BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Expecting a temporary rebound for all indexes. They have reached some kind of temporary support line. -- Intraday of indexes show sign of life on Thursday and Friday night. -- Weekly chart of VXX is currently reaching resistance of 20MA line. Expect it to cool down temporary. -- Many sectors ETF charts show that they have reached some kind of support line. Expecting temporary rebound. | -- Coming is another data heavy week. Volatility is expected. Furthermore it comes with FOMC meeting minutes announcement + GDP -- VXX now has strong support from the 20MA and 50MA lines. Watch out how it react at those support lines. -- Very high possibility of Head-n-Shoulder for all three major indexes in the very near future. Watch out carefully, it can be really really ugly. |

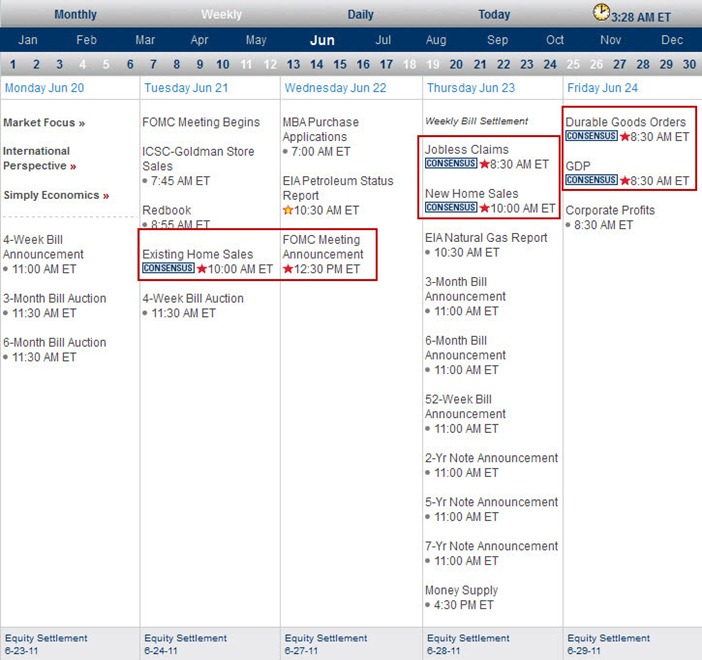

Next Week Economic Data:

Input:

- Again, data heavy week. In addition FOMC meeting minutes and GDP.

- Be careful, data can swing both sides heavily.

VXX chart:

Input:

- Daily VXX chart now has strong support from 20MA and 50MA lines.

- Weekly VXX chart now blocked by 20MA line. Expect it to temporary cool down a bit.

- Strong volume of VXX is not a good sign for the market.

SPY chart:

- Daily and intraday charts show the intention of market to have a rebound.

- Weekly chart shows that SPY has reached a temporary support line, will there be a rebound?

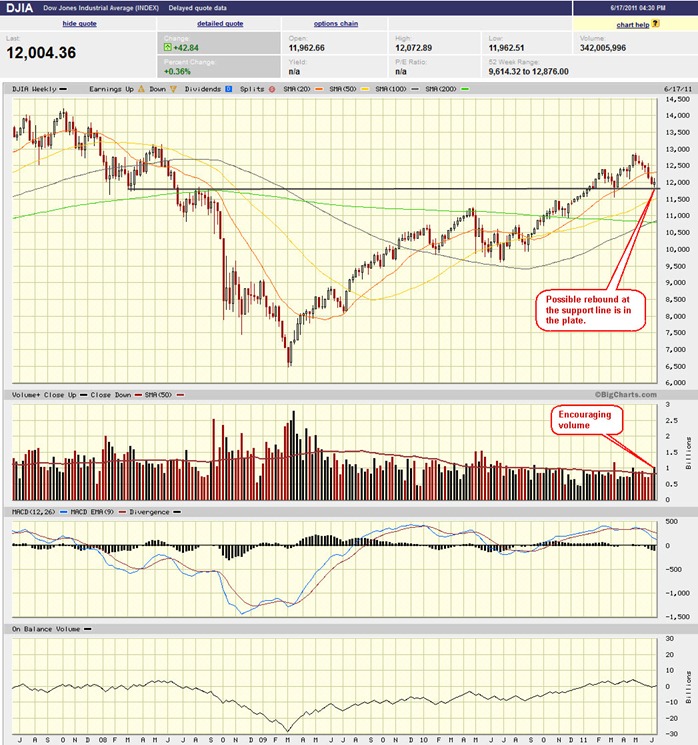

DJIA chart:

Input:

- Similar to SPY.

NASDAQ chart:

Input:

- Similar to SPY.

UUP chart:

Input:

- UUP is getting stronger, but it is still below the trend line and its 20MA is still its resistance.

- Does this mean that GLD will have a strong upper hand?

Sector Analysis:

Input:

- Many of the sectors have reached at the lower part of their trend lines or sitting at some kind of temporary support lines.

- Expecting some kind of temporary rebound.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD is now forming a big pennant formation.

- SLV is a very weird commodity. Its daily chart looks bearish for me, but still it keeps climbing slowly. Its 20MA and 100MA lines are its resistance line.

- USO is testing the lower part of the up trend line. Will there be a rebound?

- Weekly chart of UNG is again showing slightly below 20MA line and testing the down part of the trend line. Its daily chart looks king of ugly too. But this may be a good time for long entry??!!

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Similar to the indexes in USA, FXI is resting on the trend line and 100MA line now.

Baltic Dry Index chart:

Input:

- It is roughly about time to pay attention to the shipping stock. Many have reach the "bottom".

No comments:

Post a Comment