BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- Expect the rally to continue for a week. -- Indexes showing bullish weekly candle formation with support at 200MA line. -- All sectors and USO are showing sign of stabilization. -- FXI also show sign of stabilization at 35. -- Baltic Dry Index shows a lot of improvement to my surprise. -- The rally can be short ! | -- Look for the handle part of theVXX cup with handle formation. This is very dangerous. -- The temporary rally may not last. -- Watch out for the FED announcement in month of Sept. -- MACD of all indexes already below zero line. |

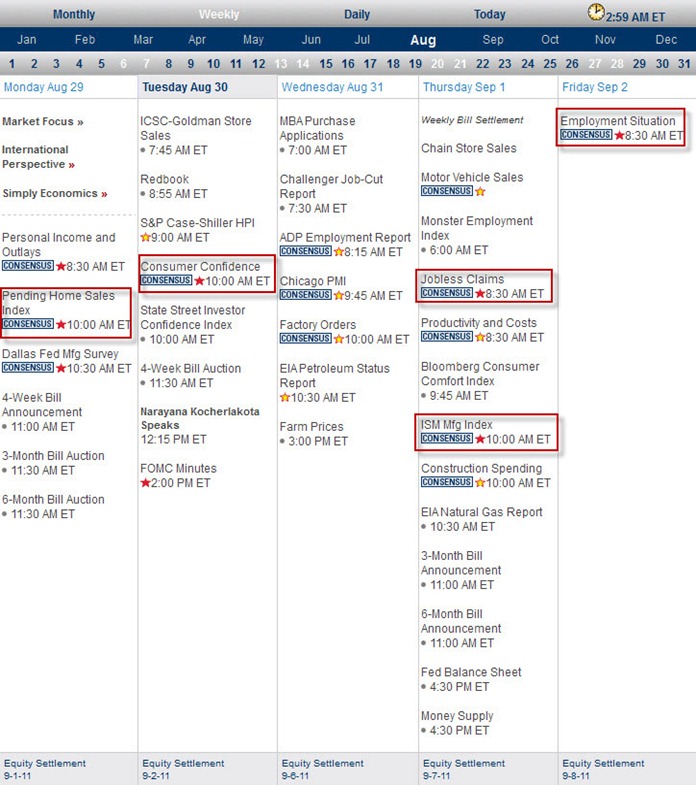

Next Week Economic Data:

Input:

- There should not be much surprise data next week.

- This should help to bull to charge the market next week.

VXX chart:

Input:

- This VXX weekly chart definitely tell a lot of bad news. It has a very BEAUTIFUL but DANGEROUS parabolic shape. Bottom could be in place for 3 months already.

- Extreme high volume for the past few weeks.

- It looks like forming a cup with handle, a text book pattern that has very high potential of higher move in the near future.

- Be very careful of the weekly 50MA line.

SPY chart:

Input:

- Weekly 200MA line provide a good support.

- Weekly 100MA line is now its resistance line.

- MACD start dipping into 0 line. This is not good.

- Previous weeks trading volume is equivalent to the high volume crashed in 2008.

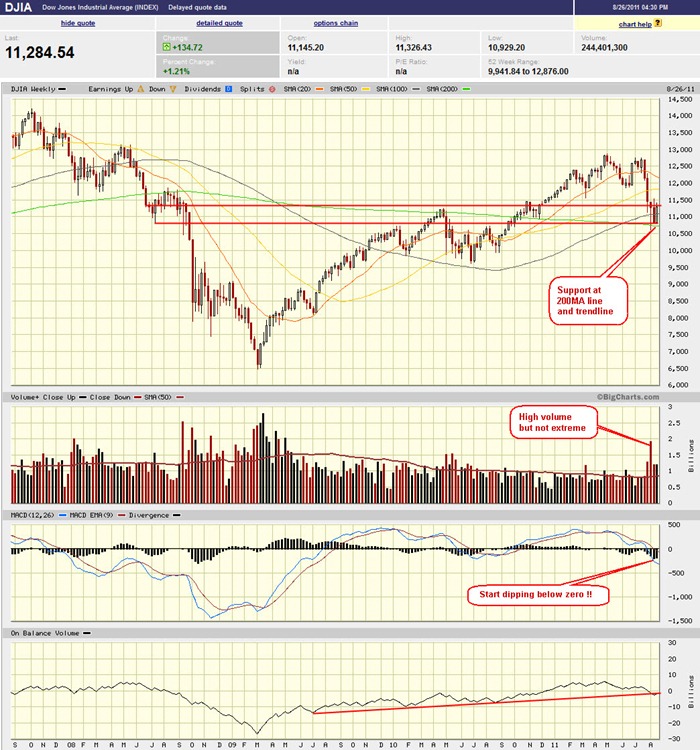

DJIA chart:

Input:

- Support at 200MA line and the trend line.

- MACD start to dip into negative zone, this is not good.

NASDAQ chart:

Input:

- Similar to DJIA

UUP chart:

Input:

- We still need to see how UUP react after coming out of the triangle.

- This will show where the market and GLD is going forward.

Sector Analysis:

Input:

- Sign of stabilization across all sectors. Good sign for bull.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- Weekly charts of GLD and SLV show that they are both getting weaker.

- Petrol USO is showing sign of stabilization.

- UNG coming to another triangle formation. Its MACD looks like more potential to the upside. It is at the all time low again.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Weekly charts of GLD and SLV show that they are both getting weaker.

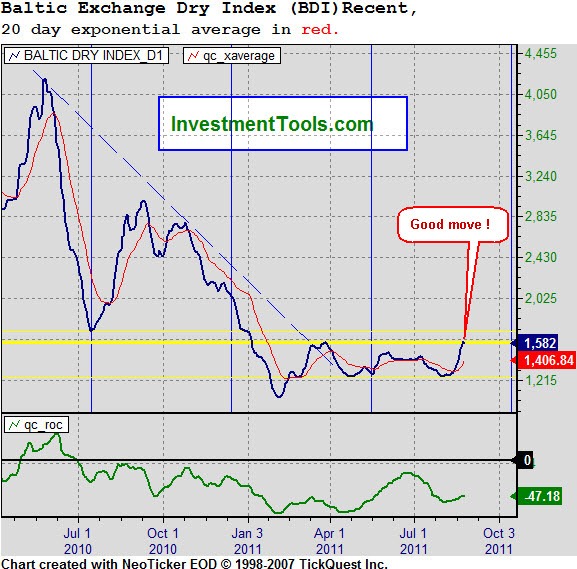

Baltic Dry Index chart:

Input:

- Very encouraging sign from the Baltic shipment chart.

- Not sure how well it can sustain and not sure whether does it really going to represent the pick up of international trade, but definitely it is a good move.

- Refer to my previous post on Baltic.

No comments:

Post a Comment