BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

| -- This short term bull is kind of weak now. -- A burst in the UUP can kill this Bull right in the head. | -- Major support line is not broken yet even though they are penetrated and came back. |

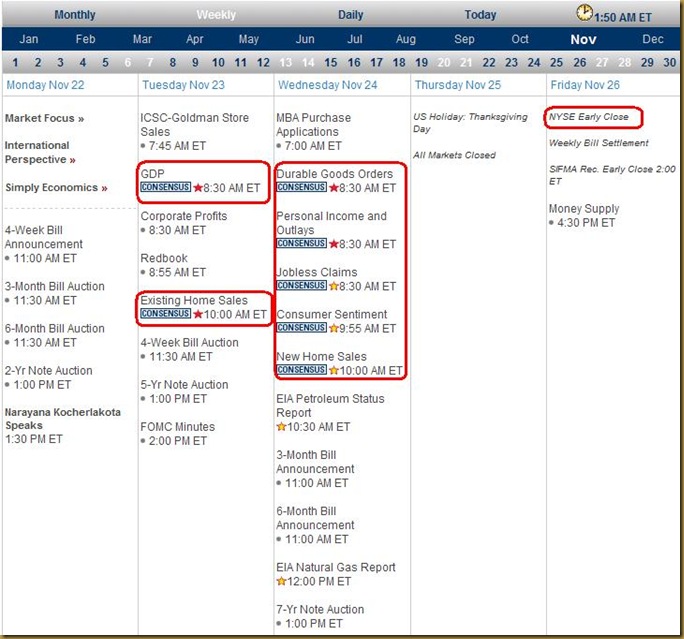

Next Week Economic Data:

Input:

- Heavy data on Tuesday and Wednesday

- Holiday on Thursday and half day session on Friday. Could bring some volatility.

VXX chart:

Input:

- The VXX daily chart shows that it has come to the bottom again. This can be a double-edge sword.

- WATCH OUT!!!

SPY chart:

Input:

- Intraday SPY chart broke through the trend line and also its 20MA and 50MA line, which gives confident on the up trend.

- Daily chart SPY shows that it has finally come on top of 20MA line. However it is still beneath the thick blue trend line.

- Weekly chart shows that it is still able to stay on top of 200MA line even though it poke through it at the beginning of the week.

- I consider this indication as "Bull is still intact".

DJIA chart:

Input:

- Intraday DJIA chart broke through the trend line and also its 20MA and 50MA line, which gives confident on the up trend like SPY.

- Daily DJIA chart shows that it is still beneath 20MA line. So be CAREFULL on this.

- Weekly chart shows that it had touched the 200MA line and rebound back. Hope that this is a healthy sign for a much stronger BULL coming in the pipeline.

NASDAQ chart:

Input:

- Intraday NASDAQ chart shows that is hs penetrated the 20MA and 50MA line.

- Daily NASDAQ chart shows that it is still beneath the 20MA line. WATCH OUT!!!

- Weekly NASDAQ chart shows that it is still beneath the April high.

UUP chart:

Input:

- Hope that the 20MA and 50MA lines will keep the intraday chart up UUP lower.

- On daily chart it is sitting on the trend line. Watch out for the support coming in from the 20MA line. That might lift the USD$$$.

- I don't understand why after QE2, UUP reverse up instead. Is it just because of China raise interest rate?

- Weekly chart shows that UUP is still in bullish mode. Pay close attention to this guy. This is not good for stock.

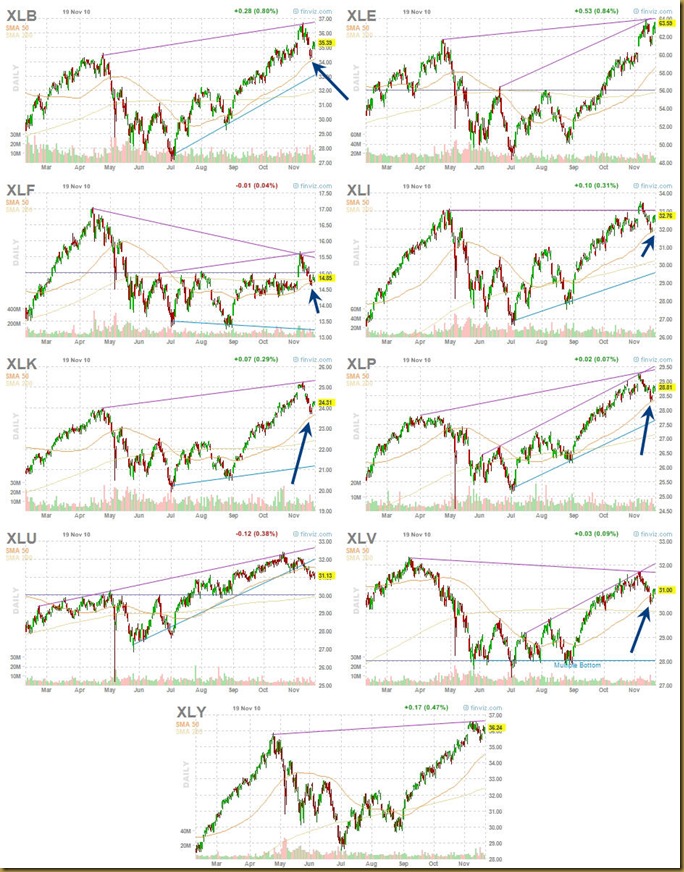

Sector Analysis:

Input:

- Most of them rebound at the 50MA line.

GLD, SLV and UUP charts:

Input:

- GLD rebound at the 50MA line just like most sectors.

- USO was hit badly just in one week time. This might be some kind of indicator what is going to come next. Anyway, it is always a reverse of UUP.

- UNG is getting interesting again.

- UUP is the one to really watch for.

No comments:

Post a Comment