BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

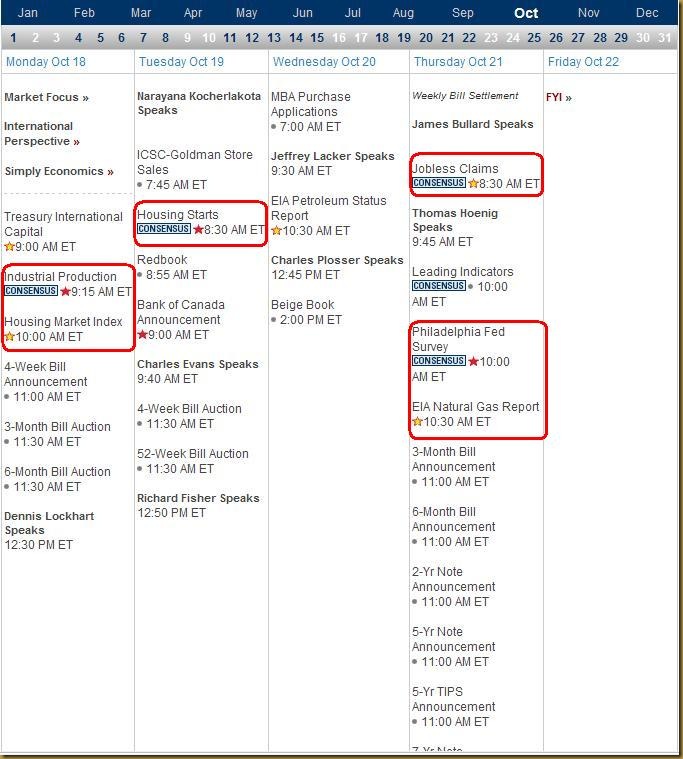

Next Week Economic Data:

VXX chart:

Input:

- VXX keep going lower. Now it is even beneath the downtrend line some more. Could this be the second wave down?

SPY chart:

Input:

- The short term Up Trend line is still intact.

- Approaching the 200MA line. This is going to be very intersting.

- Long term MACD still bullish.

NASDAQ chart:

Input:

- Even DJIA is in red, NASDAQ is very bullish driven by GOOG financial report.

- Entire technology sector is very Bullish, including AMZN, AAPL, YHOO

DJIA chart:

Input:

- Penetrated 200MA line

- 11K point is now a strong support line

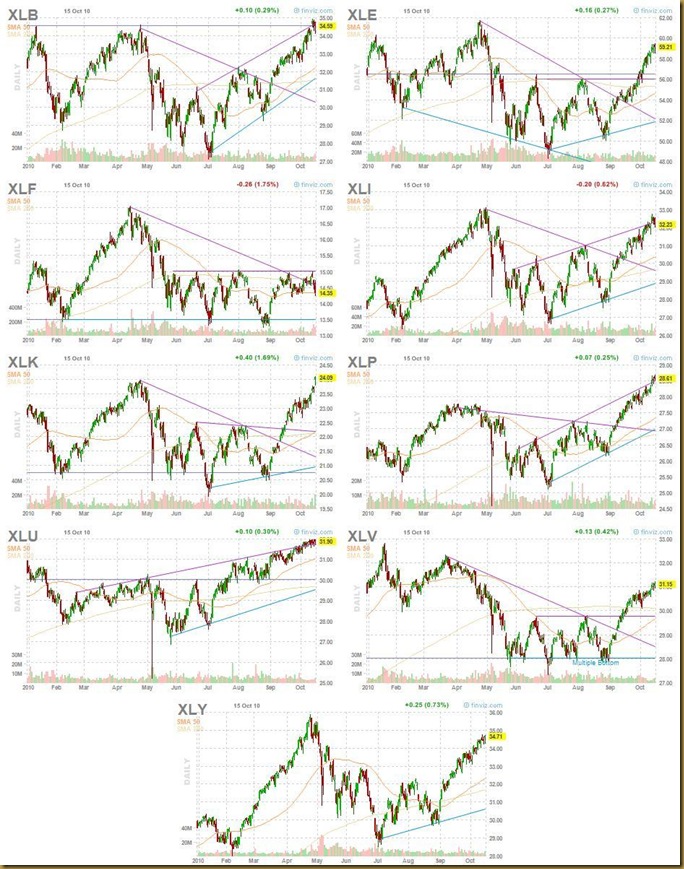

Sector Analysis:

Input:

- Only financial sector XLF is showing a slow down, resting on its 50MA line.

- XLB, XLI, XLU and XLP are all reaching the trend line resistance.

No comments:

Post a Comment