BULL or BEAR ??

| Short term (1 week) | Long term (1 month) |

| -- All 3 indexes weekly chart shows facing resistance at trendline. It makes the short term bounce looks like "dead cat bounce". -- Short term uptrend for all 3 indexes are still intact, but once the MA line and resistance line are broken, it can be real BIG trouble. -- Short term uptrend for all sectors are still intact. -- Baltic Dry Index is getting higher again. Something interesting to take note. | -- All 3 indexes weekly chart plus FXI weekly chart shows that we are still in a Bear market. -- There is no more blocking MA line for VXX anymore. -- UUP is trying to get higher. -- If all 3 indexes broken down from MA line and trend line support in their daily chart, we are going down hard. |

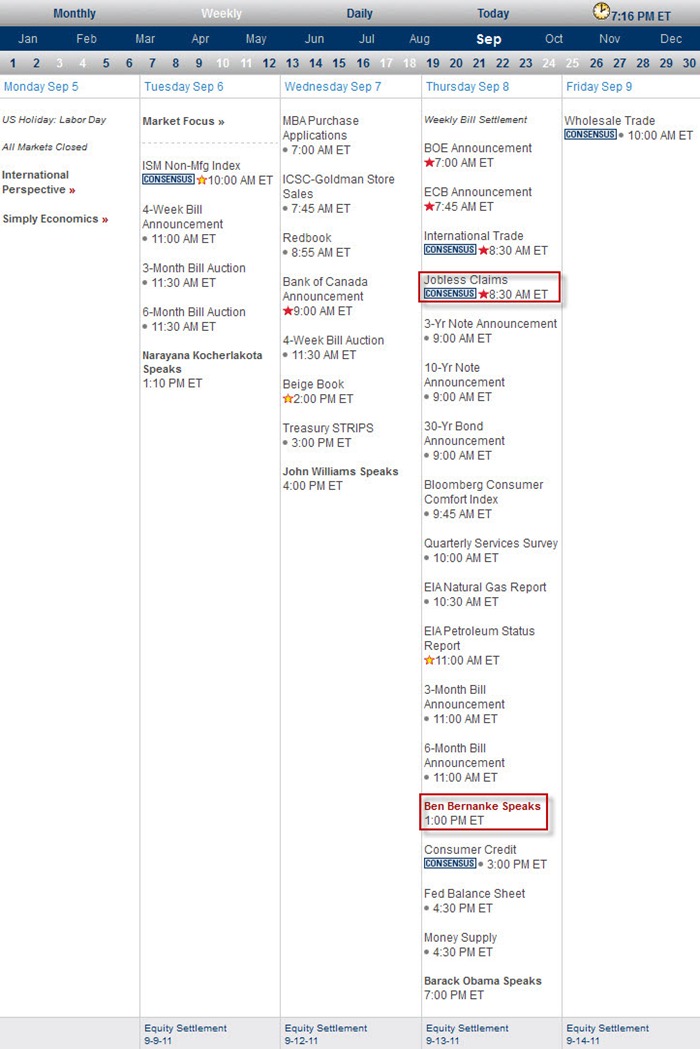

Next Week Economic Data:

Input:

- Not much data except Thursday.

VXX chart:

Input:

- Predicted this coming in last week analysis, but again I was not paying attention to it.

- It bounced right on the 20MA line and create havoc on Friday.

- Costly mistake, else could have pocket more $$$ on my trades.

- Looks like there is no MA lines is blocking the advancement of VXX anymore.

SPY chart:

Input:

- Big drop (2.55%) but only less than average volume. This is weird.

- Daily chart shows that short term it still has the 20MA line and trend line as support.

- Weekly chart shows that it has bounced into the resistance trend line even though it still has the 200MA line as support.

- Now is a matter to observe how it behaves at the resistance line. Another failure through the 200MA line will really mean BIG disastrous trouble.

DJIA chart:

Input:

- Similar to SPY, DJIA weekly chart shows trouble.

- All these make the short term bounce looks like "dead cat bounce".

NASDAQ chart:

Input:

- Similar to SPY and DJIA

UUP chart:

Input:

- UUP is still struggling inside the weekly triangle formation in the weekly chart.

- Daily chart shows that MACD is moving up through the zero line already and the price is trying to break upward through the 50MA line.

- This might be bad for stock, but will that mean a bad news for GLD? The relationship between UUP, stock market and GLD is getting harder and harder to correlate especially now everyone is expecting a QE3 in the pipeline.

Sector Analysis:

Input:

- It is clearly seen that all sectors actually gapped down, however the short term uptrend for all of them are still intact.

GLD, SLV, Petrol and Natural Gas charts:

Input:

- A gap up of GLD. Could this be the isolation pattern? Watch closely. The volume is below average, this increase the chances of isolation island pattern.

- SLV behaves just like GLD. Potential isolation island.

- USO is sitting on the daily 20MA line and the trend line.

- UNG chart is not shown here, but it is not pretty either.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is still weak. MACD digging deeper.

- It is still below all MA lines.

Baltic Dry Index chart:

Input:

- This is not something that we should take lightly anymore. Something is going on here.

- It is time to check out the shipping stocks and see what is coming in the pipeline.

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj060CIRkWprmsZZkfpxoOx8YN0da1nlb7u-YrTGpKKFh5Gka87QlCptuvzHBSwmOJEeddbuGyMXMzpSwnQeWaGicXMs5SwlGEtzp87JMHz2x5x1zCMHMxCWlAnrBEdE1eKzcnI0be_X-0//?imgmax=800)

No comments:

Post a Comment