BULL or BEAR ??

| Short term (1 week) | Notes |

| -- All three indexes are still showing Bull's signature. -- All sectors reached resistance line and do minor correction. -- UUP uptrend is facing challenges. |

SPY (30 years monthly) chart:

Input:

- SPY 30 year chart still stay healthy.

- Value is still above the 20MA line and the support trend line.

- We still have to accept that bulls are still in control.

Next Week Economic Data (1 week):

Input:

- Not much data report for the week. The news will be basically all those Europe debt news.

VXX chart:

Input:

- Both daily and weekly VXX charts show that it still has support from 18MA line.

SPY chart:

Input:

- Daily SPY still has support from 123MA and 18MA lines.

- Bull still has the control.

DJIA chart:

Input:

- Similar to SPY, daily DJIA has strong support from 18MA and 123MA lines.

- Golden cross is forming for 18MA and 123MA line.

NASDAQ chart:

Input:

- Similar to SPY and DJIA, strong support from both 18MA and 123MA lines.

- Golden cross for 18MA and 123MA lines completed.

- Bull has the upper hand.

UUP chart:

Input:

- UUP uptrend is weak but not completely dead yet.

Sector Analysis:

Input:

- All sectors touched their resistance lines and now in minor correction mode.

Copper JJC chart:

Input:

- JJC chart facing resistance at 47MA line.

GLD and SLV charts:

Input:

- GLD is tremendously strong. Looks like some kind of easing policy is going to implement for the Europe problem.

- SLV is following GLD's move, but facing resistance at 47MA line.

Petrol and Natural Gas charts:

Input:

- USO facing resistance at trendline.UNG is again doing its all time low multiple bottom again. Anyone dare to go near?

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI is facing resistance at 123MA but still has support from 76MA line.

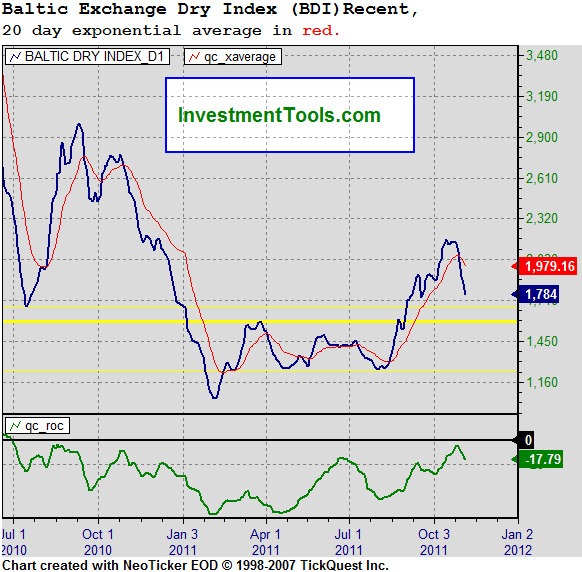

Baltic Dry Index chart:

Input:

- Shipping turn South suddenly. A very sudden and interesting turn. What does it mean to the market?

No comments:

Post a Comment