BULL or BEAR ??

| Short term (1 week) | Notes |

|

| -- The downgrades of Spain, Italy and etc by Moody seems to be not effective at all to create a bear market. -- Every time after a down day, it follow by another big up day the next day. This is pretty bullish sign. -- Greece headlines will still return in the next couple of days. -- Daily VXX is still sitting on the daily 20MA line. This is a threat to the market. -- Daily NASDAQ chart has overtake the previous May 2011 top. DJIA is now challenging the May 2011 top again. Now SPY is going to challenge the May 2011 also. This is a very bullish sign. -- All sectors are still healthy and up trend is still intact. -- Shipping stocks are all doing the magic wonder, shooting to the sky. -- Natural gas UNG seem to bottom up. -- UUP is still under the control of long term 20MA line. |

SPY (30 years monthly) chart:

Input:

- Long term monthly SPY chart shows that SPY is still strong and healthy.

- Volume is residing. Will this be a good news or not?

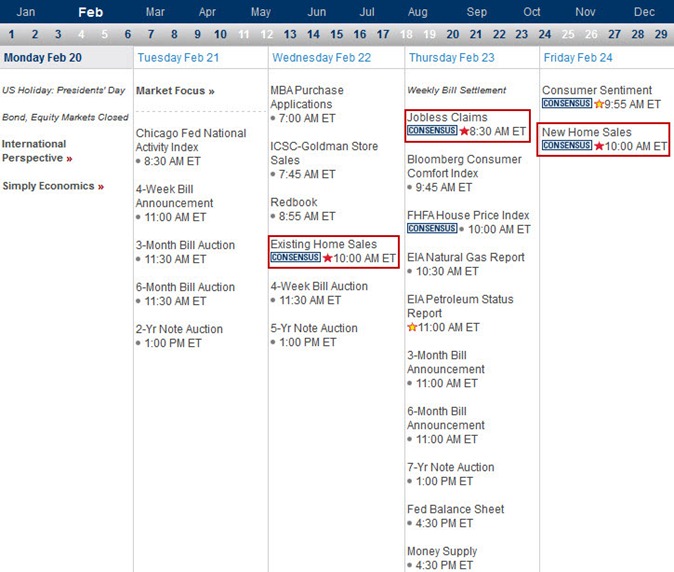

Next Week Economic Data (1 week):

Input:

- Not much data is expected next week. Volatility should be lower compare to last week.

VXX chart:

Input:

- The trend line has successfully predicted the volatility last week.

- Its value is now sitting on the 20MA line. It is still a big threat to the market rally.

SPY chart:

Input:

- Daily SPY chart shows that it will challenge the May 2011 top with the 20MA line as a support.

- Since NASDAQ has overtake the May 2011 top and DJIA is again challenging the May 2011 top, this is a very bullish sign to the market. Should be able to help SPY to achieve the same objective too.

DJIA chart:

Input:

- Long term DJIA chart is still strong and healthy.

- Value still staying about the resistance trend line in the monthly chart.

- Daily chart shows that it is again challenging the May 2011 high again with the 20MA line moving upward as support line. This is quite bullish.

- However, secondary indicators such as MACD are starting to point towards slow down.

NASDAQ chart:

Input:

- Long term NASDAQ chart is still strong and healthy.

- Value still staying above the support trend line at the monthly chart.

- Daily chart shows that the value has exceeded the May 2011 high. This is very bullish.

UUP chart:

Input:

- Long term UUP chart is still under the control of 20MA line. Still staying under the long term down trend.

Sector Analysis:

Input:

- All sectors still behave in a healthy and bullish manner.

- Utility is a bit weaker, but that is the norm trend in a bull market. Isn't it?

Copper JJC chart:

Input:

- Long term copper chart is still under the control of 20MA line. However, up trend is still in progress even though it is slow and not obvious.

GLD and SLV charts:

Input:

- Long term GLD chart still show weakness. Price is still under the control of the down trend line.

- Expect the price to probably dropped and touch the long term uptrend line before rebound.

- GLD MACD seems to start a bearish cross.

- Monthly SLV chart shows the down trend much clearer. SLV price is still under the pressure of the down trend line.

- Bearish cross of MACD in SLV is much clearly seen; however, the 20MA will act as the support line.

Petrol and Natural Gas charts:

Input:

- Petrol is still staying on top of the long term 20MA line.

- Current upward movement of USO is driven by the issue from the middle east.

- Natural Gas UNG seems to establish a good bottom.

- After 3 and a half months, this is the first time UNG managed to get on top of 20MA line.

- Anybody who has interest to go long in UNG should monitor closely for good entry.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI has came out of the triangle formation. Currently challenging the long term 20MA line.

- This should be a bullish indicator.

- If it manage to overtake the long term 20MA line, more upward move will follow.

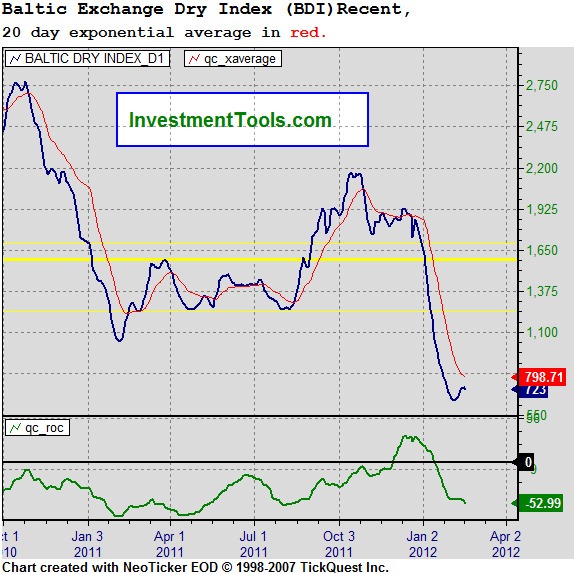

Baltic Dry Index chart:

Input:

- As I mentioned last week. Shipping stocks have started to turned around. If you checked them out, they have rallied extremely STRONG!

- I was RIGHT, but again, I did not take the position. Big mistake for a trader.

No comments:

Post a Comment