Sorry for not posting anything for the entire last week. I was on Chinese New Year holiday and have totally no access line to the internet.

***Trust me!!! It is painful without internet connection***

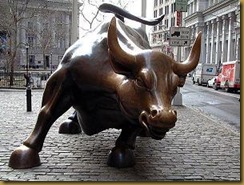

BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

| -- Company earning still encouraging. -- Not much economy activity this week. -- All the "correction" so far has been viewed as more chance to get in. -- Do you really think that America stock market cares about Egypt in the short run?! -- VXX chart dip lower again. -- All sectors charts still remain healthy. | -- Instability in Egypt has caused oil to surge. -- UUP is coming to the multiple bottom formation. -- FXI is still in down trend |

Next Week Economic Data:

Input:

- Do not expect much volatility this week.

VXX chart:

Input:

- Intraday VXX chart dip lower again. Looks like there is no end in sight yet.

- Last week "interesting spike" could have cheated many.

SPY chart:

Input:

- The BEAR trap last week could have caught many by surprise.

- Be very careful of this kind of BEAT trap.

- Always get confirmation from DJIA and NASDAQ.

DJIA chart:

Input:

- You might get panicked by the "correction" of SPY, but DJIA tells us that everything should be alright.

- Always refer to the UUP chart also.

NASDAQ chart:

Input:

- The "correction" could have been triggered by NASDAQ when it came up from bottom to touch the trend line last Friday (before Chinese New Year).

UUP chart:

Input:

- Watch out for a "touch down" at weekly UUP chart at $22.00 which might give a correction to the market.

- However, this might take a week or more.

Sector Analysis:

Input:

- All sectors still look healthy. Only XLP is a bit weaker.

GLD, SLV and Natural Gas charts:

Input:

- GLD down trend from head-n-shoulder formation still remain.

- SLV came poke through the down trend line and came back up the 20MA and 50MA lines. Looks bullish, but might just be forming a right shoulder. RSI still weak.

- UNG is coming back to the up trend line again. Looks good for a long entry if you have the patient and $$$.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still intact at the down trend.

Baltic Dry Index chart:

Input:

- Weak… weak… weak !!!

No comments:

Post a Comment