BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- All indexes have come to a long term multiple top formation. However, if all indexes broke up from their resistance lines, then we are going to have a very strong BULL. -- All indexes went up for the past weeks too fast and the volume is not that encouraging. -- Daily SPY chart seems to form an isolation island formation (BEARISH). -- UUP is at a critical stage with a very upside volume on May. Possibility of UUP going higher is quite high and that will be a bad news for the stock market. -- VXX is at it lowest low again. Intraday chart shows that it is at a critical junction. -- USO is back to its downtrend again after a fake breakout. -- FXI is still below its uptrend line. | -- Except that all indexes break up from all their multiple top formation, else we could be reaching a long term top which can be dangerous. -- Baltic shows a bit of uptick, but not significant enough. Most shipping stocks are still been beaten down to earth. |

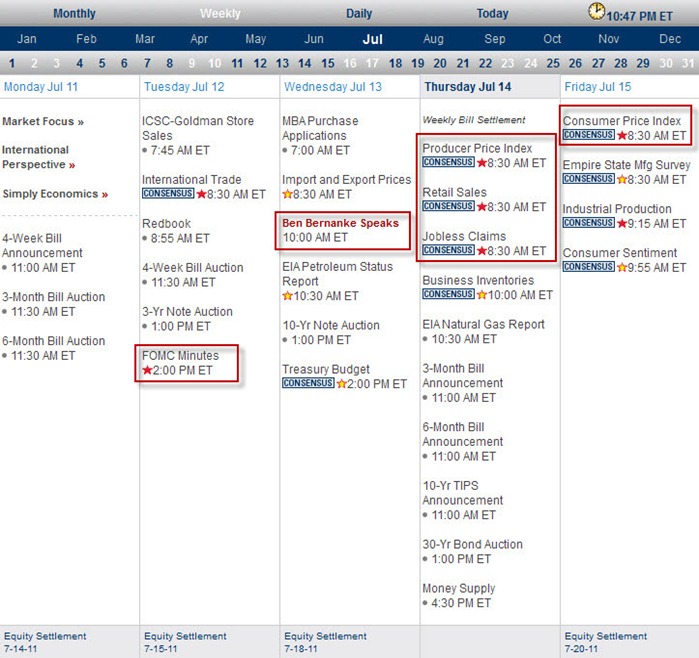

Next Week Economic Data:

Input:

- Heavy data week next week. CPI, PPI and Jobless claim all will be out.

- Ben speaks?? What can he do??

VXX chart:

Input:

- VXX continue to make lower low. This is an insane market.

- However, intraday VXX chart shows that it is at a critical junction.

SPY chart:

Input:

- Look at the long term weekly chart, you will find that it is again following text book.

- A very possible of isolation formation (BEARISH) in SPY daily chart.

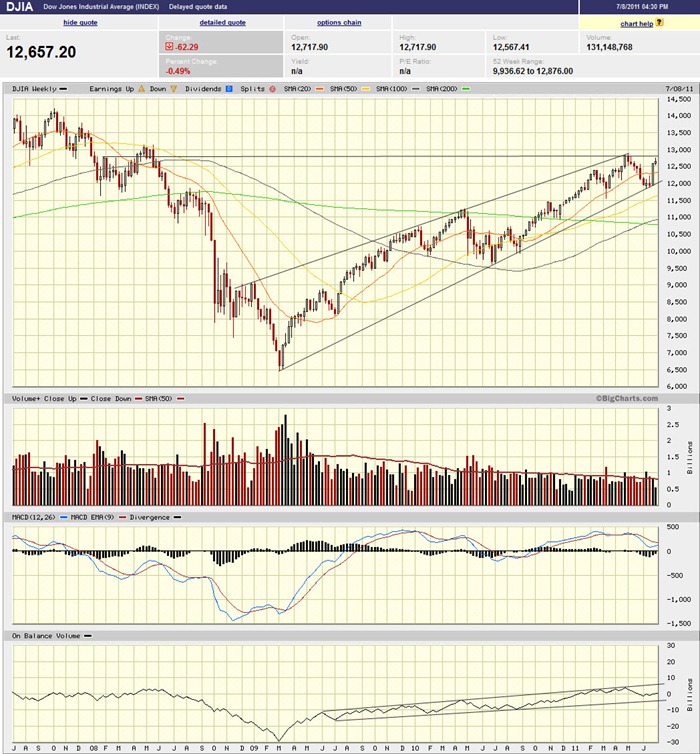

DJIA chart:

Input:

- It is a very fantastic long term DJIA chart. Everything just follow text book.

