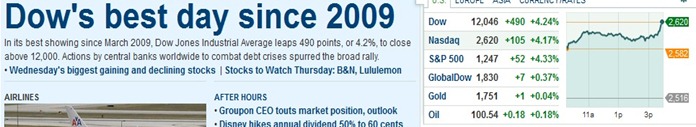

BULL or BEAR ??

| Short term (1 week) | Notes |

|

| -- The market had a few good rally days last week. All MA lines previous broken have been recovered in just one single week. This is a very bullish indicator. |

SPY (30 years monthly) chart:

Input:

- As shown in the monthly chart, SPY is still staying on top of the 20MA line and the 120.00 line. Overall SPY is still healthy and uptrend is still intact until it is broken.

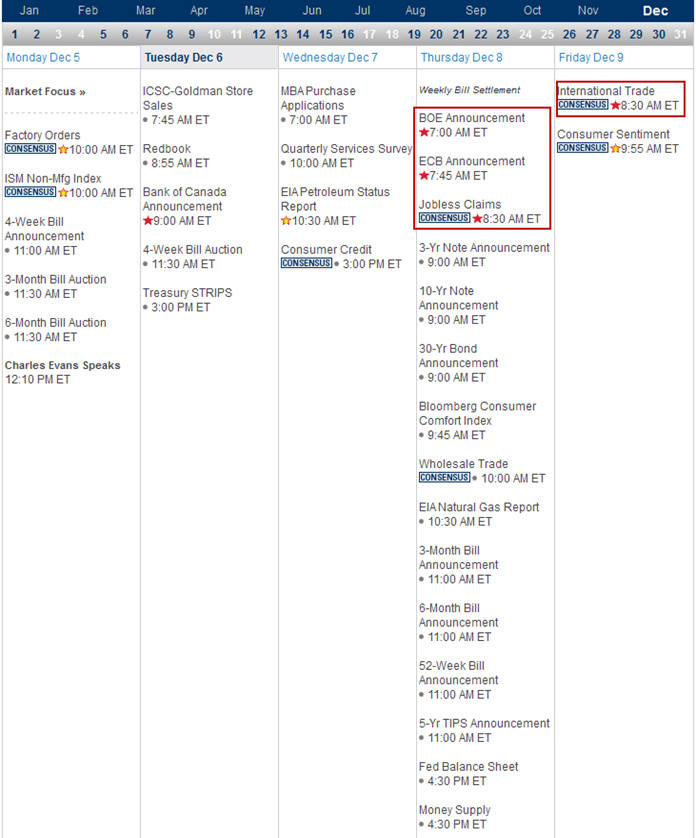

Next Week Economic Data (1 week):

Input:

- Not much data next week, except on Thursday.

- This time the BOE and ECB announcement can be important since all the problems are from Europe now.

VXX chart:

Input:

- Weekly chart shows that it is now resting at the support trend line of previous high and the 20MA line. This can be a bit dangerous.

- Daily 20MA has crossed up 50MA line and value has been surfacing at the 20MA line. This is not a good sign for the equity market in the long run.

- Its next support line is at 50MA line.

SPY chart:

Input:

- Daily SPY chart shows that it is facing resistance from the 200MA line and the trend line. Correction is a healthy reaction.

- This is an extraordinary week. SPY overtook back all the MA lines that it lost a week ago. Such a rally is impressive.

DJIA chart:

Input:

- DJIA has overtook all the MA lines again in just one single week.

- Currently facing resistance at the trend line. Correction is healthy.

- Monthly chart shows that DJIA is still above its 20MA and year 2000 high trendline.

NASDAQ chart:

Input:

- Similarly NASDAQ has done a good rally in a week time. Overtook all MA lines previously lost.

- Monthly chart shows that overall direction is still healthy. Value still stay above its 20MA line.

UUP chart:

Input:

- UUP daily chart shows that uptrend is still intact. This is not that good for equity.

Sector Analysis:

Input:

- Many sectors have reached their resistance trend lines. Correction is expected.

Copper JJC chart:

Input:

- Monthly chart shows that JJC is indicating rally but its long term down trend still remain.

GLD and SLV charts:

Input:

- Monthly GLD chart shows that GLD is still healthy at its uptrend but daily GLD chart shows that it is facing resistance from its trend line.

- SLV monthly chart shows that it is coming to the 20MA support line even though it is still in its downtrend.

Petrol and Natural Gas charts:

Input:

- USO uptrend is still intact.

- UNG downtrend is still not done yet.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Similar to all indexes, FXI has overtook all the MA lines previously lost.

- Very bullish signal.

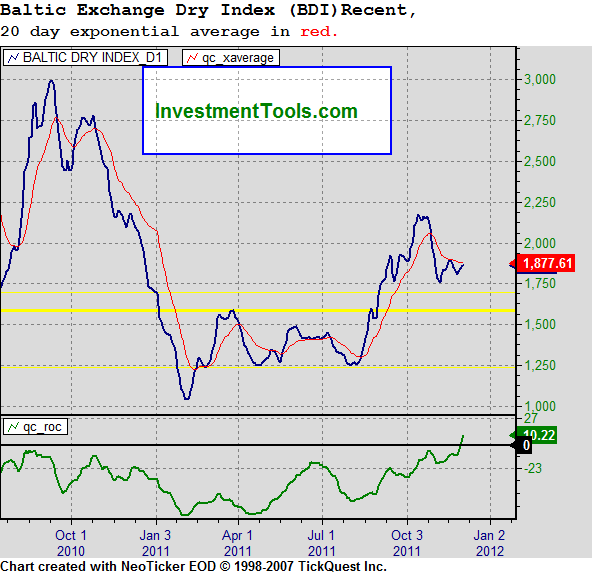

Baltic Dry Index chart:

Input:

- Shipping index still looks healthy, however, shipping stocks are falling like rocks. There are a lot of opportunities on shipping stocks when the economy recover. Keep monitoring them.

No comments:

Post a Comment