BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Inflation is starting to become an issue. -- All 3 indexes are forming double top formation. Expect temporary weakness. -- Petrol broke up resistance. -- PPI and CPI data and retail data coming up. -- VXX is showing rebound at the double bottom. | -- Many big company going to report earning like GOOG and AAPL. |

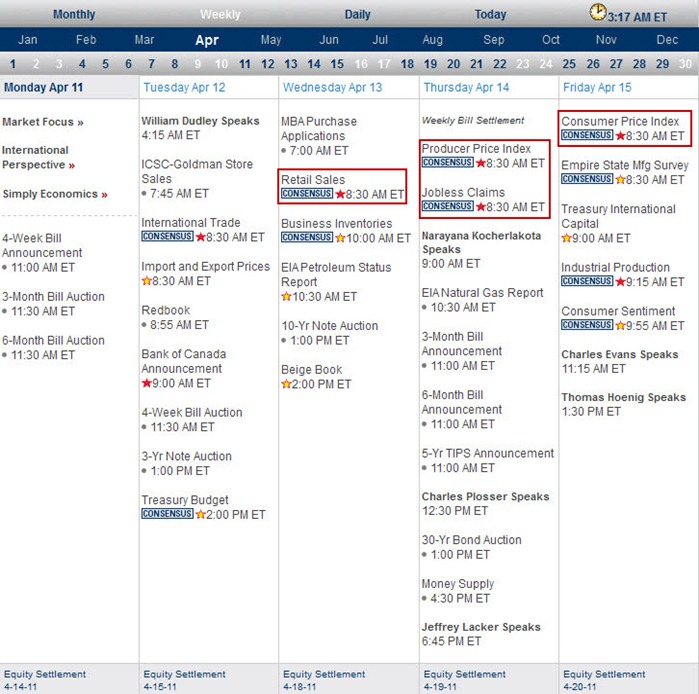

Next Week Economic Data:

Input:

- Not much of data until end of the week.

VXX chart:

Input:

- VXX is retesting its low and show sign of rebound.

- This will be good for my Thursday's entry of DXD and FAZ.

- TMF and MACD indicators are rising.

- Previous few weeks of rallying volume was quite promising.

SPY chart:

Input:

- SPY seems to face resistance at point 134.00

- Intraday SPY shows curvy shape forming with 20MA and 50MA line doing bearish cross and now the point drops below 50MA line.

DJIA chart:

Input:

- Intraday same like SPY. Curvy shape and with 20MA and 50MA line doing bearish cross.

- Double top formation at the daily chart.

NASDAQ chart:

Input:

- Same like SPY and DJIA.

UUP chart:

Input:

- I guess I don't have to say anything about UUP. You should be able to see the trend here clearly.

Sector Analysis:

Input:

- XLK and XLF are now block by 50MA line.

- The rest of the sectors are now showing weakness.

- Overall marker is still healthy.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD and SLV just went wild.

- Petrol broken through the resistance. A lot of upside for petrol to rally.

- UNG is just a weird gas, however, it has a pretty safe entry now chart wise.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Still in its uptrend but is either turning or consolidating.

Baltic Dry Index chart:

Input:

- No recovery seen yet.

No comments:

Post a Comment