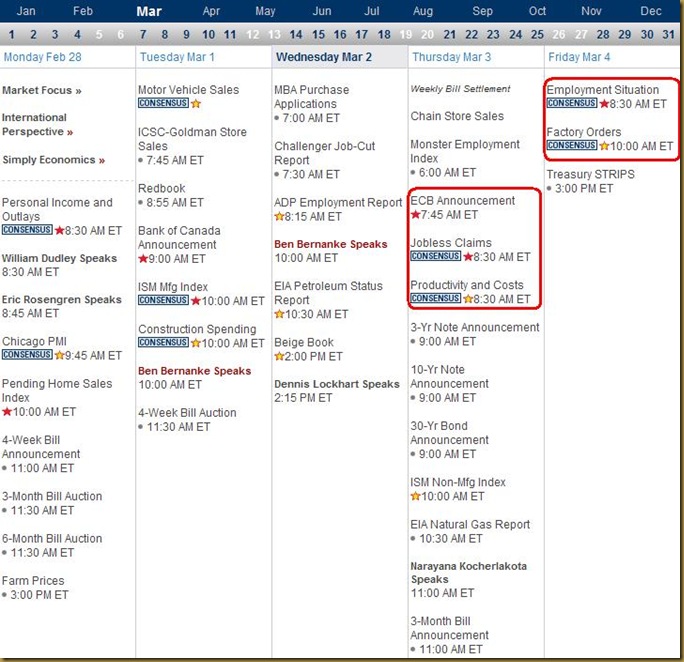

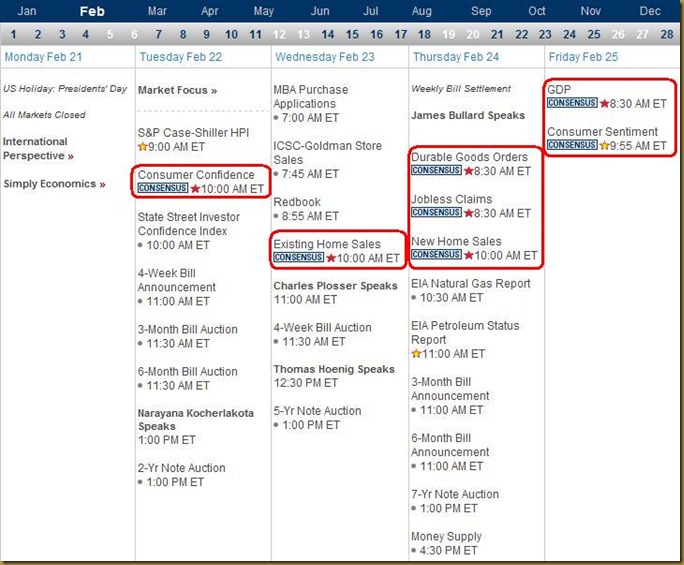

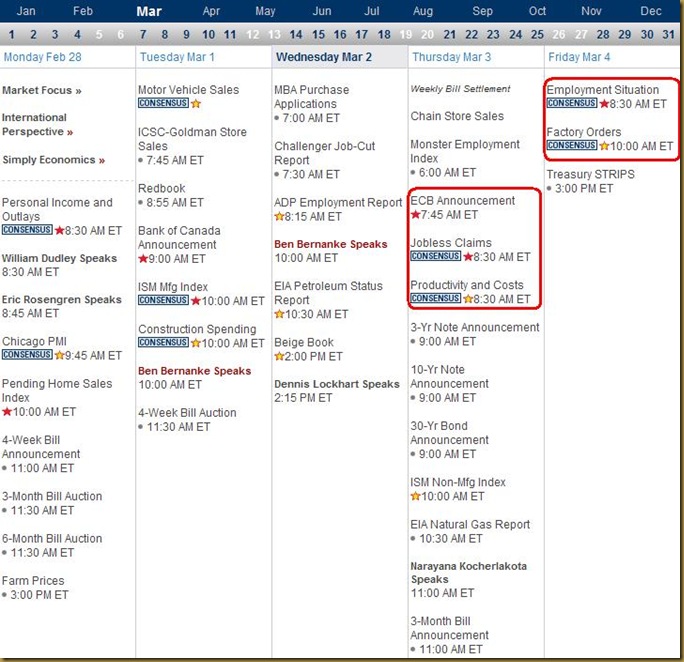

Next Week Economic Data:

Input:

- Not much economy data is expected coming week, except on Thursday and Friday.

- Expect the current index rebound to continue in coming week.

- Now only depend on the Libya situation, but then again, the stock marker has basically digested that. Don't think that Libya situation is going to hurt the market anymore.

VXX chart:

Input:

- The stable down of VXX is actually expected.

- However, watch out when it comes to the 20MA line. If it is quite stable at 20MA line, market might be in danger.

- This is the first time it poke through the 50MA line after such a long time. This might be a hint for the BULL.

- High volume and upward MACD on the weekly chart shows that a change of direction might be in place soon.

SPY chart:

Input:

- SPY daily and weekly char all looks fine and intact.

- MA lines and trend lines are not broken.

- MCD and RSI indicator are all in uptrend.

DJIA chart:

Input:

- DJIA chart is not as healthy as SPY. It is retesting the 20MA line which now act as resistance.

- Weekly chart is still intact and healthy. Not a time to get panic yet.

NASDAQ chart:

Input:

- NASDAQ rebound strongly. Good positive sign.

- MA lines and trend lines are again intact and healthy both for daily and weekly charts

UUP chart:

Input:

- The retreat of UUP justify for the rebound of indexes.

- However, watch out closely on the point 22.00 at UUP weekly chart. See where it is heading.

Sector Analysis:

Input:

- All sectors rebound at 50MA line. A very healthy correction indeed.

- XLE goes even higher due to instability of middle east.

GLD, SLV, Natural Gas and UUP charts:

Input:

- GLD and SLV seems to be at the correction point.

- UNG started to rebound.

- USO seems to be at correction point as well. Expect middle east problem to get "resolved" soon.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Daily FXI chart is still at the down trend channel and still intact.

- However, weekly chart indicated that it is at a critical junction. Downward trust seems to be more likely supported by the MACD, TMF, . This can be a threat to the world indexes.

Baltic Dry Index chart:

Input:

- No improvement in shipping index.

- Don’t go neat the shipping stock yet.