BULL or BEAR ??

| Short term (1 week) | Notes |

| -- VXX is coming to a double bottom. Have to expect a short term correction. -- All three indexes are showing positive development, however, volume is too low, which raise a question on its sustainability going forward. All secondary indicators are in positive direction. -- All sectors are indicating healthy development. XLF is coming to the top part of the uptrend line. Correction is expected soon. -- Shipment Baltic index has crossed the 20MA line. A positive development for shipping stocks. Shipping stocks are also developing positive chart trend. -- UUP uptrend is still intact and more uptrend is expected. GLD and SLV remain weak and could be short candidates soon. -- FXI still remain weak and not able to take its long resistance 20MA line. -- Copper uptrend is still a mystery. -- USO uptrend is firmed and steady. Natural gas is now in progress of establishing a bottom. Looking pretty interesting and posting a good and safe entry point. |

SPY (30 years monthly) chart:

Input:

- We have a strong SPY performance; however, volume is getting too much lower.

- All secondary indicators are showing positive direction.

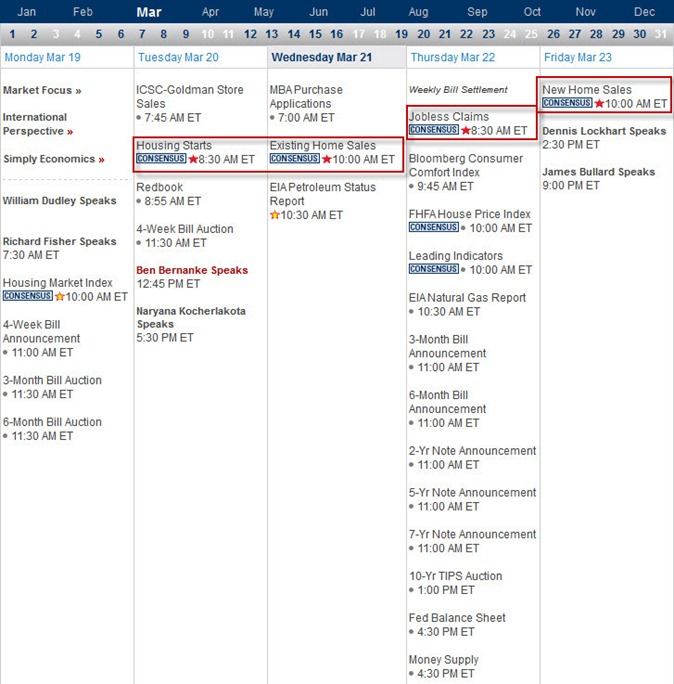

Next Week Economic Data (1 week):

Input:

- Data coming out everyday. This should give the kind of volatility that VXX chart is showing.

VXX chart:

Input:

- We are going to see a double bottom for VXX, this is a dangerous sign.

SPY chart:

Input:

- Weekly SPY chart shows healthy condition.

- Volume is decreasing.

DJIA chart:

Input:

- Similar to SPY, DJIA is strong. All secondary indicators are indicating positive direction.

- Similar to SPY, volume is getting lesser and lesser.

NASDAQ chart:

Input:

- Similar to SPY and DJIA.

UUP chart:

Input:

- UUP uptrend is still intact. Price is now in between the uptrend line and the 20MA line. In fact, price has started to protrude the 20MA resistance line.

- This should be a bad sign for GLD and SLV.

Sector Analysis:

Input:

- All sectors look healthy. XLF has reached the top part of uptrend line. Pay attention to it. Sort term correction might be in the pipeline.

Copper JJC chart:

Input:

- Copper price is still staying above the support line, but still facing resistance from both 50AM and 100MA lines.

- Its direction is important.

GLD and SLV charts:

Input:

- Daily chart shows that GLD is getting weaker and weaker. Its price is now below all its MA lines.

- Daily chart also shows that its best shoring price could be $165.00.

- Long term GLD chart shows that uptrend is still pretty much intact, but the price is going to retest its uptrend line soon. MACD has also gone into negative territory for the first time after more than 2 years.

- Daily SLV chart also showing weakness. Price is now below all MA lines and now resting on 200MA line.

- Long term SLV chart shows the down trend line remain intact and the price is now retesting the 20MA line again. MACD is also showing negative direction.

- Best shoring point for SLV could be at $33.00.

Petrol and Natural Gas charts:

Input:

- USO uptrend remain intact.

- Intraday UNG showing interesting turning pivot point. Could this be the bottom for UNG?

- Weekly UNG chart does not indicate a bottom yet, but volume is very encouraging.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still struggling with its 20MA line. Secondary indicators are still pretty weak.

- It has potential going downward.

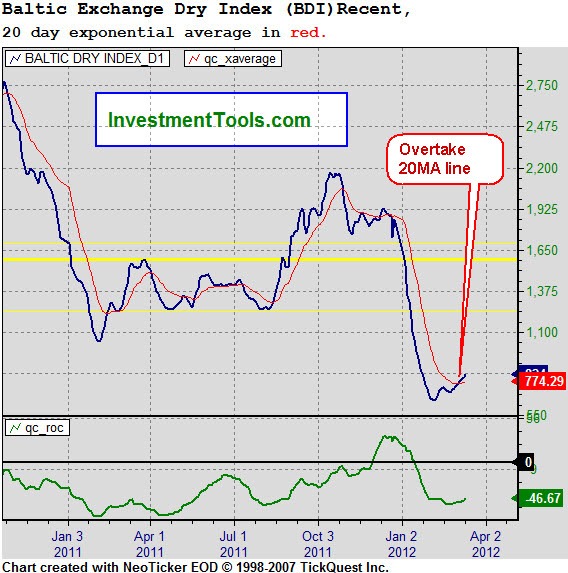

Baltic Dry Index chart:

Input:

- A good sign for shipping index.

No comments:

Post a Comment