BULL or BEAR ??

** I have decided to change the format for my Market Analysis Page to this new format.

-- to include the 30 years SPY, DJIA and NASDAQ charts.

-- to predict only the next one week move.

-- to include the Dr. Copper.

| Short term (1 week) | Notes |

| --SPY, DJIA and NASDAQ have all overtake its 20MA line for 30 years chart, incredibly. -- However, all 3 indexes MACD is doing bearish cross. -- Unemployment high, USA and Europe debt all seems like not a problem. -- Market seems to like the protest that is going on world-wide. -- Looking at the way VXX is falling, there are still room to drop which means there are still room for the bull to run. -- Baltic dry index continue to rally. -- FXI is testing its strong resistance line now. |

SPY (30 years monthly) chart:

Input:

- Incredibly, the 30 yrs SPY chart overtake the 20MA line, which is definitely a bullish indication.

- Does that mean history for "1" and "2" will not happen?

- Should I wait till the end of month before I know the truth of the direction?

DJIA (30 years monthly) chart:

Input:

- Incredible! Overtake 20MA line.

NASDAQ (30 years monthly) chart:

Input:

- Incredible! Overtake 20MA line.

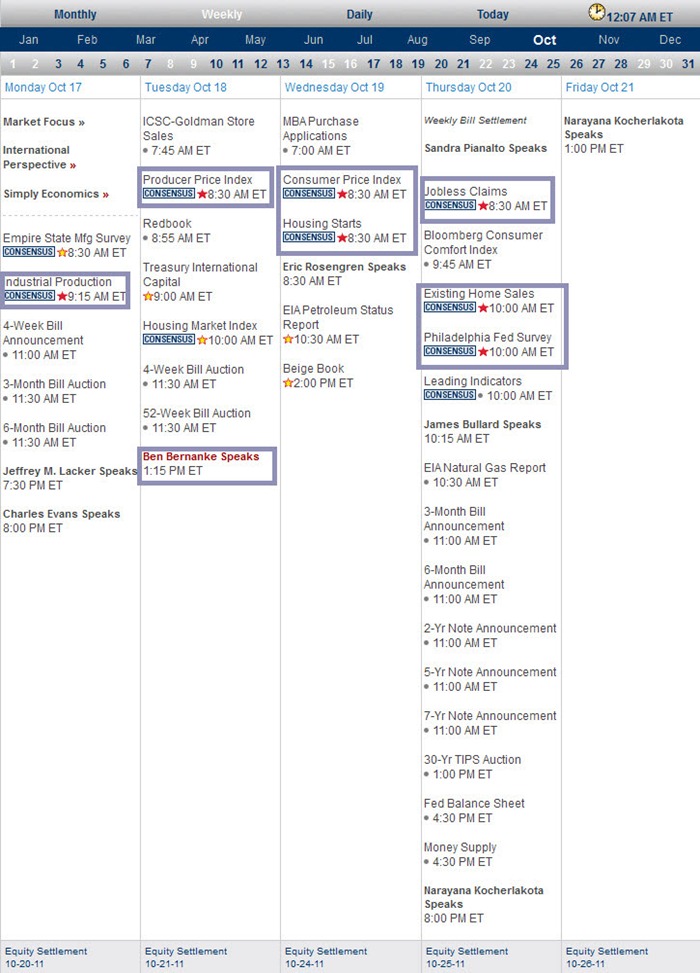

Next Week Economic Data (1 week):

Input:

- Quite a number of reports coming up with Ben's face too.

- Could well be a volatile week.

VXX chart:

Input:

- Fall through 20MA and 50MA line for daily chart.

- Weekly chart shows that the next support line is at around 40.oo and a much stronger support is at around 36.00

SPY chart:

Input:

- Weekly chart shows that it is approaching the 20MA line resistance which is 123.

- Daily chart shows that it seems to have overtake the high side of the rang-bound.

- The rally was impressive.

DJIA chart:

Input:

- Daily chart shows that it has reached the upper band of its range-bound and is more likely to overtake the resistance.

- Monthly chart shows that it is now facing resistance from 20MA line.

NASDAQ chart:

Input:

- NASDAQ chart is the most impressive among all 3 indexes.

- It is now facing 200MA line at its daily chart and 50MA line resistance at weekly chart.

UUP chart:

Input:

- Quite a drop for UUP in a week.

- Next support line is at $21.60 and $21.50.

Sector Analysis:

Input:

- XLK is the best performer.

- Quite a mix pictures. Some have overtake their resistance and some are still been bounded.

Copper JJC chart:

Input:

- Copper has rebounded and now retesting the 500MA line.

GLD and SLV charts:

Input:

- GLD rally back with below average volume.

- Daily chart shows that it is now sitting on the daily 20MA line but reaching the resistance line of $165.00.

- Daily chart shows that SLV is facing resistance from 20MA line at $32.00.

- Weekly SLV chart also shows that there is a resistance line at $32.00 too.

Petrol and Natural Gas charts:

Input:

- USO has rallied together with the market.

- UNG is retesting its daily 20MA line.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI has rebounded well and now reaching the resistance line of $35.00 and 50MA line.

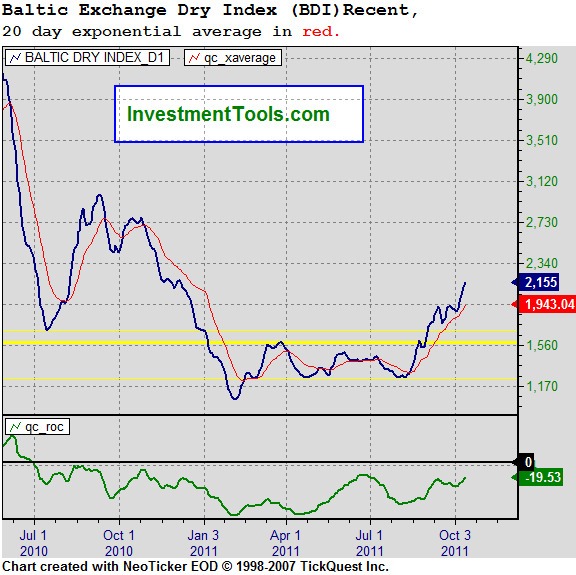

Baltic Dry Index chart:

Input:

- The rally of Baltic does have legs.

- There is nothing that I can find to support the rally of the stock market except this one.

No comments:

Post a Comment