BULL or BEAR ??

| Short term (1 week) | Notes |

|

| -- Shipping Baltic index is in the positive move. -- All 3 indexes are still in the positive range despite some downturn last week. Have to take last week downturn as only a minor correction. NASDAQ is the strongest where it is hard to see the downturn last week. -- Important economy data will be out on Wednesday and Thursday. Don't be surprise for some volatility. -- The VXX downward move indicating that we should expect a bull market in the short term moving forward. -- China FXI is not healthy. How is China index going to spill over to the United States is yet to be seen. |

SPY (30 years monthly) chart:

Input:

- SPY is still healthy. All long term secondary indicators are going in the positive direction.

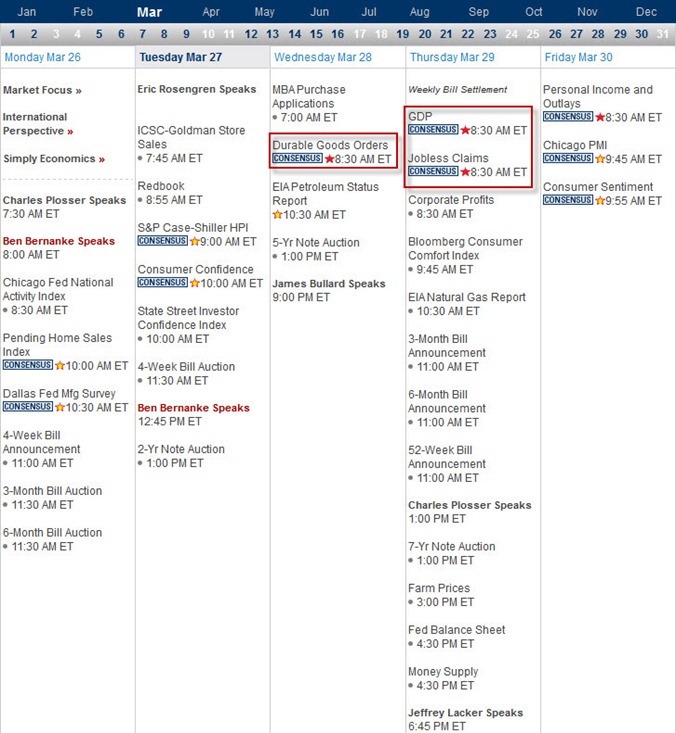

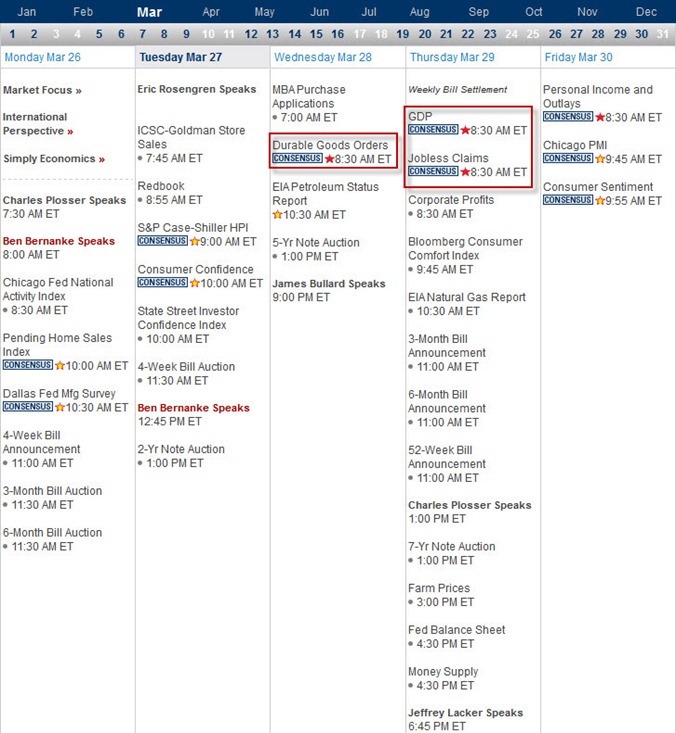

Next Week Economic Data (1 week):

Input:

- Important data coming out on Wednesday and Thursday. Should give some kind of volatility to the market on that 2 days.

- Expect the market to follow the bull move at the beginning of week.

VXX chart:

Input:

- Long term monthly VXX chart indicating that its value has broken down from the previous base that it had built on from May to July 2011. Volume is also building up heavily.

- Daily chart shows that the value has dropped below its support line again with high volume. All secondary indicators are at the negative direction.

