BULL or BEAR ??

I am running out of time again this week to do my analysis. This is a quick one!

| Short term (1 week) | Long term (1 month) |

| -- Not much data coming up, except the BIG DEBT announcement. -- VXX suddenly turn negative while all indexes are still going down. | -- The debt problem will not be going away. |

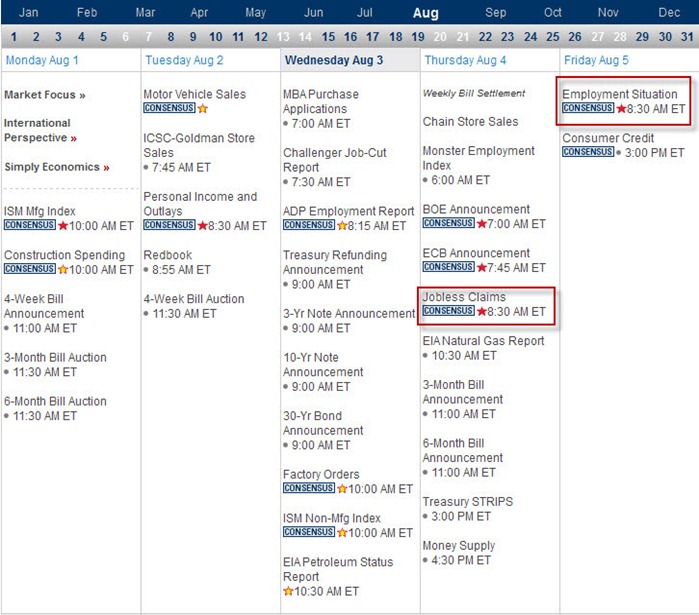

Next Week Economic Data:

Input:

- Not much data coming up.

VXX chart:

Input:

- Indexes are going down but VXX suddenly turn negative. Unbelievable !!!

- 100MA line acts as a resistance line.

SPY chart:

Input:

- SPY came down and touches trend line. Expecting a short term rebound first.

DJIA chart:

Input:

- Similar to SPY.

NASDAQ chart:

Input:

- NASDAQ is much stronger compare to SPY and DJIA. It still hold above its 20MA line.

UUP chart:

Input:

- UUP is still getting weaker.

Sector Analysis:

Input:

- Can't comment much.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD has reached the peak of its trend line now. Safe point to do SHORT.

- Intraday SLV shows weakness. 20MA and 50MA lines doing a BEAR crossing. Now both MA lines act more like resistance line.

- Daily chart of SLV shows that it touched previous high of $40.50 and started to correct.

- USO is still weak. Its 20MA line continues to act as resistance line.

- UNG continues to get weaker and weaker. Now its 20MA line is resistance line.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI came back up from its 200MA line and now retest its uptrend line.

- Long term wise be very careful, all the MA lines are curving in. Not good in long run.

Baltic Dry Index chart:

Input:

- -NA-

No comments:

Post a Comment