BULL or BEAR ??

| Short term (1 week) | Notes |

| -- Daily charts for all 3 indexes are showing short term weakness. Should expect at least short term correction. Long term trend is still healthy. -- GLD and SLV seems to indicate downturn already. -- FXI is still weak, price still not able to overtake its resistance line. -- USO suddenly got hit and price fall below its monthly 20MA line. -- UNG shows some color this time. -- Copper has shown weakness again. -- Baltic index is still improving, but many shipping stocks are making correction from their previous big rally. -- Almost all sectors are falling out of its trend line or its 50MA lines. -- VXX completed its double bottom. Quite dangerous for stock market. |

SPY (30 years monthly) chart:

Input:

- For entire April month, SPY is not able to break out the March high.

- Long term wise, SPY is still healthy.

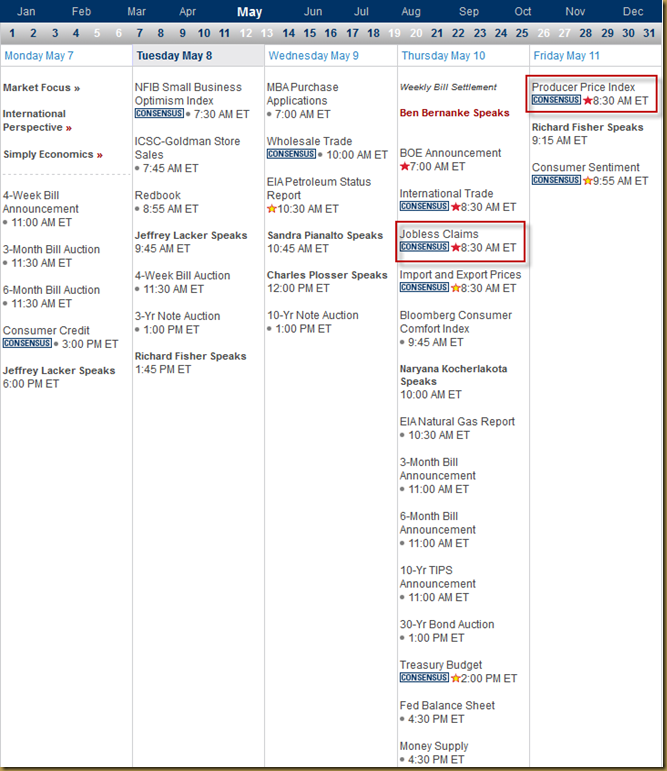

Next Week Economic Data (1 week):

Input:

- Not much data in the pipeline at all for the entire next week.

- All index technical charts should follow what it is suppose to do.

VXX chart:

Input:

- Daily VXX chart indicating that it has completed a double bottom formation which is bearish for the stock market.

- Its 20MA line is still its resistance line.

- All secondary indicators are starting to show strength.

SPY chart:

Input:

- Value of SPY has dropped below both its daily 20MA and 50MA lines. Value now sitting on the neckline support line.

- All secondary indicators are not doing very well, pointing South.

DJIA chart:

Input:

- Long term wish, DJIA is still healthy.

- Weekly chart shows that it will most probably drop to its weekly 20MA support line again.

NASDAQ chart:

Input:

- Long term wise, NASDAQ is still healthy.

- Weekly and daily chart indicate that it has pretty high chances of dropping to 2900.

- All secondary indicators are going South.

- Value has dropped below its daily 20MA and 50MA again and now sitting on the neckline support line.

UUP chart:

Input:

- UUP movement is still stuck between its triangle formation. Uptrend is still intact. However, all secondary indicators are showing weakness.

- Be careful, UUP movement is going to affect my intention to short GLD and SLV.

Sector Analysis:

Input:

- Almost all sectors are falling out of its trend line or its 50MA lines.

Copper JJC chart:

Input:

- Copper has again show weakness. Price has dropped below trend line and its weekly 20MA line again. All secondary indicators are not making much improvement too.

GLD and SLV charts:

Input:

- All the secondary indictors for GLD in the weekly and monthly charts are showing more and more downward movement.

- SLV weekly chart has again dropped through its support trend line at $29.00 and also its weekly 100MA line. All secondary indicators are also moving more and more downward.

- It is time to short GLD and SLV. Watch out for a good entry.

- However, watch out for UUP movement.

Petrol and Natural Gas charts:

Input:

- Natural gas has shown some color this time. I was late to catch it.

- Price has again punched through the 20MA line, but face resistance from 50MA line.

- Watch closely and look for good entry.

- USO has dropped below its long term monthly 20MA line.

- USO intraday chart shows a pretty drastic drop.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- FXI shows that it has not been able to take out the resistance line.

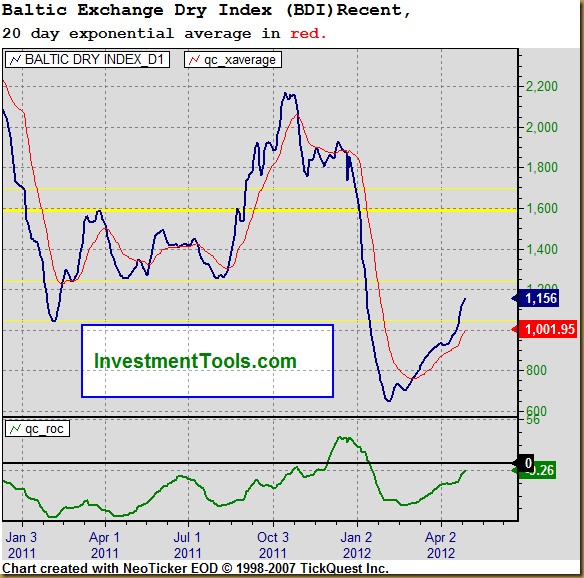

Baltic Dry Index chart:

Input:

- Shipment index is still going up. Impressive!

- Be careful, many shipment stocks actually making correction.

No comments:

Post a Comment