BULL or BEAR ??

Chinese New Year is around the corner. Let me wish everyone (including myself), A Prosper and Happy Chinese New Year.

| Short term (1 week) | Long term (6 months) |

| -- I don’t expect the bull to give up so quickly yet without a tough fight. Or the fight is already over??!! | -- China is showing the classic textbook kind of falling trend. Might be a important hint to the rest of the world -- NASDAQ is running out of steam, broke trend line and 20MA line. -- SPY is showing weakness in intraday chart. -- Many bank like BAC, GS and C shows less than estimated quarter result. -- Interest rate announcement and GDP is around the corner. -- A few of my long position have been kicked out. -- VXX chart is also showing turning sign. |

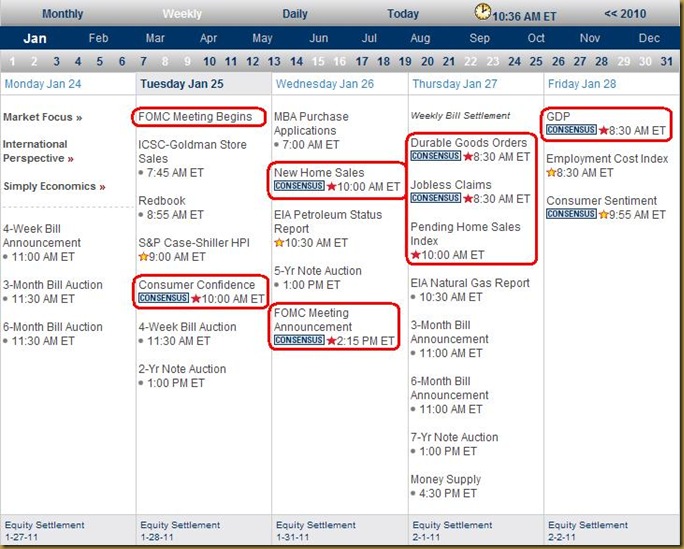

Next Week Economic Data:

Input:

- Is this why indexes go down last week.

VXX chart:

Input:

- Watch out. Volume is getting much much higher now.

- MACD is on up trend. RSI has just break the trend line also.

- Market can be turning any time. Be careful.

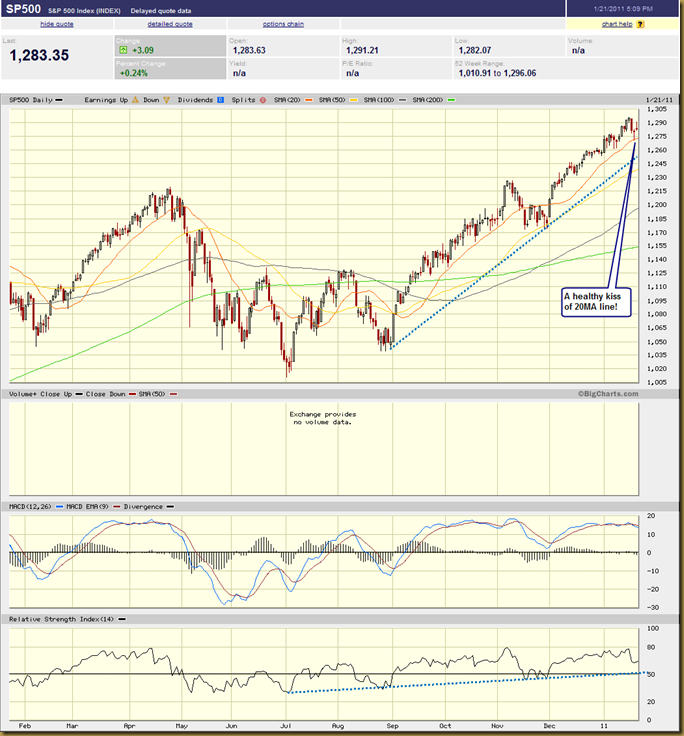

SPY chart:

Input:

- SPY is not that weak compare to NASDAQ, however, it can be running out of steam now looking at its intraday chart.

DJIA chart:

Input:

- No sign of weakness for DJIA.

NASDAQ chart:

Input:

- NASDAQ has started to show weakness. It has broken the trend line and also the 20MA line.

- Could this be the hint that overall market is starting to fall?

UUP chart:

Input:

- Downtrend of UUP should be confirmed by now.

Sector Analysis:

Input:

- Minor correction is observed across the sector. However, correction in XLB and XLK are more than the rest of the sectors.

GLD, SLVand Natural Gas charts:

Input:

- My expectation have all came true for GLD, SLV and UNG.

- Both GLD and SLV are in confirmed down trend. However monitor closely the UUP changes.

- UNG is in uptrend as expected.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Is China hinting at us now?!

- Are they going to experience the text book kind of fall soon?! *A 3 months down, 2 months up and then Crash!!! *

Baltic Dry Index chart:

Input:

- No sign of recovery for shipment. Don't expect much from this group.

No comments:

Post a Comment