BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- UUP making multiple bottom. -- UNG making multiple bottom. -- USO making multiple bottom. -- Many sectors are making double bottom. -- SPY weekly chart approaching the 2008 crashing line. -- DJIA weekly chart still has its 200MA line as temporary support before coming into 2008 crash line. -- NASDAQ is so far the safest. Its weekly chart still has a short distance to its 200MA line and also to the 2008 crash line. -- VXX weekly charts seem to show hanging man. -- Expect a short term rebound. However, if market decide to punch through the previous crashing point, be ready to run as fast as you can. | -- GLD making higher move. Either UUP dip down, or market go down, it can still going up both ways. -- GDP and Housing data on Thursday and Friday, watch out! -- MACD for all 3 indexes start dipping into negative territory. -- All 3 indexes are approaching closer and closer to yr 2008 crashing point. |

Next Week Economic Data:

Input:

- Data on Thursday and Friday should be the main player of the week.

- [Added on 23rd Aug] Watch out for Ben’s speech on Friday. That can swing the market heavily.

VXX chart:

Input:

- A weekly hanging man formation ??!! Will this bring some rebound back to the market?

SPY chart:

Input:

- Very near to the 2008 crashing line. Steps away.

- Very high volume past 2 weeks.

- MACD dipping into negative territory.

- Things look pretty similar to 2008 crash.

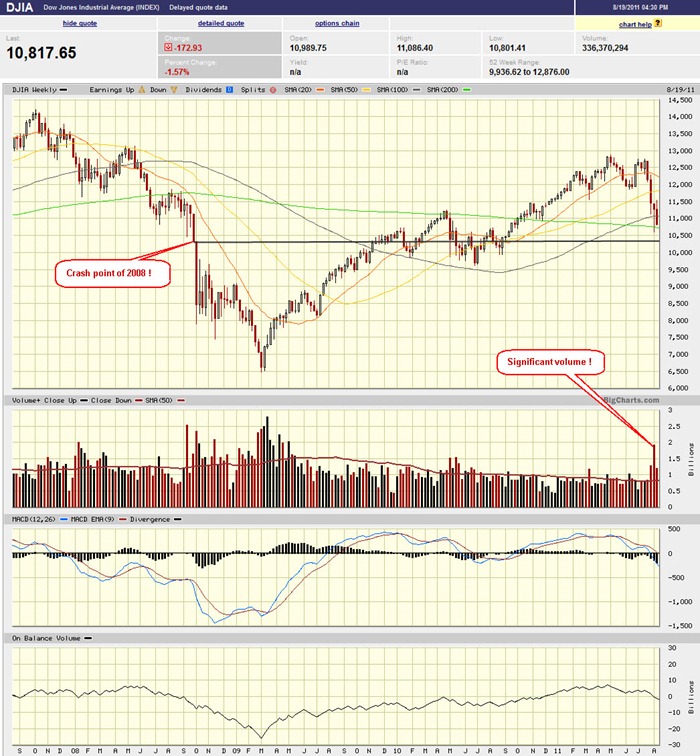

DJIA chart:

Input:

- Similar to SPY, but DJIA is in better shape comparatively.

- 200MA support line for DJIA is critical.

NASDAQ chart:

Input:

- Similar to SPY, but NASDAQ is in better shape comparatively.

- 200MA support line for NASDAQ is critical. It still has a better play compare to DJIA.

UUP chart:

Input:

- UUP is now at tipping point. It may react both way violently.

- What is its relationship with GLD now??

- UUP up is normally bad for market, GLD will go up. UUP down also will drive GLD higher. Does that mean GLD will keep going up no matter where UUP goes?

Sector Analysis:

Input:

- Many sectors are showing some kind of double bottom.

- Utility stay strong during bear market.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- GLD still making all time high.

- SLV is making another big rally with low volume.

- UNG is continuously making multiple low. 20MA and 50MA lines are merging. Things are getting interesting for UNG. Is now the entry time?

- USO is making multiple low again. Expect a rebound.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is making multiple low. Standing above its previous crashing point at Sept 2008.

Baltic Dry Index chart:

- NA

Input:

- Not enough time for this.

No comments:

Post a Comment