BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Don't see any reason to call for bull at all. -- The European problem is getting worse. -- All newsletter that I read is indicating all advisors are at Bear camp. | -- VXX has legs. -- All sectors charts are at the Grand Canyon ' cliff. They are about to fall and fall hard. -- All 3 indexes show more lower low. More chances of breakdown from the support line than a rebound. -- UUP MACD shows that more uptrend is on the way. -- Copper is all time low and expect to drop even more from here. |

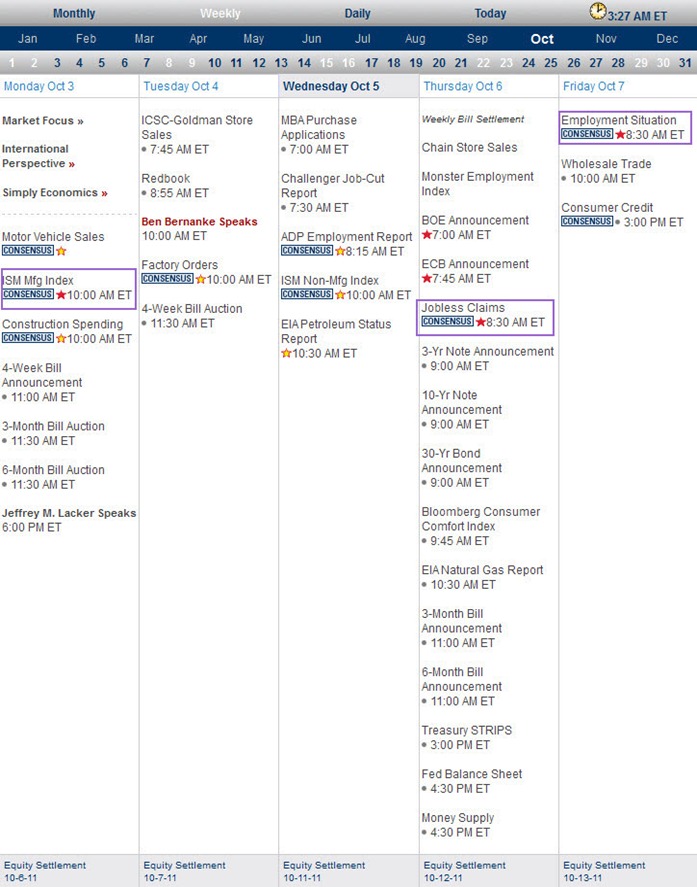

Next Week Economic Data:

Input:

- Not much data coming out.

VXX chart:

Input:

- VXX's rally has legs.

- OBV and MACD keep climbing. Weekly MACD already came out from zero line. This is bad for the stock market.

SPY chart:

Input:

- Looks like we have more lower low in this range-bound trading. Expect a break down soon through the support line.

- Weekly MACD already below zero line. Daily MACD dipped down again after reaching near zero line.

- Weekly chart shows that it is already 200MA line.

- Daily chart MA lines all broken.

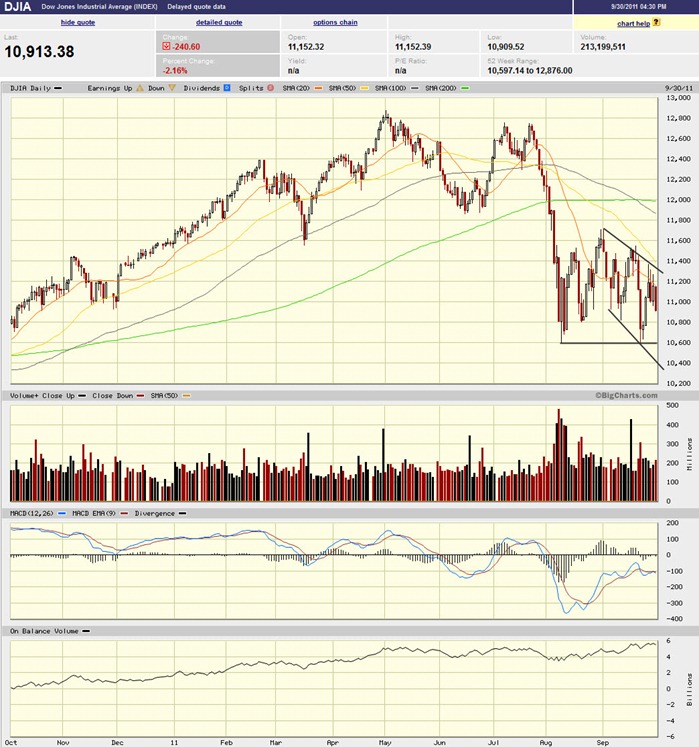

DJIA chart:

Input:

- Similar to SPY, except that weekly chart still shows that it is sitting on the 200MA line.

NASDAQ chart:

Input:

- Similar to SPY.

- Daily and weekly charts shows that it has broken the trend line again and going South.

UUP chart:

Input:

- UUP MACD shows that more rally is on the way.

- Strong volume support.

- This is bad for stock market.

Sector Analysis:

Input:

- All the sectors are at the edge of breakdown. In fact some have protrude the trend line support.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD, SLV and USO found temporary support. However, all their secondary indicators like MACD and OBV are showing more down trend ahead.

- UNG just keep going South.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Can't see any support line for FXI at all.

- Strong selling volume does indicate more down turn ahead.

Copper JJC chart:

Input:

- Strong volume of selling for Copper shows very weak economy ahead.

- Weekly MACD and OBV all dipped below zero line.

- The economy is really bad.

Baltic Dry Index chart:

Input:

- This is the only puzzle in the entire market. Shipment is UP !!??

- Who want to explain this?

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiyrgL1mgX_azMTiTugHXQ3ubuCvrmvv3h0ReqQapyJ-2wmYlBgs21b9z1189M3uP81WmrhFs0HrSwi28DouSXiJT9kO_FbrYypZd96rT_8eOK3CuCQqJHZSfSROMpFwxYhohiudiL2G3k//?imgmax=800)

No comments:

Post a Comment