BULL or BEAR ??

Finally!!! Back from Chinese New Year. It is time to get back to work.

Market was treating us pretty well for the entire New Year week. ;-)

| Short term (1 week) | Notes |

| -- Expect short term retracement due to resistance at SPY, DJIA and NASDAQ charts. -- China FXI index is still weak and facing multiple resistance from its MA lines. -- Most sectors ETF are facing resistance from trend lines. -- Shipment Baltic index was a total failure. Watch out carefully, it might be a warning. -- VXX is indicating that even retracement is expected, overall market is still positive and has high potential for more upward move. -- GLD and SLV rebound looks good. -- Bottom might be in for UNG. Watch carefully. |

SPY (30 years monthly) chart:

Input:

- Long term SPY chart is still facing resistance from the trend line. Retracement is expected but overall it is still healthy and could possibly overtake the resistance line and march forward.

- Value still stay way above the 20MA line.

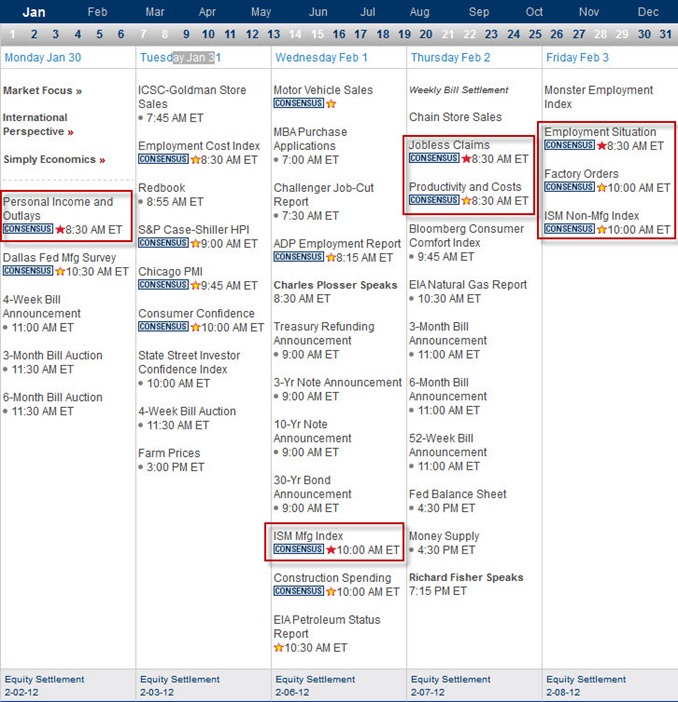

Next Week Economic Data (1 week):

Input:

- Some important data at end of week. Expect some volatility at end of week.

VXX chart:

Input:

- VXX looks set for more downtrend movement. All secondary indicators also pointing towards that direction.

SPY chart:

Input:

- Weekly chart SPY shows that it is still healthy and still staying way above all MA lines as well as the tend line.

- All secondary indicators are still pointing towards more up trend.

DJIA chart:

Input:

- DJIA monthly charts shows that it is also facing resistance from the trend line, but still healthy and stay way above the 20MA line.

- Value actually overshot the trend line but making retracement.

NASDAQ chart:

Input:

- Similar to SPY and DJIA. Facing resistance from the previous top line. Value is trying to overtake the resistance.

- Still staying above the 20MA line.

UUP chart:

Input:

- UUP monthly chart shows that the up trend of UUP is facing resistance and making a retracement back below its 20MA line.

Sector Analysis:

Input:

- Most sectors have reached the resistance level. Expecting them to make retracement in short term.

Copper JJC chart:

Input:

- Copper facing resistance from 50MA and 100MA lines, but volume and secondary indicators show that it has potential to overtake the resistance lines.

GLD and SLV charts:

Input:

- GLD is strong. Overshot the resistance 20MA line and trend line.

- SLV follow thru the GLD steps.

Petrol and Natural Gas charts:

Input:

- USO is expected to stay within $36.00 and $40.00 range bound.

- It is not time to bet on UNG yet; however, bottom looks like set in. Volume was great and secondary indicators indicating positive move.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI I still facing multiple resistance from 50MA, 100MA and 200MA lines. Not as encouraging as SPY, DJIA and NASDAQ.

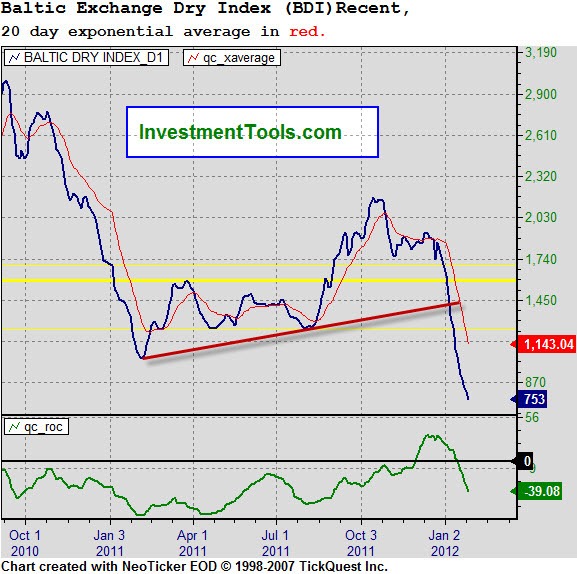

Baltic Dry Index chart:

Input:

- Shipment index was a total disgrace. What is it trying to warn us?

No comments:

Post a Comment