BULL or BEAR ??

| Short term (1 week) | Notes |

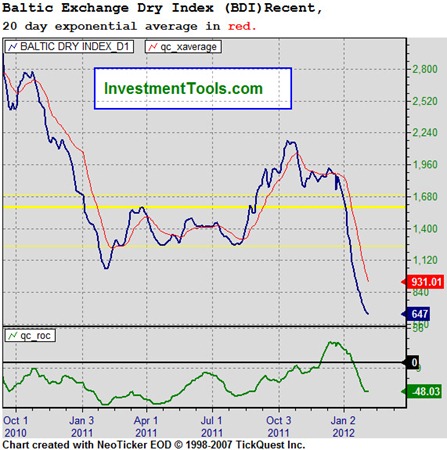

| -- All 3 indexes are all healthy either in weekly or monthly chart. -- However, VXX is coming to a possible double bottom. As a result, pay close attention to the turning point. -- FXI is coming to resistance line. -- Shipment Baltic is going to straight to hell. -- All sectors are reaching top trend lines, retracement will not be a surprise. -- UUP is still in the long tern down trend which is good for the market. |

SPY (30 years monthly) chart:

Input:

- Very strong bull market! The value has successfully overtook the trend line resistance.

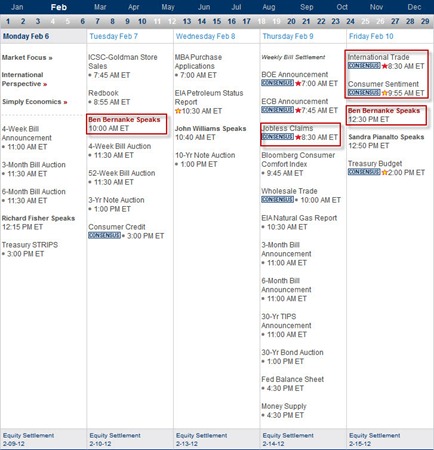

Next Week Economic Data (1 week):

Input:

- Not much data in coming week. Should not be too volatile.

- Ben would like to speak for two times!

VXX chart:

Input:

- VXX is at a dangerously low level. A possibility of double bottom could be there.

SPY chart:

Input:

- Weekly chart shows that SPY index is still very healthy.

DJIA chart:

Input:

- Monthly DJIA chart shows that it has reach the resistance trend line. Retracement is expected.

- Weekly DJIA chart is very healthy.

NASDAQ chart:

Input:

- Monthly and weekly chart of NASDAQ shows a lot of strength and continuation of rally.

UUP chart:

Input:

- UUP is still stuck in the long term down trend which is good for stock market.

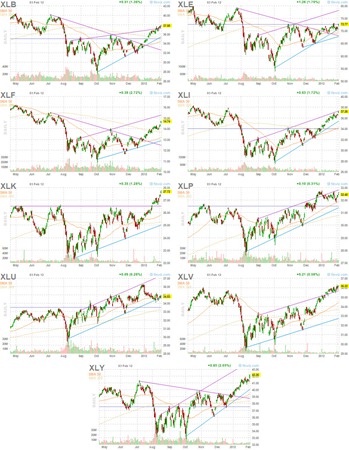

Sector Analysis:

Input:

- Most sectors are at the top range. A retracement will not be surprise.

Copper JJC chart:

Input:

- Long term JJC approaching the 20MA line.

- Still look strong going forward which is good for the market.

GLD and SLV charts:

Input:

- GLD and SLV seems to reach the long term resistance trend line.

- Retracement is expected.

Petrol and Natural Gas charts:

-NA-

Input:

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is facing resistance from its long term 20MA line.

- Expect a retracement.

Baltic Dry Index chart:

Input:

- Oh! My God! No bottom insight yet.

No comments:

Post a Comment