BULL or BEAR ??

| Short term (1 week) | Notes |

| -- It is interesting that market actually went crazy when I was not doing my homework for a month. -- China FXI is still very weak and might be getting weaker. -- All indexes clearly indicate strong resistance at their weekly 20MA lines and daily 100MA lines. -- VXX is now at a triple bottom situation. Volume is also getting higher. -- USO, GLD and SLV have came down to retest their trend line. Ben's announcement is also not encouraging to the Gold bugs. -- The only weird one is the natural gas UNG. It has poke up through its weekly 20MA line again. This could well be a buy signal. -- Thursday's jobless claim report can be very important to the market has mentioned by Ben the he will be watching job report very closely. -- UUP has retest its upper part of trendline and retraced temporary, -- Shipment index is again pointing downward. -- Most sectors are showing mid term downtrend is still intact. |

SPY (30 years monthly) chart:

Input:

- Monthly chart shows that its 20MA line has been threaten once. Price rebound back above the 20MA line but not much.

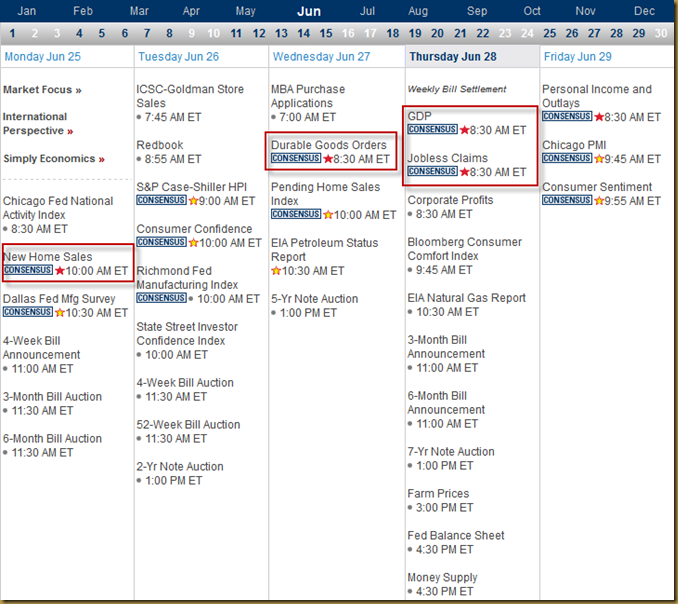

Next Week Economic Data (1 week):

Input:

- Thursday data will be crucial.

VXX chart:

Input:

- Weekly VXX chart is again all time low and came out with a triple bottom. This is dangerous.

SPY chart:

Input:

- Looking at the weekly and daily chart of SPY, one should not be surprised with the big drop on Thursday. Were you? ;-)

- A big resistance of 20MA line in the weekly chart and 100MA line in the daily chart has warned us very well.

DJIA chart:

Input:

- Similar to SPY. Just that DJIA is slightly stronger and gave you an illusion that its daily chart's 100MA line has been taken over.

- However, weekly chart has warned you that there is a big resistance line from the May'11 high.

NASDAQ chart:

Input:

- Similar to SPY and DJIA, but NASDAQ is much weaker among thee three.

UUP chart:

Input:

- UUP might have started to establish a reverse of its downtrend.

- Price has successful go above the monthly 20MA line. Will see how it comes back to the 20MA line.

Sector Analysis:

Input:

- Most sectors are still staying within the mid term downtrend with strong resistance from their 50MA lines.

Copper JJC chart:

Input:

- Copper's downtrend continues. Price has again came down to test its trend line.

- Monthly MACD is still pointing more downward potential is building up.

GLD and SLV charts:

Input:

- GLD has again broke down its monthly 20MA line. Monthly GLD chart shows that all secondary indicators are all going downward and weak.

- SLV is even weaker. Came out with a multiple bottom. All secondary indicators are pointing more downward potential.

Petrol and Natural Gas charts:

Input:

- USO is very weak too. A three year multiple bottom chart is now in front of us. Price is also below its monthly 20MA line.

- UNG is the only one that is indicating something else. Good volume has started to come in and price has broken through the weekly 20MA line twice. A W bottom shape seems to be in the making.

- UNG can be a very good long candidate.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- China is only showing more weakness. All secondary indicators continue their downward moves.

Baltic Dry Index chart:

Input:

- Shipment has again dropped below trend line and its 20MA line.

No comments:

Post a Comment