SPY chart:

Input:

- Daily SPY chart shows that it rebound from 20MA line. This is a good sign.

DJIA chart:

Input:

- Long term DJIA chart shows that it is still healthy. All secondary indicators are still in the positive direction. However, volume is low.

- Daily chart shows that value touched the 20MA line and start to rebound. Similar to SPY daily chart.

- High volume down day on Friday looks very similar to mid Dec 2011 high volume down day which actually brought in the bull market.

NASDAQ chart:

Input:

- Long term NASDAQ chart looks healthy. All secondary indicators are in the positive direction. Again, with low volume.

- Daily NASDAQ chart doesn't seems to indicate any downturn at all like what had happened to SPY and DJIA. It shows the power of technology stocks.

- The downturn last week is not even able to bring its value back to its 20MA line.

UUP chart:

Input:

- UUP is now in a very undecided stage. Its direction is very important and will decide the direction of market too.

Sector Analysis:

Input:

- Financial sectors is one of the best performing sector so far. This is quite a good news for stock market. Should expect a bull move towards stock market.

- Basic material and energy sectors are slightly lower in comparison.

Copper JJC chart:

Input:

- Weekly JJC chart shows that it is still fighting within a tight range of $47.70 ~ $50.00.

- 20MA line is its support and 50MA and 100MA lines are acting as resistance lines.

GLD and SLV charts:

Input:

- Monthly GLD chart shows that GLD is still searching for its direction. However, secondary indicators are getting into negative direction.

- Daily GLD chart shows that $164.00 can be a safe shorting position.

- Daily SLV chart shows that $33.00 is a safe shorting position.

Petrol and Natural Gas charts:

Input:

- Monthly chart shows that USO still in the uptrend position.

- Daily USO chart shows that it is now in the consolidation before the next possible up move.

- Monthly UNG chart indicates that the downtrend of UNG is pretty hard to stop in the near term. Volume was pretty intense for these three months. In fact volume were the highest of all decades for UNG.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is looking pretty bad shape. It is not only able to overtake the long term 20MA line, it is now even broke down the uptrend line.

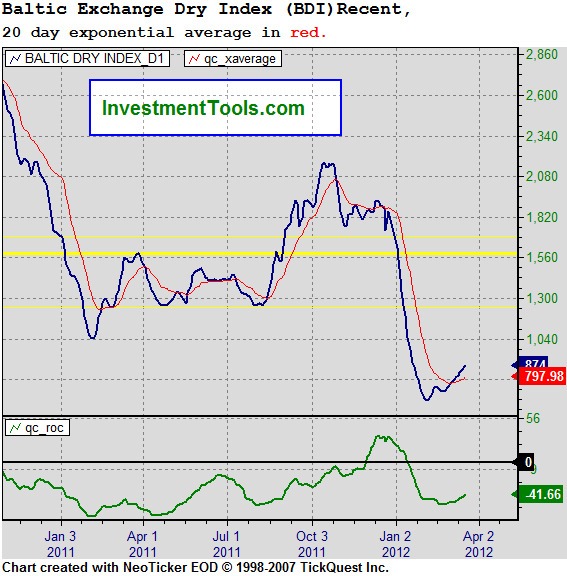

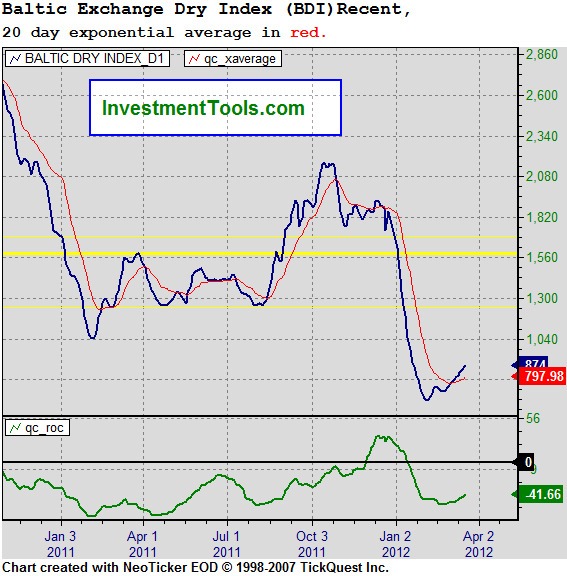

Baltic Dry Index chart:

Input:

- Shipping Baltic index is indicating positive move.

- Some shipping stocks are quite interesting for entry position.