BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Every sector is doing pretty well. -- Don't think that FED is able to do much on the interest rate. -- Libya and Japan problem seems to quite down again. -- FXI is doing pretty well. China is not really a threat now. -- VXX is testing its low again. If it break down the low, we might be seeing GREAT BULL run again. -- Petrol is testing its upper trend line again. | -- If FED tilt the market on Tuesday, the whole picture might change overnight. Other than that I don't see much reason how BEAR can attack the market. -- Market don’t really care about Libya and Japan problem. Warren Buffett also said Japan is a good investment now. -- A temporary lower indexes are expected since they are forming double top formation. |

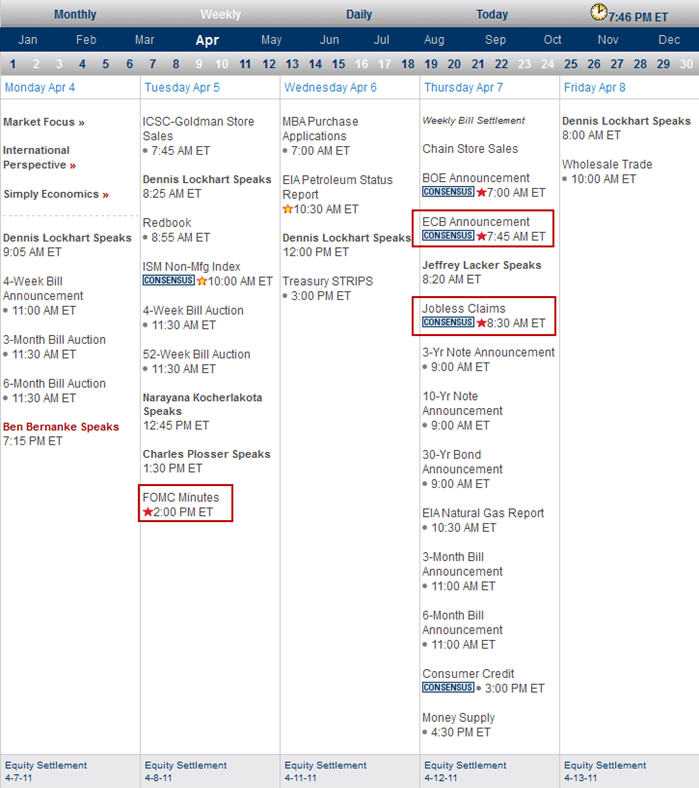

Next Week Economic Data:

Input:

- Watch out for Tuesday FOMC. I think that is the only one that can tilt the market. Other than that I think nothing much to worry about. Inflation could be the keyword for FOMC this round.

VXX chart:

Input:

- Market can be very volatile this week.

- VXX is at low again.

- FOMC on Tuesday 2:00am

- If VXX goes below 28.00, we could be seeing anther BIG BULL market ahead.

SPY chart:

Input:

- SPY is testing its previous March high again.

DJIA chart:

Input:

- DJIA is testing its previous high of 12,400 point again.

- It looks like a double top formation, however, be extra careful because this second top came really quickly.

NASDAQ chart:

Input:

- Same like SPY, this NASDAQ is testing its March top again.

UUP chart:

Input:

- The downtrend of UUP is still intact. Don't think that it is going to come back up in short near future.

Sector Analysis:

Input:

- Every sector seems to be quite healthy.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- Gold and Silver never want to rest.

- Natural gas looks pretty good for long position.

- Petrol USO is testing its upper trend line again, expect it to break through it in just one or two days.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- China index is very healthy.

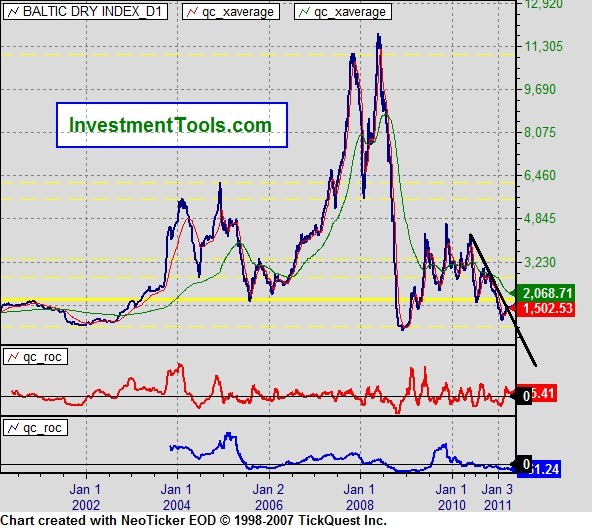

Baltic Dry Index chart:

Input:

- Not much of an improvement on the shipping area. Stay far far away.

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgUzeG_1-R99DyvOZaEyr_uLjYJ1OJbGOuayUnmWKJODJXf3LooeyE-IzyDB9uHPn8rC3mGJRdO7qxXXuLtiMr8modgcjFXE-plda-w2CG8ITgbzXgSNHEfxV7gGPrxXulRTbBvQTzt4GA//?imgmax=800)

No comments:

Post a Comment