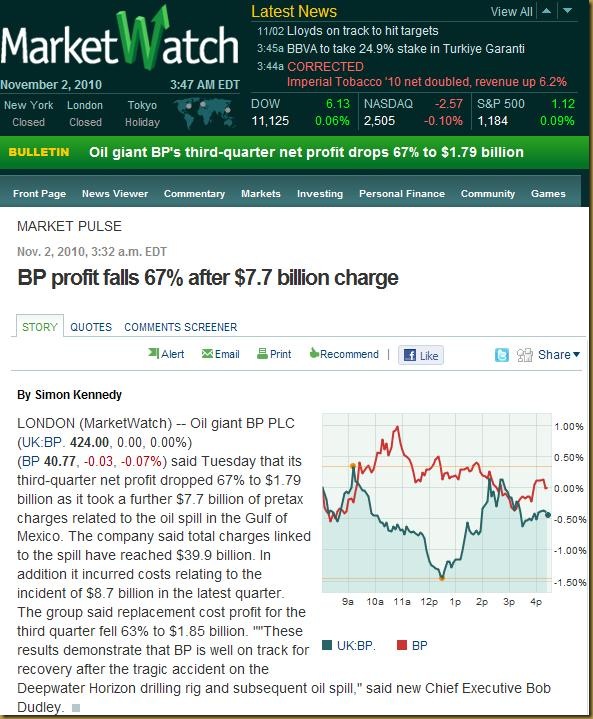

- Net Profit drop but stock went up. This hurts

| Buy $ | Sell $ | Sell Short $ | Buy Back $ | Stop Loss $ | Profit / Losses |

|

|

|

|

|

|

|

Reason for Buy / Sell / Sell Short / Buy Back:

- -NA-

Lesson Learnt:

- I should have sell when the market opens where it gap to $41.25 which is also the top part of intraday trend line.

- I think I have to find a way to buy to recover for this stock before it even reach my stop loss.

- Will see how volatility tonight (FOMC) can help me or …. Destroy me.

| Intraday Chart |

|

MarketWatch First Take Nov. 2, 2010, 7:08 p.m. EDT BP’s accidental stakeholders Commentary: Gulf Coast needs profits to safeguard payouts By MarketWatch SAN FRANCISCO (MarketWatch) — After being tarred and feathered in the marketplace, BP is clawing its way back. And the Gulf Coast couldn’t be happier. On Tuesday, London-based BP PLC (NYSE:BP) posted a net profit of $1.79 billion. That’s down 67% from a year ago, but it’s also a return to profit after a second-quarter loss of $17 billion. More importantly, it’s better than the analysts expected, and it offers further evidence that the company is getting the upper hand on the crisis that nearly sank it. See full story on BP's latest results. Today’s upbeat report is in sharp contrast to those first dark weeks following the April 20 Deepwater Horizon blowout, when BP was staring at a very real threat of bankruptcy. As the magnitude of the Gulf spill became clear and it became equally clear BP’s plan to cap the well was no more than a trial-and-error exercise, investors fled. Oil traders also fled, wary of doing business with a wounded giant. And the ratings agencies put BP on credit-watch negative, the first step toward costly downgrades. About the time Washington jumped on board the public outrage, BP’s dividend was toast. On June 16, the company officially suspended dividend payments. A week later the stock’s stock bottomed out at $58.86 a share in New York, having had more than half of its pre-blowout market value wiped out. Meanwhile, the cost of the spill continues to grow. BP is already on the hook to raise $20 billion to fund claims against it. Today, the company took an additional $7.7 billion charge against earnings to cover the cost of capping the well, a task that took nearly three months and cost way more than expected. The failed ‘preventer’ Unedited video shows the failed blowout preventer that unleashed the Deepwater Horizon oil spill being lifted from the well this autumn. That’s all in the past now. The legal wrangling over culpability for the spill is still in the early stages, and there are billions of dollars in damages to be doled out. But only if BP stays healthy. In the space of six months, BP has gone from demon to cash cow. Where does this leave investors? When does BP get a clean bill of health? Not until it restores its dividend. The company has said that could happen in February, when it announces its 2010 full-year results. They might still be cleaning tarballs off the beaches down south, but BP’s fall from grace does not preclude financial redemption. Just ask any of its newfound stakeholders on the Gulf Coast.

Pasted from <http://www.marketwatch.com/story/story/print?guid=19459E52-E6BB-11DF-ABF6-002128040CF6>

|

| Historical Chart |

|

|

No comments:

Post a Comment