BULL or BEAR ??

| Short term (1 week) | Notes |

| -- GLD and SLV charts have started to shows strong possibility of downtrend. What is that going to mean to the market? -- All sectors are now hitting at the top limit lines. Retracement is highly expected. -- Shipping index is still on its uptrend. -- UNG is going straight to hell. |

SPY (30 years monthly) chart:

Input:

- Long term SPY chart is pretty bullish. Price remain above the 20MA line and the trend line.

Next Week Economic Data (1 week):

Input:

- Heavy data week. Retail Sales, CPI and PPI all in. Volatility will be pretty high at end of week.

VXX chart:

Input:

- Daily VXX chart shows a Bearish candle breaking down the 100MA line again. Expect it to retest the support line at around 36.00. Watch out for strong rebound.

SPY chart:

Input:

- Daily SPY chart shows that the price has came all the way back up to retest the 200MA line and trend line. A very bullish act. However, please expect a short term retracement before the next leg up.

- Daily chart shows that the next support is at 123.00 with 20MA and 50MA lines.

DJIA chart:

Input:

- Daily DJIA chart shows that it has strong support from its 200MA line.

- Weekly chart shows that support is at 50MA line.

NASDAQ chart:

Input:

- NASDAQ is the only index that is lagging behind of all 3 indexes.

- Daily NASDAQ chart shows that it is facing resistance from 200MA line.

- Weekly chart facing resistance from 50MA line.

UUP chart:

Input:

- UUP uptrend is still intact, this is not a very good news for equity.

Sector Analysis:

Input:

- As the charts showed, many sectors have hit the top limit. Correction is highly expected.

Copper JJC chart:

Input:

- JJC is dropping back to its 20MA and 50MA support lines.

GLD and SLV charts:

Input:

- GLD and SLV downtrend looks like just got started.

Petrol and Natural Gas charts:

Input:

- USO is resting on its 200MA support line.

- Way to go…. UNG!!!

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI daily chart still face resistance from its trend line and 20MA and 100MA lines.

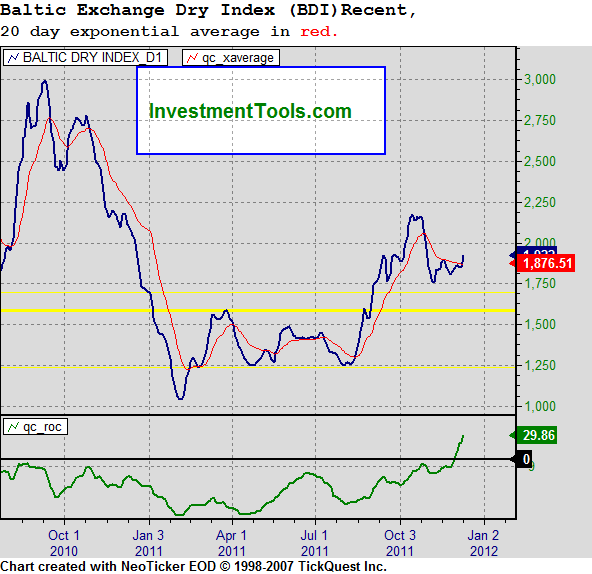

Baltic Dry Index chart:

Input:

- Baltic shipping index is pretty encouraging.

No comments:

Post a Comment