BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

| -- There is basically "nothing" that comes to stop the rally. -- VXX has no sign of bottom yet. -- Watch out for all time high NASDAQ. -- SPY could be in progress of forming a head-n-shoulder if you look at it from helicopter point of view, but even that, it has a long way to go up before the right shoulder is formed. -- UUP still has some time before it comes to form a multiple bottom. -- Many sectors have poke through its uptrend line upward. -- GLD still embarked on its downtrend while SLV could follow with a possible head-n-shoulder formation. -- FXI is somehow at a critical junction. Friday's USA rally should help to rally FXI market. -- Murbarak from Egypt stepping down. -- UNG is the weird one. What a toxic gas. | -- From now on, I think I will this column blank. -- So far, I don’t think this column helps me. It does not do any harm, but….. |

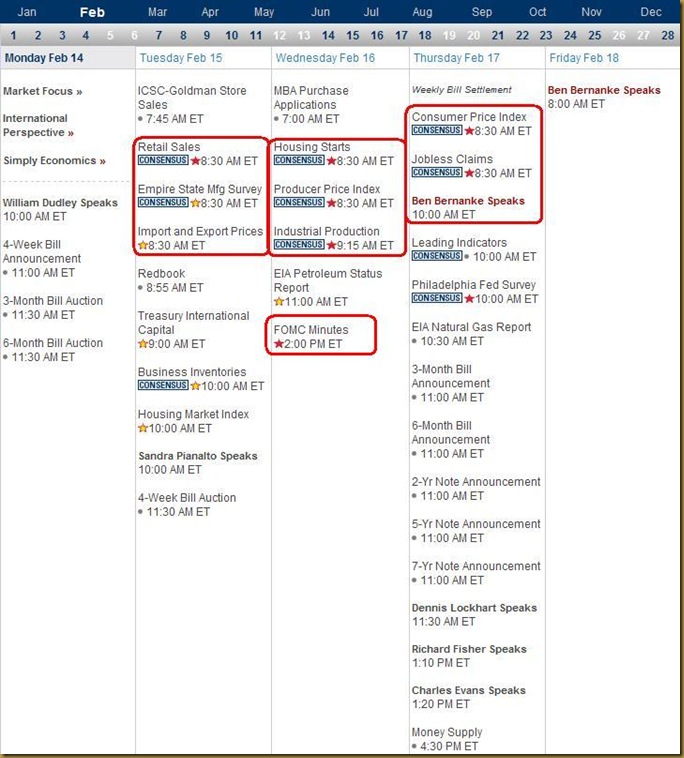

Next Week Economic Data:

Input:

- A bit of important data coming out. Expect a bit of volatility in the middle of week.

VXX chart:

Input:

- The VXX chart looks really crazy, but you just have to accept it. You have no idea how low can it still go.

SPY chart:

Input:

- What a BULL market.

DJIA chart:

Input:

- Very Bullish.

NASDAQ chart:

Input:

- NASDAQ is hitting an all time high. What is it going to bring us to?

UUP chart:

Input:

- UUP down trend is still intact. Watch out for multiple bottom formation.

Sector Analysis:

Input:

- Many sectors have gone beyond its uptrend line.

GLD, SLV and Natural Gas charts:

Input:

- GLD's rebound is not as hard as SLV.

- GLD has not overcome its Head-n-Shoulder downtrend yet.

- SLV looks like forming a Head-n-Shoulder pattern.

- SLV is one step slower than GLD, so if GLD had completed a Head-n-Shoulder, SLV should be taking the similar step.

- UNG -- What a TOXIC gas. Coming for a double bottom. Read this article from FORTUNE http://money.cnn.com/2011/02/11/news/economy/chesapeake-natural-gas-shakeout.fortune/index.htm

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI looks like still in down trend.

- Is it in a Head-n-Shoulder pattern?

Baltic Dry Index chart:

-NA-

Input:

- -NA-

No comments:

Post a Comment