BULL or BEAR ??

| Short term (1 week) | Notes |

| -- Volatility is expected. Many data coming out on Thursday and Friday. -- All 3 indexes long term charts still look healthy. -- Be careful of the VXX indicator. -- Shipping Baltic starting to take a turn. Many shipping stocks have turn positive. -- UUP is still under the long term down trend, which is good for the market. -- GLD and SLV market is still waiting for more decision on where to head to next. -- UNG bottoming process still in progress. -- FXI still show weakness. -- All sector ETFs still look healthy. |

SPY (30 years monthly) chart:

Input:

- Long term monthly SPY chart still look healthy.

- Last week retracement is considered as minor correction. Expect some more this coming week.

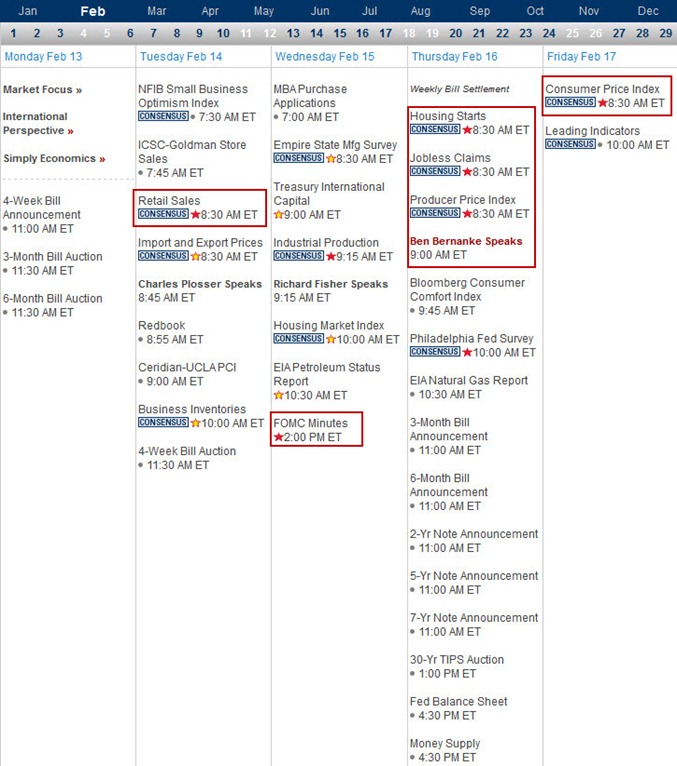

Next Week Economic Data (1 week):

Input:

- Expect some volatility coming week.

- CPI, Job, Fed, PPI and FOMC all falling on Thursday and Friday.

VXX chart:

Input:

- Look at the flatness of the 50MA line. Amazing !

SPY chart:

Input:

- Weekly SPY chart still look healthy.

DJIA chart:

Input:

- Long term monthly DJIA chart look healthy.

NASDAQ chart:

Input:

- Long term monthly NASDAQ chart look healthy.

UUP chart:

Input:

- UUP is still in the long term down trend.

Sector Analysis:

Input:

- All sectors look healthy.

Copper JJC chart:

Input:

- Copper is still under the control of long term 20MA line.

GLD and SLV charts:

Input:

- GLD and SLV are still behaving well under the trend line.

- Secondary indicators seem to indicate possible down trend in the future.

Petrol and Natural Gas charts:

Input:

- USO still staying on the long term 20MA line.

- UNG bottoming process still has not ended. Not time for entry at all yet.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still weak. Not able to take out the 20MA resistance line.

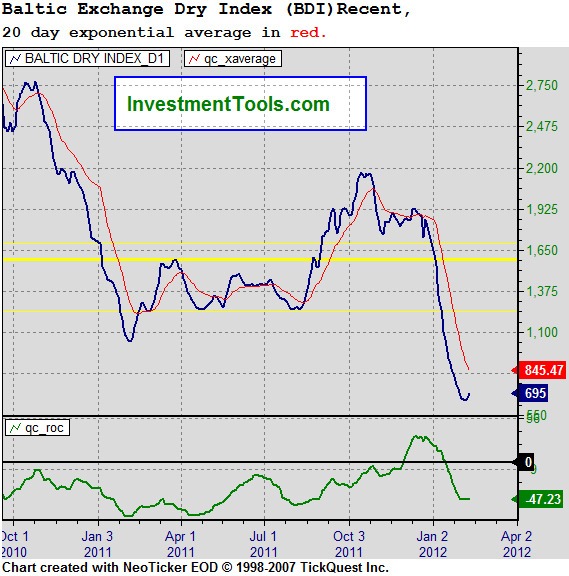

Baltic Dry Index chart:

Input:

- It is taking a interesting turn.

- Some shipping stocks have actually turned around.

No comments:

Post a Comment