Something that I need to clarify here:

- Short term means for 1 week

- Long term means for 6 months

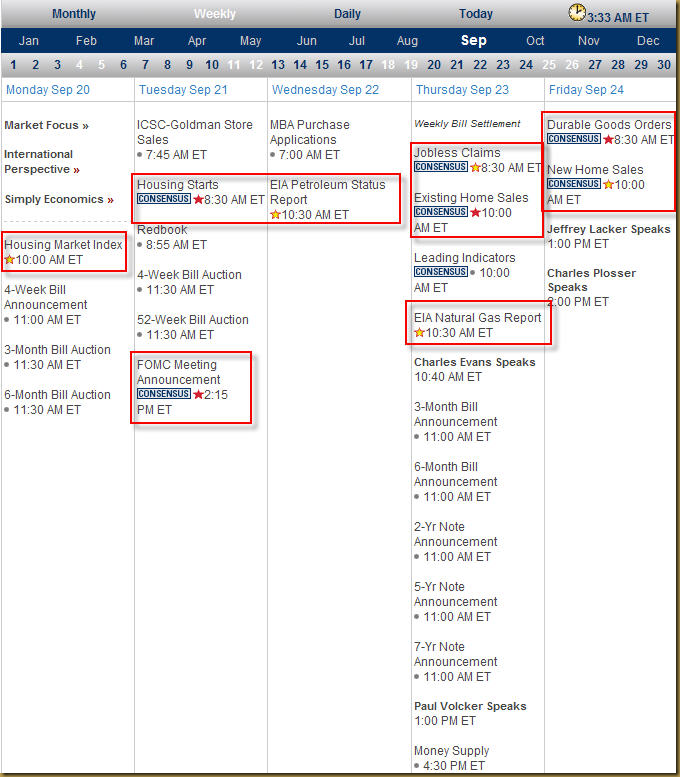

- It is going to be another heavy data week ahead especially on Tuesday night the FOMC interest rate announcement.

- My analysis can be tilted 180 degree by BEN on Tuesday night.

Why do I say so:

- http://www.elliottwave.com/freeupdates/archives/2010/09/15/The--Outright-Deflation--Economy-Enters-A--Critical-New-Phase-.aspx.

- http://slopeofhope.com/2010/09/they-can-almost-taste-it.html.

- This expert is saying that we have a long term BULL market. Better be careful. But he still feel that his claim will only be more true if SP500 broke the barrier of 1130. http://blogs.decisionpoint.com/chart_spotlight/2010/09/new-long-term-buy-signal.html.

VXX chart:

Input:

- Long term Renko chart tells me that there might be still downside for VXX. So all my Short positions are not secured yet.

- Long term OBV and MACD still look Bearish. So be agile when needed.

- Short term VXX chart looks like going to do Bullish cross with a high volume coming in. Again, still not crossed yet.

SPY chart:

Input:

- Short term 20MA and 50MA lines are about the do the Bearish Crossing.

- Short term SPY value is falling below the 50MA line for the first time in the past 2 weeks or so.

- Short term high volume sell Friday night early in the night.

- Short term MACD is dipping into the -ve zone.

- Long term chart is still facing resistance at the 113 line.

- It is a bit hard to read, but look at the 3Yr 1Wk long term chart, 20MA fall below 50MA line again. Is this a loud and clear SELLLLLL signal?

DJIA chart:

Input:

- Not as Bearish as SPY, maybe not yet

![clip_image001[5] clip_image001[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEicD75ZV_8pZtlyU6i2zy62icUH-UziXjqrwSGkVMtySsdWvp3XplmVK2Ncm2R3ZMa-INAs5u5YcrYUQwcIMZCctT2zayXsM-JfmQc-m4twxzShT4V95fibcwevBQSnuck9iInrdI_gUfo//?imgmax=800)

![clip_image002[5] clip_image002[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg4OmZXOulbrLOKyt0B7Y8TdanEcLYhOagqI5TKD_mSIwOefkvEMWftbjU6-FEp2cOsBeZtUGX4skmHxitXcrXmeVHaRBNRpV-5I0qw_VO59g11e4z19t8llZnJHoRiIeEiW0KPVoQJkCc//?imgmax=800)

![clip_image001[7] clip_image001[7]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiw4ktRQEwvhwZOin4GiUQUGP5c_-GHBPWQyKnNKxwb__cp_n6Srj_tPb70Y1dRzkAPknnxcP7M8rrc5-oHFAg5ri5TGhl8no4LwhS1vKWDg0jfXrfGs47ep46DYtUWh7EtmcDynwrSjWU//?imgmax=800)

![clip_image002[7] clip_image002[7]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiySAvb_wWvDluurryD7bG1Z5hY7Q6NyGDT_CtISskE5RYYsjXxKs__2pnr6vxBQDqLAfGKEPRePpACV8Si4BRWAvmglA9MJLhON-H1UuYSj-SFvZ8mXgRiqBHPzBCvPJJxeP8fGgqiSuE//?imgmax=800)

No comments:

Post a Comment