BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- All 3 indexes have rebounded from their 50MA and 20MA lines. This is temporary bullish. -- VXX has came down to the double bottom, its lowest point so far and it can get even lower. -- UUP is at all time low. | -- This rebound of 3 indexes can be just temporary. -- VXX might rebound from its lowest point and if it does, it can be volatile. -- The QE2 is going to end at June. This can be havoc. -- The US debt issue is again on the focus. -- Japan and Libya issues are not yet settled. -- "Sell in May, Go Away…" Remembered? |

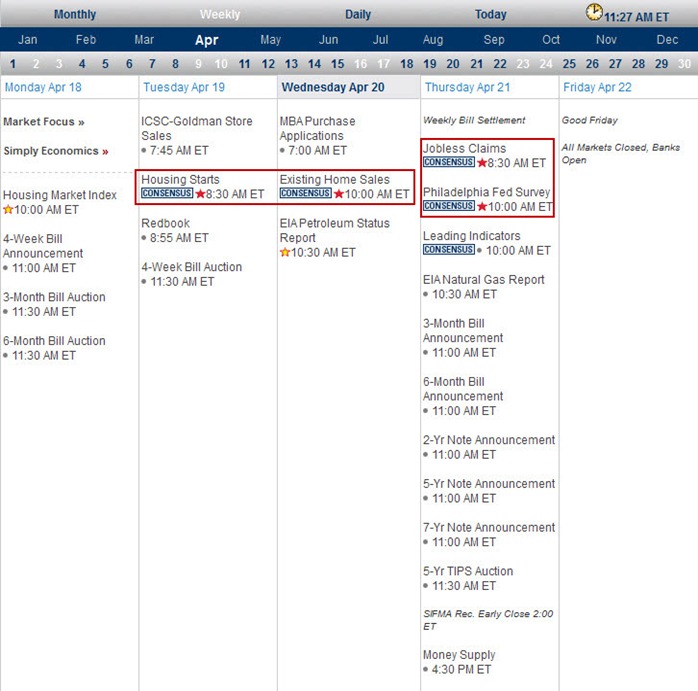

Next Week Economic Data:

Input:

- Only housing data and Jobless claim on next week data release.

- Market should not be too volatile.

VXX chart:

Input:

- VXX is again coming to the double bottom. It is again at a critical point. We will watch closely how it behaves from here,.

- VXX has potential to get even lower from here, so if you are shorting stocks, it is wise to tighten your stop loss now.

SPY chart:

Input:

- SPY has gave two days of strong rebound if you observed carefully.

- Right now it has just brake through the daily trend line going upwards.

- Daily 20MA line is bullish crossing the 50MA line again.

- This rebound can be short live, but we will see.

DJIA chart:

Input:

- Intraday go above 50MA line already. This is bullish indicator for DJIA.

- Daily chart rebound from the 50MA and then 20MA line shows that bulls are back (at least for now).

- Behave similar to SPY.

NASDAQ chart:

Input:

- NASDAQ remain the weakest of all three indexes. Its intraday chart still below 50MA line but managed to get up from 20MA line.

- Daily chart however shows that it has also manage to rebound from the 50MA and 20MA lines. This is also a bullish indication.

UUP chart:

Input:

- USD is basically hopeless. ;-)

Sector Analysis:

Input:

- You can see clearly all the charts that was pointed with black arrow. Those are the sectors that are now touching the lower part of the trend line.

- XLP and XLV are the only two sectors that are really strong.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- If you buy GLD and SLV…. You are definitely rich by now. The charts tell it all.

- The natural gas is behaving ok.

- USO is consolidating at the upper trend line. It has more potential to go upward rather then downward.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- China index still remain very healthy.

Baltic Dry Index chart:

Input:

- Not much different from last week. So I am not showing it here this week.

No comments:

Post a Comment