BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- All sectors look healthy. -- China index is also healthy. -- Not much data in coming week. -- VXX crashing down again like before. -- All 3 indexes are have rebound very well and taken out few MA lines along the way. -- UUP is still in its downtrend. -- Even UNG is showing recovery. | -- Libya and Japan nuclear problem have not resolved yet. -- Portugal debt issue resurfaced. -- Be careful of VXX behavior when it came down to point 22.00 again. -- Higher petrol is just a matter of time, might be bad for the economy. |

Next Week Economic Data:

Input:

- Looks like we are going to have a pretty quiet week next week.

- I will expect the bull to continue charging the market.

VXX chart:

Input:

- The BEAR is again crunched by the BULL.

- 3 weeks Bear work is gone in just one week.

- However, pay close attention when it touches down at point 28 again.

SPY chart:

Input:

- SPY chart is at the cross-road. Its direction next week is critical.

- It has basically bounced from 100MA line and take out both 20MA and 50MA lines which is a very bullish sign.

- MACD and TMF indicator at daily charts is showing positive sign.

- Bull has the upper hand now.

DJIA chart:

Input:

- Same as SPY, DJIA shows strength this week. 12,000 point is taken out, 20MA and 50MA line at daily charts and the downtrend line are take out too. Excellent bull job.

- Strong support at daily 100MA line.

- MACD and TMF indicators looks positive and encouraging.

- Weekly chart shows strong support at 20MA line.

NASDAQ chart:

Input:

- Daily chart shows good rebound in progress. It had taken out 100MA and 20MA lines. It still has the 50MA line resistance to be taken out.

- It is resting at the downtrend line.

- MACD and TMF indicators showing good sign.

- Strong support at the Nov high point line.

UUP chart:

Input:

- Daily UUP chart shows that 20MA line is now acting as resistance.

- Weekly UUP chart shows that it is retesting the 22.00 resistance line.

Sector Analysis:

Input:

- All sectors look healthy.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- There is only one work for the yellow metal (GLD) ---- STRONG !!!

- If the word STRONG is for GLD ---- STRONGER is for SLV.

- USO is retesting its upper uptrend line. With the Libya condition, I think it is just a matter of time.

- The toxic gas may not be toxic anymore. Its weekly chart has taken out the 20MA line and now is challenging the upper downtrend line with good volume. TMF is crossing through the o point from bottom.

- Daily chart of UNG has taken out 20MA, 50MA and 100MA lines. Now it has reached the point where it previously dropped from.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- China index is still healthy. It is back up above the 20MA line again.

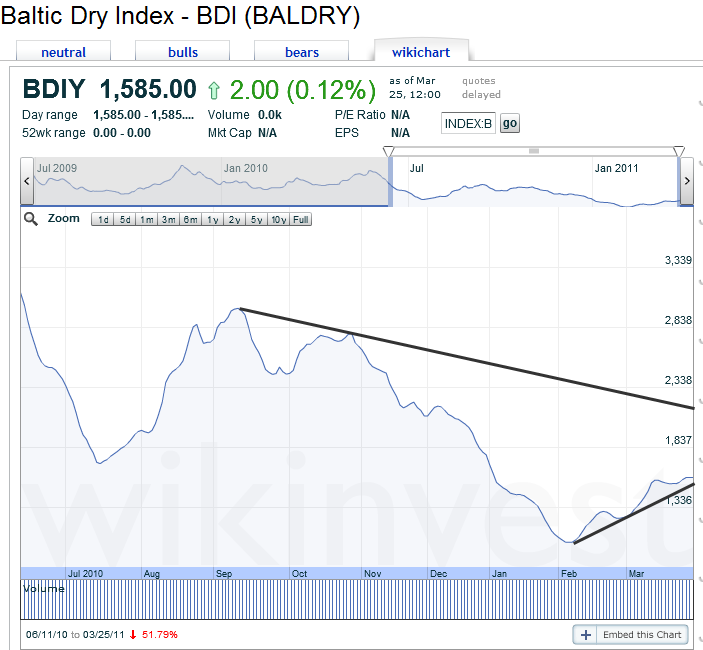

Baltic Dry Index chart:

Input:

- Baltic Dry Index looks improving.

No comments:

Post a Comment