BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- SPY, DJIA and NASDAQ are challenging their top most resistance line for around the fourth time. This is bullish. If Obama able to get the congress to buy his idea, Monday will open much much higher, else watch out! -- All sectors are showing that they are challenging their top resistance line. | -- Debt talk by Obama can get worse if the congress play with him. -- Heavy data week ahead. -- VXX is still challenging the bottom line. -- GLD rally shows how worry gold bug is. -- FXI is still stuck in its downtrend. |

Next Week Economic Data:

Input:

- Pretty heavy data week ahead.

VXX chart:

Input:

- It is challenging its bottom line. Things can get nasty. However, currently the bottom line still act more like a resistance than as support and it is still been guarded by the downtrend line.

SPY chart:

Input:

- SPY reach a all time high again.

- The uptrend line and its 20MA line still act as strong support line.

- This should be about the fourth time it challenge the upper resistance line.

- Pattern wise it is bullish. However it is a sword with double edge. It can act as a multiple top.

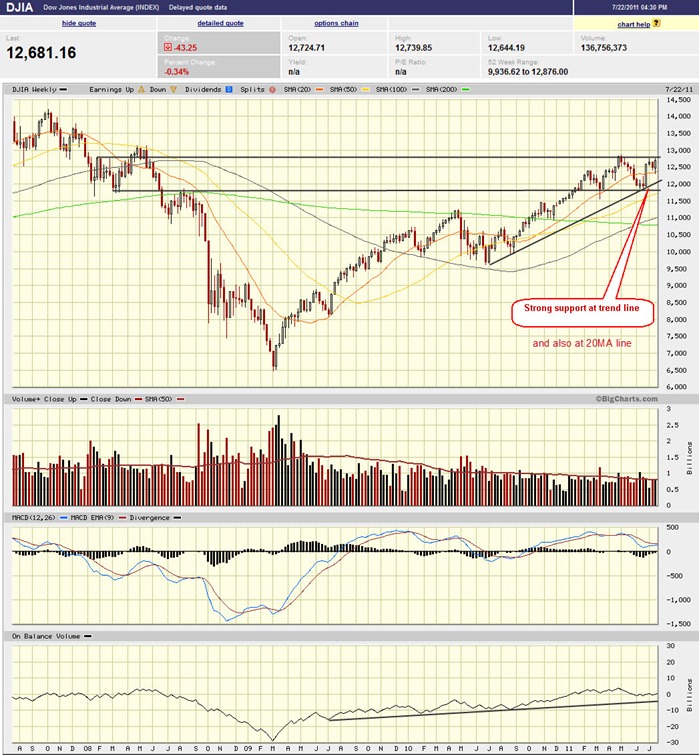

DJIA chart:

Input:

- Similar to SPY

NASDAQ chart:

Input:

- Similar to SPY.

UUP chart:

Input:

- Again, UUP broken down again. A sign for the bull run for stock?!

Sector Analysis:

Input:

- Almost all of them are forming multiple top or challenging its downtrend line. This is very bullish. However, temporary set back is somehow expected.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD and SLV are just so strong. Not a good shorting target yet.

- GLD is going to reach its upper part of its uptrend line. Shorting opportunity might be near.

- It is much harder to predict for silver.

- USO has came back up to its uptrend line.

- UNG is still very weak. This commodity is also hard to trade.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still fix to its downtrend.

- All its MA line (20, 50, 100, 200) all curving downward. Be careful of all the China stock that you currently hold. Can be a hard hit.

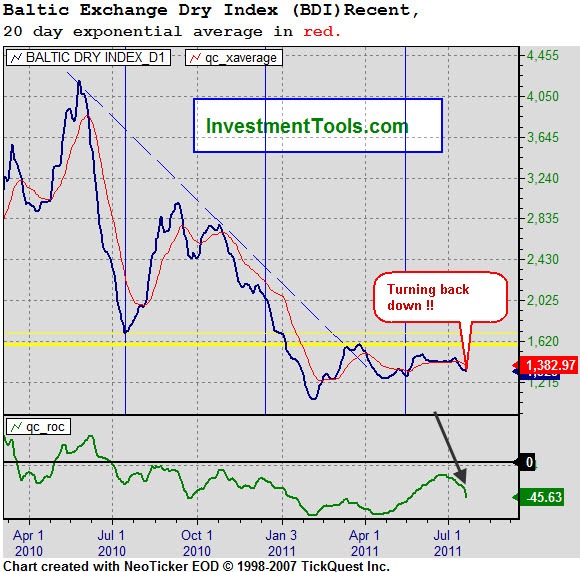

Baltic Dry Index chart:

Input:

- Shipping segment is turning south again. Not good.

- If you check out the shipping stocks, they are just horrible.

No comments:

Post a Comment