BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

| -- No reason at all for me to call off this BULL with such an awful VXX chart | -- Will not call off this BEAR before DJIA broke 11,200 point for sure |

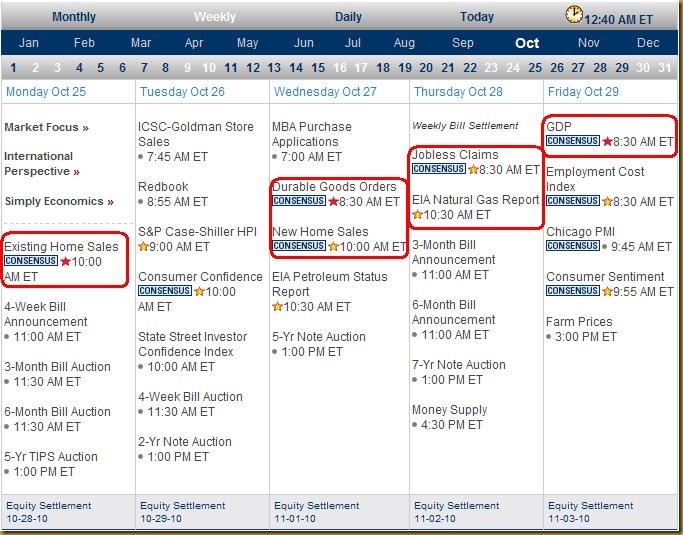

Next Week Economic Data:

VXX chart:

Input:

- BULLs are marching in strong. Don’t go into reverse ETF.

SPY chart:

Input:

- Intraday chart shows that it should penetrate the top line on Monday next week.

- Long term chart shows that it still have energy to come to 120 point where the resistance of 200MA line is.

DJIA chart:

Input:

- Intraday DJIA chart also shows the willingness to penetrate the top next week.

- Long term charts shows that it might retest the 11,200 point next week.

NASDAQ chart:

Input:

- Same thing. Penetration thru the top is very likely.

- All the Big Boys like AMZN, GOOG and EBAY reported good profits, bullish sentiment.

Sector Analysis:

Input:

- I could have made "a lot" of $$ just trading these ETF, if I have paid attention to them.

GLD, SLV and UUP charts:

Input:

- Looks like commodities and USD have reversed course.

![clip_image001[6] clip_image001[6]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiBtN1ehh-c_FeeshyphenhyphensHtMEptuStxyi9CuehMYDApb7ywMYf0nI1y8TLj7HBUeNT1iiraOxt8ORzV6RlId3Co1JclJiNBmQQ4lNmQGUX9a0ja_VXECc_ct-XehBK_64_un04zD1IByOduk//?imgmax=800)

No comments:

Post a Comment