BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- VXX chart is quite bullish. 3 up bars in consequence 3 weeks. -- It has been staying above the 20MA and 50MA lines. -- FOMC meeting coming on Tuesday, more data in the pipeline too, more volatility expected. -- All 3 major indexes have broke their uptrend formation and is basically below their 20MA lines. -- Many sector ETFs have started to break their uptrend. | -- Unrest in Libya and middle east. -- Disaster in Japan. -- The only thing that can help the bull is the Dollar and FXI. |

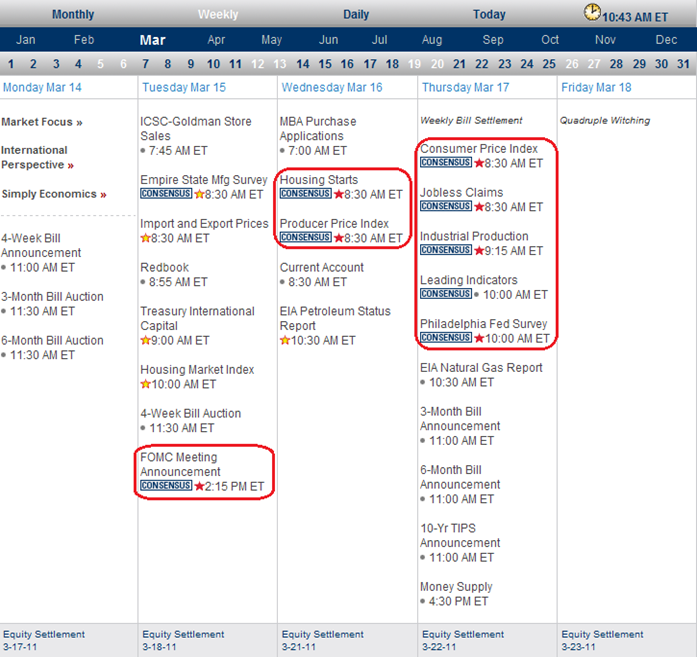

Next Week Economic Data:

Input:

- FOMC announcement on Tuesday.

- Some heavy data out on Wed and Thursday.

- All these could add on the volatility from last week.

VXX chart:

Input:

- VXX has shown green bar for 3 straight weeks. This is not good for the bull.

- Overall it is showing a bull formation which means Bear for the stock market.

- All indicators are pointing upwards.

SPY chart:

Input:

- Daily chart still show weakness. Below trend line and below 20MA line. However, it did break upward througt 50MA line again.

- Weekly chart shows that it is still in tact.

DJIA chart:

Input:

- Similarly, daily chart looks weak. Weekly chart still intact.

NASDAQ chart:

Input:

- Both daily and weekly charts are "out of shape".

UUP chart:

Input:

- Daily chart shows that Dollar is weak. This might help the bull in the market.

- Weekly chart shows that it might have broken the multiple bottom formation. Now it is retesting the multiple bottom line. If it fails, there will be more down turn for Dollar.

Sector Analysis:

Input:

- Some sectors starting to brake their uptrend.

- Only utility is showing strength. Isn't this a Bear pattern?

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD is still in strong bull mode.

- SLV is a crazy Bull.

- USO is in correction mode but it is expected by looking at the weekly chart. Overall it is still in bull mode.

- Natural gas is still in Bearish mode.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI broke the down trend and now testing its 20MA line resistance.

- Will this indicate a bull in US market?

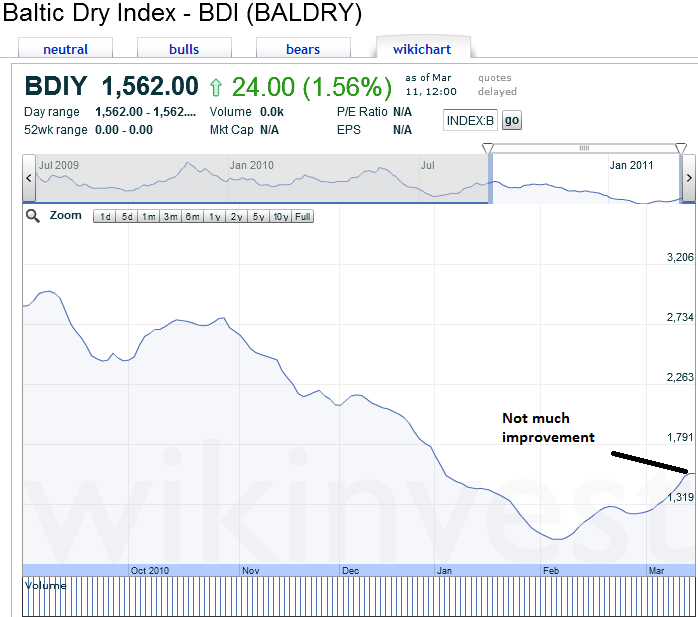

Baltic Dry Index chart:

Input:

- Definitely not something that you want to go near to.

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgprdl9yTRkKC-XDwpAYAId47RXuVp_gLyG46J14H_S94ByLmY3wwpdk2zlojEaLKxPv40IPLyZ6MKr9iuvGUpitaZveR9ssXNvP7UcP_wRlkGZqWMwX8Hk-pBc4nqMPCGdB0PB4YObxOA//?imgmax=800)

No comments:

Post a Comment