BULL or BEAR ??

| Short term (1 week) | Long term (6 months) |

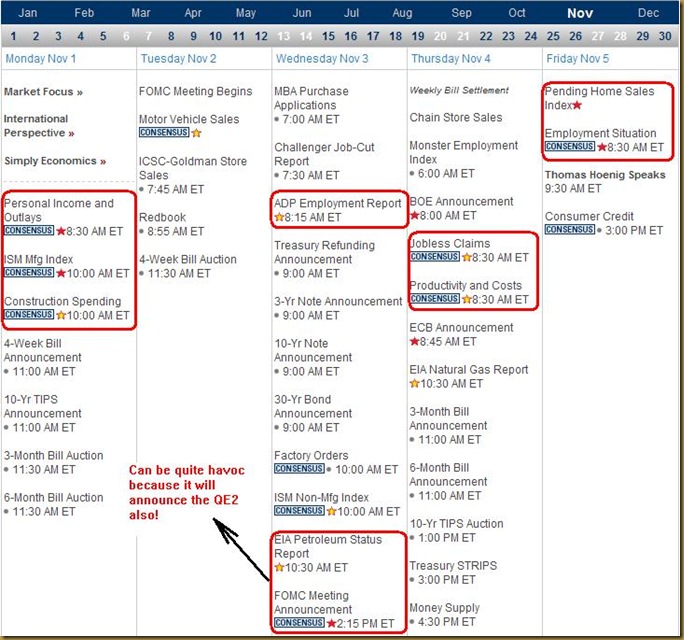

| -- We could be at a turning point. VXX is posing some threat. -- MACD in daily charts of SPY and DJIA has started to turn negative. -- The QE2 and interest rate announcement will be the key. -- Get ready to turn to BEAR when it happens. | -- Will not call off this BEAR before DJIA broke 11,200 point for sure |

Next Week Economic Data:

VXX chart:

Input:

- Be careful, VXX could be bottom up. It should all depend on the FOMC day on Wednesday.

SPY chart:

Input:

- Daily 6 month chart shows that SPY is still intact, but MACD is starting to show bearish sentiment.

- Some kind of correction might start. Long term chart shows that price are retreating from the 200MA line.

DJIA chart:

Input:

- Same as SPY.

- 11K point is a very important support point at 200MA line.

- Daily 6 month chart MACD start to turn bearish

NASDAQ chart:

Input:

- NASDAQ is still very strong and it still has room to grow.

Sector Analysis:

Input:

- XLK is still very bullish. That explain why NASDAQ still not stopping.

GLD, SLV and UUP charts:

Input:

- UNG is quite interesting, looks like already bottom.

- UUP is fluctuating quite heavily at bottom. Could be in progress of deciding bottom.

- USO continue to be block by the trendline.

No comments:

Post a Comment