BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Not much data coming out next week. -- VXX chart still all time low. -- No indication that indexes are resting. SPY and DJIA still has some room before the next resistance line. NASDAQ is even better, just take out its resistance line. Watch out for DJIA 13000. -- UUP keep going lower. Stock will continue its rally. -- All sectors have taken out their resistance line, except XLF which is now at important junction. | -- US debt is not going away. -- Japan problem is not resolve yet. -- Spain debt problem is on the way. -- Berkshire profit drop 58%. Market might take that as a slow down. -- The bond king sold all his bond and some more short it. -- S&P downgrade US debt. |

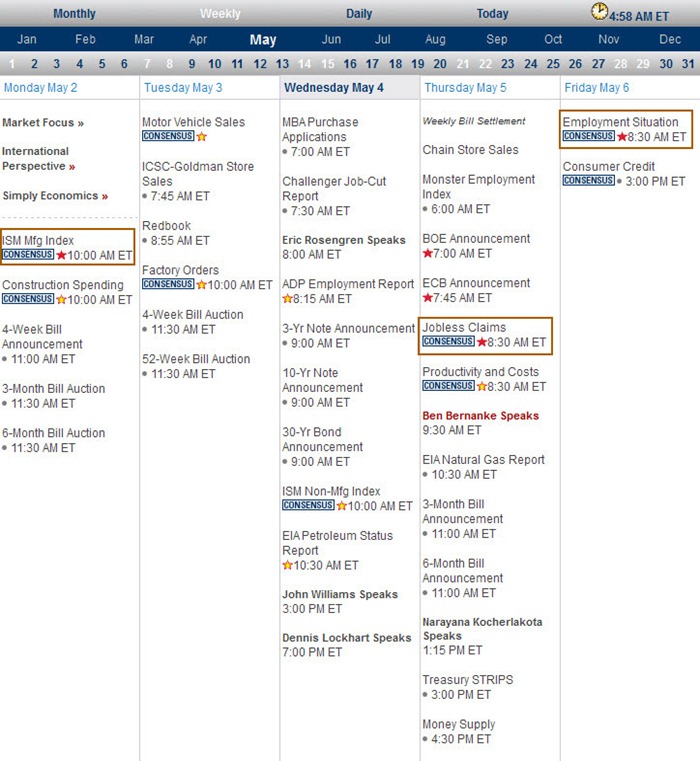

Next Week Economic Data:

Input:

- Not much data coming out next week. Should be an advantage for the BULL.

VXX chart:

Input:

- You just have to believe what you see. I know it does not make sense for the BULL to be this strong at all, but don't fight against it.

SPY chart:

Input:

- SPY clearly tells us that the BULL has leg. It still has some room to go before coming to the next resistance line. Watch out for at least a small correction when it reach there.

DJIA chart:

Input:

- Still has some room to go before coming to the resistance line of 13,000. Watch out for correction there.

NASDAQ chart:

Input:

- NASDAQ just taken out the resistance line. It is all time high now. Seems like nothing is blocking it anymore. What a BULL !

UUP chart:

Input:

- Do I have to say anything on this? USD buying power is gone for good.

- This is why GLD keep going up.

Sector Analysis:

Input:

- Other than XLF, all other sectors are going higher as indexes.

- Watch closely where the XLF will be going, it is now at a very important junction.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- It might be time to SHORT SLV by going long in ZSL.

- Don't short GLD first. It is still strong as long as UUP is weak.

- USO up trend is still intact. Expect it to go higher even though now bounce into double top formation.

- Yes, I was right that UNG is a BUY.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Looks like FXI is facing a resistance at 46.40

- Looks very much like a head-n-shoulder, but no confirmation yet. Strong support at 42.00

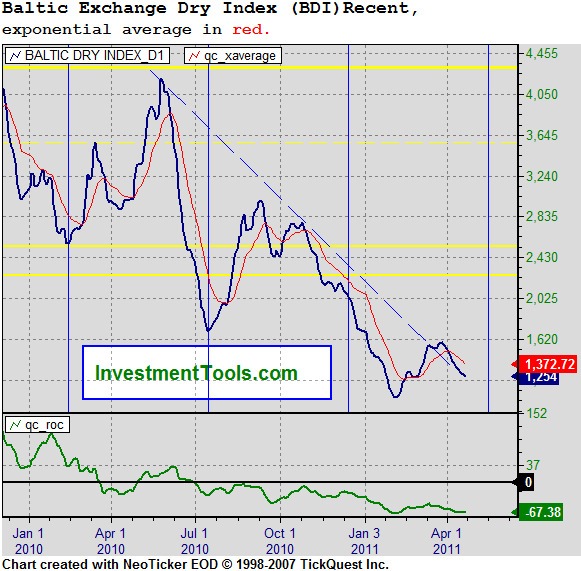

Baltic Dry Index chart:

Input:

- See how important it is to monitor the Baltic Dry Index in order to have the right decision on stock investment in shipping companies? Check out how a sample shipping stock like EGLE going down step by step even though indexes kept going higher and higher.

No comments:

Post a Comment