BULL or BEAR ??

| Short term (1 week) | Notes |

|

| -- All3 indexes are still healthy. -- Will Italy run into problem. Na… I don't think so. They have a Monti GOD! -- The threat from UUP is still quite limited. -- Watch out for VXX. Make sure it is not going to take out the resistance level of 76MA line. -- All sectors are coming to their resistance trend line. Correction is expected. -- Heavy data coming out. Expect volatility. -- Copper is still weak but USO is pretty strong. Painting a confusing picture. |

SPY (30 years monthly) chart:

Input:

- SPY is still healthy and strong.

- Still above its 20MA line.

Next Week Economic Data (1 week):

Input:

- Quite a number of data coming out next week on Tuesday, Wed and Thursday.

VXX chart:

Input:

- VXX is struggling in between the 18MA and 76MA lines.

- MACD is now touching each other.

SPY chart:

Input:

- SPY still remain healthy. Long term chart facing resistance at 47MA line.

DJIA chart:

Input:

- Daily chart of DJIA showing it has reach the short term resistance of the trend line. Expect it to retrace before it is able to advance again.

- Weekly chart shows that it is still healthy. It has taken the 12000 line again.

NASDAQ chart:

Input:

- Daily chart shows that NASDAQ is still healthy.

- Weekly chart shows that it is facing resistance at 47MA line.

UUP chart:

Input:

- UUP is still struggling in between 18MA and 47MA lines.

Sector Analysis:

Input:

- All sectors coming to the resistance of trend lines. Watch out for retracement or corrections.

Copper JJC chart:

Input:

- Daily Copper chart show weakness.

GLD and SLV charts:

Input:

- GLD and SLV are still strong and rallying.

Petrol and Natural Gas charts:

Input:

- Pretty big advancement of USO.

- Natural gas is another step closer to hell.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still healthy. Facing resistance from 123MA line.

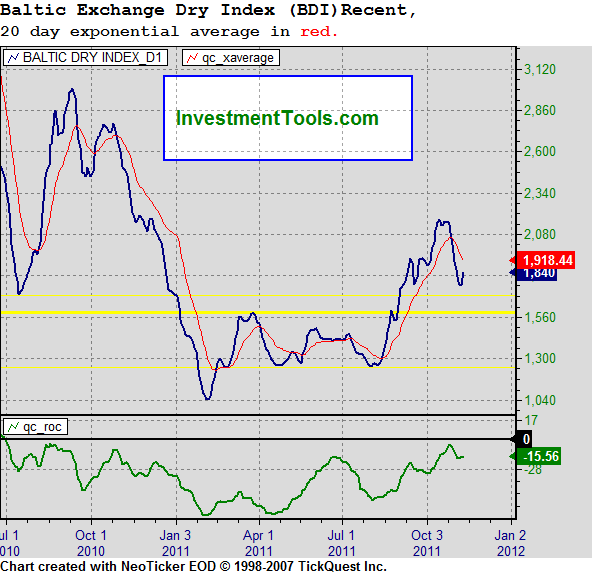

Baltic Dry Index chart:

Input:

- Slight rebound on Baltic index.

No comments:

Post a Comment