- Expecting at least a healthy correction at this point.

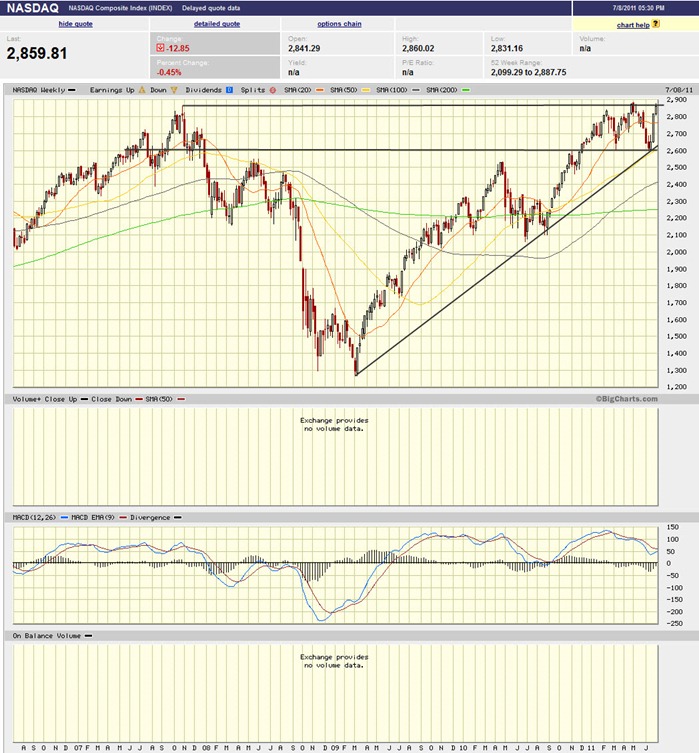

NASDAQ chart:

Input:

- It look like a triple top formation. The up is too quick too fast.

- Expecting a healthy correction from here.

UUP chart:

Input:

- UUP is at a critical stage. A turn to the upside is quite likely because of its upside volume on month of may.

- This can be a bad news for stock market.

Sector Analysis:

Input:

- Many sectors reached their multiple top, so correction is not a surprise.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- Looks like GLD is still in its uptrend. GLL is broken down from its uptrend line again.

- Silver is now in a tight range play and approaching the 20MA line which now acts as resistance line. Low volume may not be able to sustain its up move. A chance to short silver could be very near now.

- Looks like the down trend of USO is still intact. That sounds like a bad news for the economy growth.

- With the USO in the downtrend, UNG won't be in much of a good shape.

- UNG is doing a multiple bottom formation for its long term chart, but it looks weak rather than an opportunity. All its MA lines are acting as resistance line.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is sitting on its 100MA and 200MA lines which it previously punch through downward.

- The long term FXI chart shows that the downtrend is still intact.

- MACD shows that it has not been able to go up from its 0 line for one and a half year already.

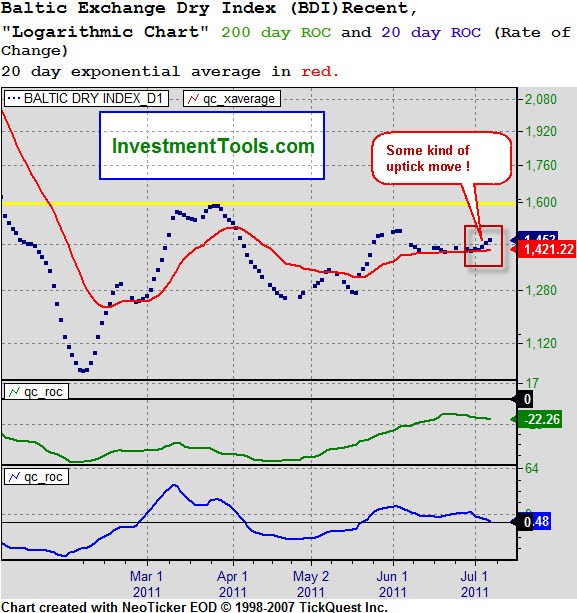

Baltic Dry Index chart:

Input:

- Don’t rush into shipping stock yet. Many of them are almost dead.

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhL38qgCxCMhsVwk2rNNKbIEAnsyPu_SKAb_wZnLKGfZY4h_xGlsTJwDwo5fbNeDGiAQrN4Ueou5PuT-kOI42WTfH0JkwUUuNMyV7ZqPbHu8o52LOEQyK19TjNhs0ztBhcpq1HSdqUVRCo//?imgmax=800)

No comments:

Post a Comment