BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

| -- There is no sign of BEAR at all. -- There will be a lot volatility in coming week with Helicopter Ben announcing interest rate. However, there is nothing much Ben can do. So the market can just keep on their BULL move easily. | -- Long term SPY chart has shown that 20MA line has crossed up 50MA line which is a long term buy signal. -- NASDAQ index is not showing any sign of stopping. |

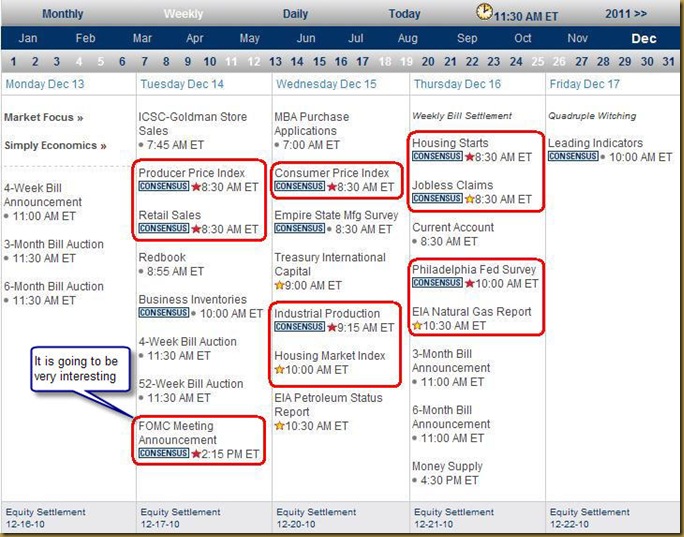

Next Week Economic Data:

Input:

- A lot of data coming out the entire week.

- Interest rate announcement on Tuesday. FED cannot do anything other than stay the same rate figure. Maybe that is why market has no fear and Friday index still go up.

- Is Helicopter Bernanke going to announced QE3? *that will be interesting*

VXX chart:

Input:

- RSI in daily chart might be indicating something. However, candlesticks look like it is still going down.

- MACD at the long term chart might indicating something also. Again, there is no confirmation yet.

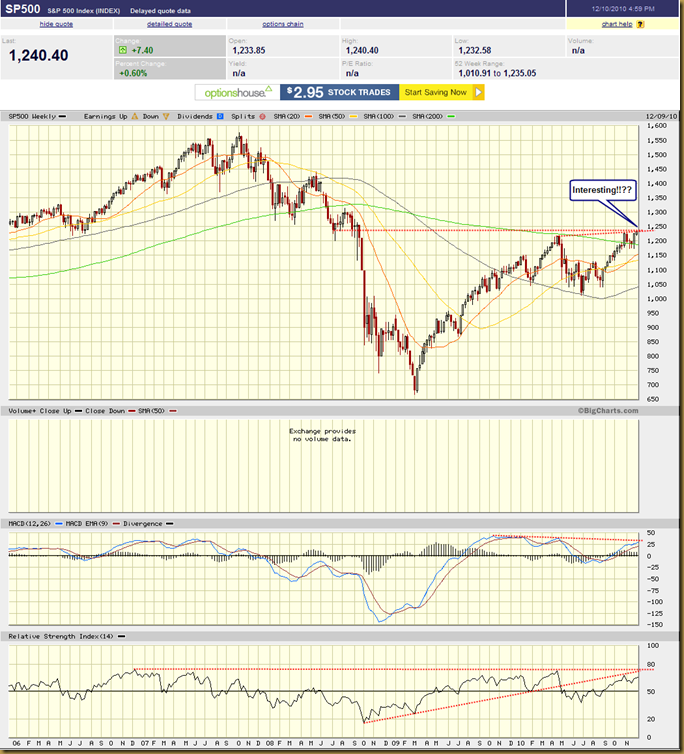

SPY chart:

Input:

- Long term SPY chart shows that SPY has bounced up from 200MA line and now has reached another high.

- 20MA has crossed up 50MA line and this is actually a long term BUY signal.

- Watch and see how it can break up the resistance line. Watch carefully how MACD and RSI line work out.

DJIA chart:

Input:

- DJIA is the only one index with very clear resistance line. However, don't under estimate the bull.

NASDAQ chart:

Input:

- Nothing is stopping NASDAQ.

UUP chart:

Input:

- UUP up trend is confirmed.

- Carefully watch the relationship between UUP and DJIA. They are supposed to be inverse relationship, but not very clear.

Sector Analysis:

- I am running out of time.

Input:

- NA

GLD, SLV and UUP charts:

- I am running out of time!

Input:

- NA

No comments:

Post a Comment