BULL or BEAR ??

| Short term (1 week) | Notes |

| -- There are just too many data for the market to handle next week. -- All index daily chart started to broke down from its 20MA and 50MA lines. -- Both SPY and DJIA daily charts seems to show the formation of Head-n-Shoulder. -- AAPL stock was hit, creating quite an impact to the market too. -- FXI is rebounding, but price still remain below the monthly 20MA line. -- Copper is still weak. -- GLD and SLV looks weak and could be a candidate for short next week. -- USO is also getting weaker. -- Most sectors have indicate the establishment of downtrend. -- VXX is still circling at its multiple low. -- UUP is right at the tip of its monthly chart. -- More and more articles on MarketWatch are indicating bearishness. |

SPY (30 years monthly) chart:

Input:

- SPY might indicate the end of wave 5. If that is the case, we are going down ---" This is Captain speaking, please kindly tighten your seat belt."

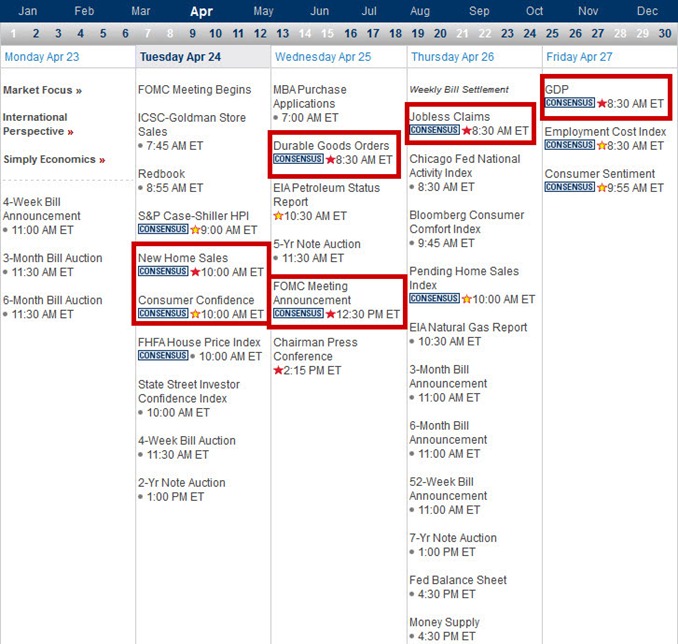

Next Week Economic Data (1 week):

Input:

- No wonder the stock market is so volatile, there are just too many data to be digested next week.

VXX chart:

Input:

- Monthly VXX chart shows that it is sitting on the multiple bottom trend line.

- Weekly VXX chart shows that it is resting on the downtrend line.

- Daily VXX chart shows that the price has dropped slightly below the 20MA line. However, all secondary indicators are pointing upward.

SPY chart:

Input:

- Weekly SPY chart shows that it resting on the previous May 2011 high. However, uptrend line is obviously broken but still maintain above 20MA line.

- Daily SPY chart shows its 20MA line started to curve down. Price has broken down not just the 20MA line, but also 50MA line.

- All secondary indicators in the daily SPY chart are pointing downward.

- A possible top of Head-n-Shoulder could be forming at the top of daily SPY chart with the neck line around 136.00

DJIA chart:

Input:

- Its monthly chart is similar to SPY chart.

- Its weekly chart is also similar to SPY chart except that it is stronger; however, its MACD is starting to do the bearish cross.

- Similar to SPY, all the secondary indicators of DJIA are pointing downward. A possible Head-n-Shoulder at around 12,700.

NASDAQ chart:

Input:

- Looks like the damage done by AAPL to NASDAQ is pretty significant.

- However, it is still the strongest index among the three.

- No obvious Head-n-Shoulder at the daily NASDAQ chart, except the HEAD part.

- Price has broken down from 20MA and also 50MA line in the daily chart. It is now resting on the support trend line from the March high. However, it looks like it can break down anytime now.

- All secondary indicators of NASDAQ daily chart are pointing South.

UUP chart:

Input:

- What a fantastic monthly chart for UUP. It is now right at the tip point.

- It can be seen clearly that price is still struggling inside the ending part of the triangle formation.

Sector Analysis:

Input:

- More and more prove of downtrend are starting to emerge for most of the sectors. Even though their main uptrend is still not really broken.

Copper JJC chart:

Input:

- It is clear that Copper is still showing a lot of weakness.

GLD and SLV charts:

Input:

- Looks like it is safe to start calling short for both GLD and SLV.

- SLV price has fall out of monthly 20MA line. All secondary indicators are all pointing South.

- GLD price has started to breach the uptrend line. All secondary indicators are also going South.

Petrol and Natural Gas charts:

Input:

- Price still staying above its monthly 20MA line for USO.

- There is only one single word for UNG ---- UGLY !!!

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Even though FXI has rebounded recently, on the monthly chart it is obvious that the price is still below 20MA line.

- Weekly and daily FXI charts also show that the price is still controlled by its 50MA line.

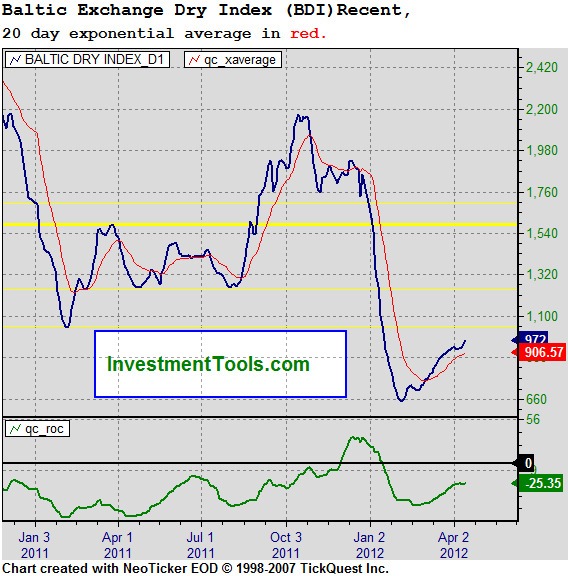

Baltic Dry Index chart:

Input:

- Shipping index is showing some strength, interesting!

No comments:

Post a Comment