BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Many sectors seem to have reached some kind of multiple bottom. -- All 3 indexes have their MA support line coming very close as support lines. -- UUP is reaching the upper trend line. Expect it retrace a bit. | -- Chart pattern wise long term they are still bearish. -- VXX is at a very zone and pattern now. |

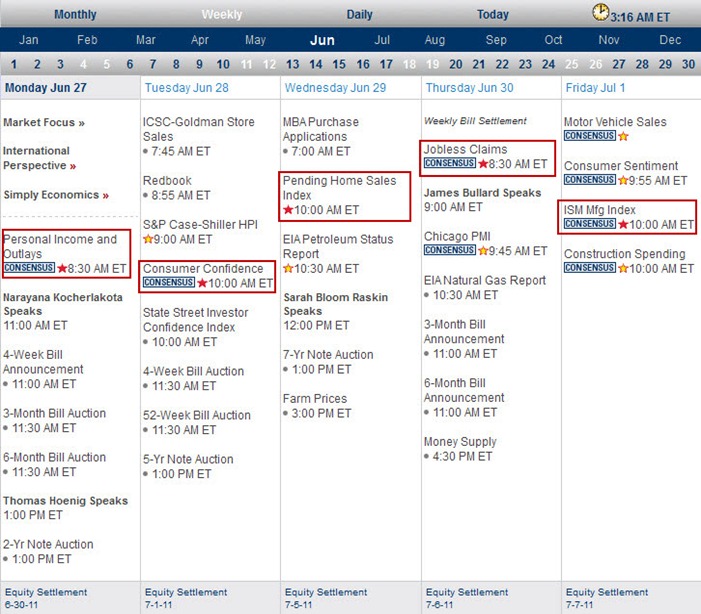

Next Week Economic Data:

Input:

- Another heavy data week. Last week is already a bad week for market, so more data this weekly might not be a good help to the bull.

VXX chart:

Input:

- Once touching the 20MA line, it rebound so hard.

- Looking at the chart pattern, we could be in the most beginning part of a major market turning point. Let us be careful.

SPY chart:

Input:

- Intraday SPY seems to show the fist support is at 126.80. Be careful, this line of support can be taken out pretty easily.

- Weekly chart shows that it will soon dropped to its 50MA line.

DJIA chart:

Input:

- Daily DJIA is sitting on its trend line.

NASDAQ chart:

Input:

- Looks to be rebound at its trend line. Next support closest is its 50MA line.

UUP chart:

Input:

- UUP is challenging its weekly trend line resistance and 20MA line resistance now. Thing could turn really ugly if UUP really break out. Pay close attention.

Sector Analysis:

Input:

- Many sectors seems to reach some kind of multiple bottoms. Are they the real bottom yet? Or should we see at least rebound first?

GLD, SLV, Petrol and Natural Gas charts:

Input:

- Just in 2 days, GLD daily chart drops below 20MA and 50MA lines. All secondary indicators have turn negative. Looks like it is set for more drops to come. Any rally in GLD should be a good chance to top up GLL.

- Similar to the yellow metal, SLV drops as expected. Both daily and weekly charts show only one direction, down!

- Weekly chart of USO drops below every single MA lines. Really weak.

- UNG is really a toxic gas. Remember this kind of double parallel wedges patterns well.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI chart pattern is deteriorating compare to last week. This week it actually punch down its weekly 100MA and 200MA lines and now just below its 100MA line.

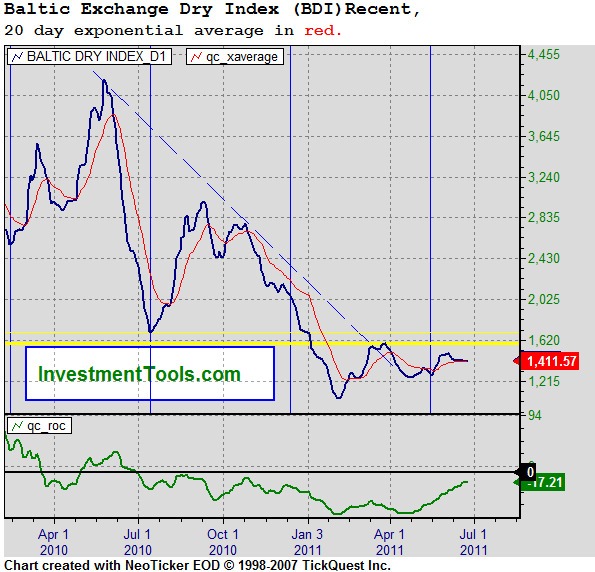

Baltic Dry Index chart:

Input:

- Interesting chart!

- Let's wait a bit more longer. Many shipping stocks are now touching their horrible bottoms.

No comments:

Post a Comment