BULL or BEAR ??

| Short term (1 week) | Notes |

| -- Long term chart for all 3 indexes are still healthy and has room to go up further, but approaching the trend line resistance. -- NASDAQ has reach a short term top. Expect short term of retracement coming week. -- Shipping index is taking a surprise tour to South Pole. Most shipping stocks are still crashing down. -- FXI and Copper is not showing strength. They are supposed to be a leading indicator. This is not too good of a sign. -- VXX is showing weakness. Bull is still in control so far. -- GLD and SLV are now in the third stage of downtrend. Very interesting charts. Bottom might soon be in place. -- Not much data coming out this week, but all fall on Thursday. -- Petrol still climbing. A good sign for economy?! -- All sector charts show that there is still room for going up. Generally bullish. |

SPY (30 years monthly) chart:

Input:

- Noting is in the way for SPY to go higher.

- Still staying above its 20MA line.

- Still a distance away from its downtrend resistance line.

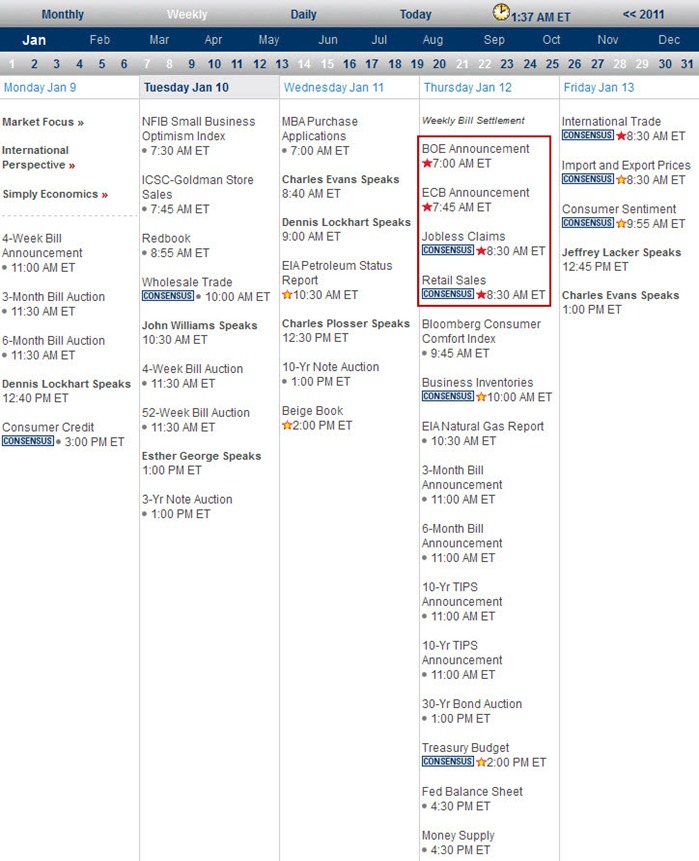

Next Week Economic Data (1 week):

Input:

- Not much data coming in the next week period except on Thursday. Should not have that much of volatility.

VXX chart:

Input:

- VXX is still showing weakness. Weekly chart shows that value has just fallen out of 50MA line and daily chart shows that value has dropped off the 200MA support line. Bull is pretty much in control.

SPY chart:

Input:

- Daily chart shows that it is still healthy and stay above 200MA line.

DJIA chart:

Input:

- Long term chart shows that nothing is blocking the way for DJIA to go higher.

- Weekly chart shows that it is still healthy but facing short term resistance from its 2010 Feb high point.

NASDAQ chart:

Input:

- Long term chart shows that it is still healthy and staying above the 20MA support line.

- Weekly chart shows that it is facing resistance from the down trend line and also its own 50MA line. Short term retracement is highly expected.

UUP chart:

Input:

- US Dollar is still in uptrend mode.

- Take note that the relationship between index and UUP is now direct proportional rather than reverse which mean is UUP goes up, index will go up too.

- This also say something about the retreat of GLD and SLV. USD is now a safe heaven compare to Gold.

Sector Analysis:

Input:

- All sectors show that there is still room for improvement. Market is overall still bullish.

Copper JJC chart:

Input:

- Copper and FXI are still in doubt. They are not really giving the same indicator like the three indexes.

- Copper is still weak but healthy and remain sitting on its 200MA line.

GLD and SLV charts:

Input:

- Interesting charts for both GLD and SLV. Both of them are in their third stage of downtrend.

- It is a waste that I missed this downtrend. Not doing enough homework myself.

Petrol and Natural Gas charts:

Input:

- Petrol keep climbing higher. Indicating better economy ahead?!

- UNG is taking a tour to the South Pole. Not sure whether it has reach the destination yet.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Interesting! FXI is showing weakness despite the fact that USA index is heading North.

- It is now sitting on its 20MA line support.

Baltic Dry Index chart:

Input:

- A quick and surprise detour of the shipment index. They are heading south. This is definitely not good.

- All shipping stocks are still crashing down.

No comments:

Post a Comment