BULL or BEAR ??

| Short term (1 week) | Notes |

| -- Watch out for SPY resistance level at around 131.00. -- VXX coming to the next support line at 33. -- A correction is expected. |

SPY (30 years monthly) chart:

Input:

- Unbelievable! It has completely overtaken the 20MA line. Maybe history is not going to repeat itself this time.

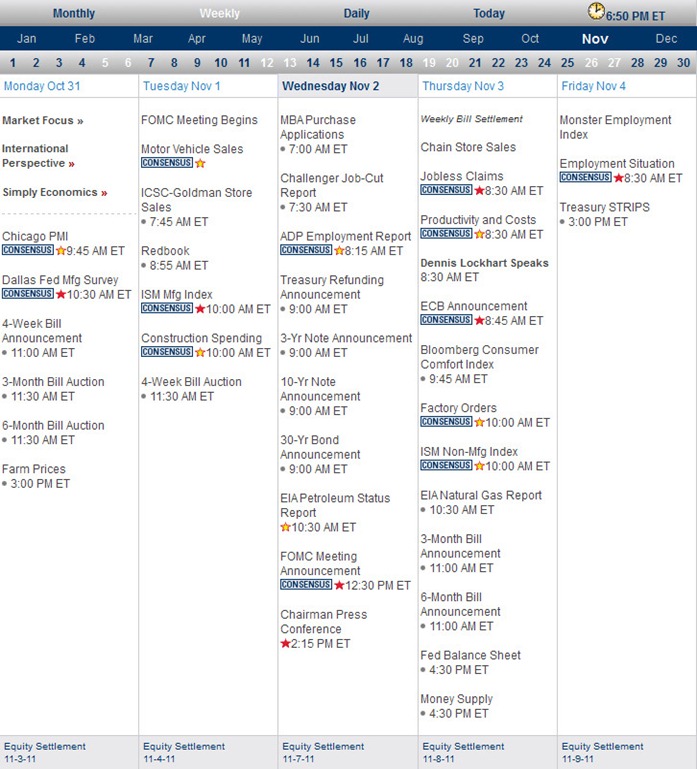

Next Week Economic Data (1 week):

Input:

- FOMC on Wednesday. Correction is expected at least on Tuesday.

- Jobless and employment on Thursday and Friday. Expect volatility.

VXX chart:

Input:

- Support at current level is important for the Bear.

SPY chart:

Input:

- Daily SPY chart shows that it is reaching a correction point.

DJIA chart:

Input:

- Similar to SPY.

NASDAQ chart:

Input:

- Weekly chart of NASDAQ shows that correction is due.

UUP chart:

Input:

- UUP has reached a strong support line for the Bear to roar again.

Sector Analysis:

Input:

- Many sectors hitting on resistance trend line.

Copper JJC chart:

Input:

- Copper approaching resistance line at $50.00

GLD and SLV charts:

Input:

- GLD and SLV are expected to have minor correction.

Petrol and Natural Gas charts:

Input:

- USO approaching strong resistance at around $37.00.

- UNG looks like trying to form a bottom "again".

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Similarly, FXI is bullish.

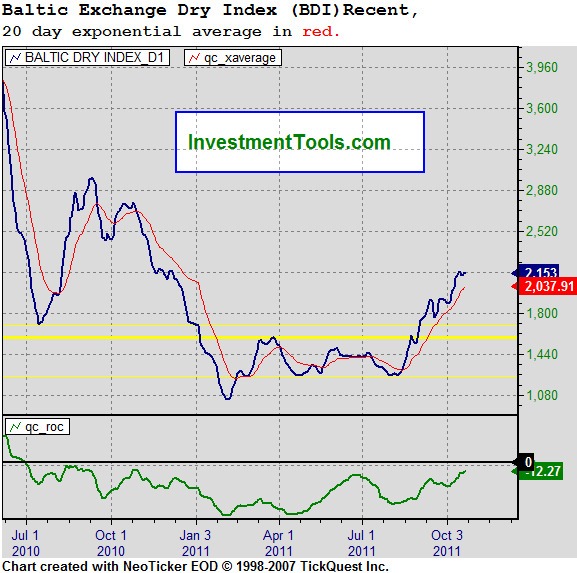

Baltic Dry Index chart:

Input:

- No sign of retreat from shipment index. Expect it to continue its uptrend.

No comments:

Post a Comment