BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Temporary rebound is expected. -- All 3 indexes intraday chart shows that 20MA and 50MA lines taken. Short term rally is expected. -- SPY and DJIA have strong support from daily chart 200MA line. -- This short tem rally might last only for a week. Watch out when indexes come back up and hit the MA lines again. | -- FXI might indicate something bad is on the way for USA. -- Housing, CPI and PPI are on tap for next week reports. -- All sectors charts are badly damaged, it will not recover so easily. -- Watch out when VXX came back down and get support from 200MA line. |

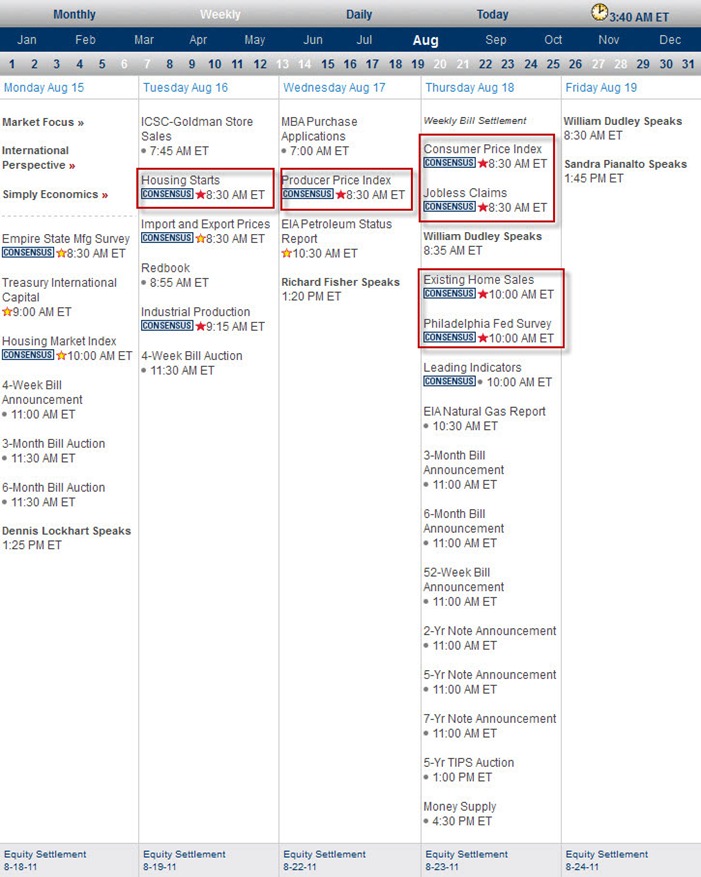

Next Week Economic Data:

Input:

- Housing, CPI and PPI all in. Can be a volatile week.

VXX chart:

Input:

- The strongest volume ever seen.

- 200MA line in daily chart is now the support line.

- 20MA line in weekly chart is now a support line and its weekly chart resistance is at 50MA line.

- Expect the daily VXX to retest its 200MA line before spike up again.

SPY chart:

Input:

- Intraday chart shows that SPY has stabilized at the range of 112.50 - 117.50.

- Intraday also shows that both 20MA and 50MA lines are taken with ease, bullish cross MA lines formed.

DJIA chart:

Input:

- Similar to SPY with additional support from 100MA line.

NASDAQ chart:

Input:

- Similar to DJIA.

UUP chart:

Input:

- Uptrend in intraday of UUP chart looks pretty hard to sustain.

- Weekly chart shows that 20MA line is still its resistance line. However, it also shows that the bottom is in at 21.00 until it is broken.

Sector Analysis:

Input:

- All sectors have been badly damaged. Temporary rebound is expected but it will be terribly hard to sustain.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD start to show weakness, but it is all time high.

- Read an article, it says that the margin call requirement for GLD has been raised. Will this trigger what happened to SLV previously?! It is going to be interesting to see that.

- Entire GLD weekly chart from day one is really interesting. Shorting of GLD looks like will be the next step.

- Daily SLV chart shows that it is trading at 20MA and 100MA line. Will the raise of margin call on GLD also going to kill SLV?

- UNG is still trading below its 20MA line. It has come to another decision making point on it daily chart. It has been trading in a range for more than 3 months.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- All MA lines taken out badly.

- FXI is totally in BEAR market. Could this be the hint of what is coming to USA? They might see something that we don't see.

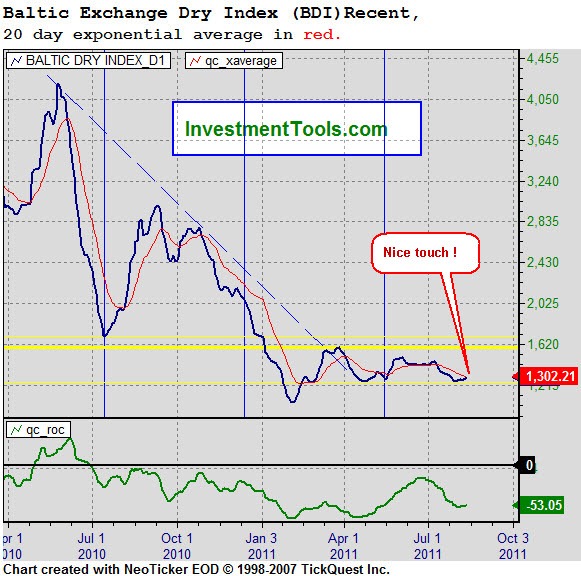

Baltic Dry Index chart:

Input:

- Still bound with the 20MA line. Nothing much interesting here. Let's see how long it take before it can break out from this stable zone.

- All the shipping stocks are hit like mad. ;-)

- Be patient and wait for the golden opportunity.

No comments:

Post a Comment