BULL or BEAR ??

| Short term (1 week) | Notes |

| -- VXX is still indicating that bull is still in charge. -- All 3 indexes are still healthy and moving in the positive direction. -- Shipping Baltic index is still in uptrend move. -- Long term GLD and SLV is still not showing any clear direction. -- All sectors charts are still healthy and mostly are still in the uptrend move, except the energy sector. -- Long term copper and USO are still in uptrend direction. -- China index FXI is the only index that has started to move in the downtrend direction. -- Natural gas is the ugliest of all. -- UUP chart is still in the downtrend and bounded by its 20MA line. |

SPY (30 years monthly) chart:

Input:

- Long term monthly SPY chart is still healthy and in the uptrend.

Next Week Economic Data (1 week):

Input:

- Not sure how the FOMC minutes will affect the market.

- Data on Thursday and Friday should play bigger role.

VXX chart:

Input:

- Long term VXX chart shows that its value is still dropping and dropped passed the support line.

- Weekly chart shows that it has dropped through the support line of 20.

SPY chart:

Input:

- Daily SPY chart indicating steady move in the upward direction with the 20MA line following through.

DJIA chart:

Input:

- Similar to SPY, long term DJIA chart is still healthy and marching upwards.

NASDAQ chart:

Input:

- Similar to SPY and DJIA, long term NASDAQ is healthy and still remain in uptrend.

UUP chart:

Input:

- Long term UUP chart shows that the downtrend is still intact and is now at a critical juncture.

Sector Analysis:

Input:

- Most sectors' uptrend are still intact.

- XLB and XLU are moving sideways.

- XLE is the only sector that is moving lower.

Copper JJC chart:

Input:

- Long term JJC chart shows that it is still in uptrend, but is bounded by the 20MA line.

GLD and SLV charts:

Input:

- No clear direction for both GLD and SLV yet.

- Long term chart secondary indicators are moving in a bearish direction.

Petrol and Natural Gas charts:

Input:

- Long term USO shows that it is still in uptrend.

- Daily USO chart shows that all secondary indicators are getting much weaker and its value has dropped through the support line.

- There is just no end insight for the ugly natural gas UNG.

FXI (iShares FTSE / Xinhua China 25 Index Fund) chart:

Input:

- Long term FXI chart shows how well it behave at the 20MA line.

- Now it has started to broke the uptrend direction and started the downtrend.

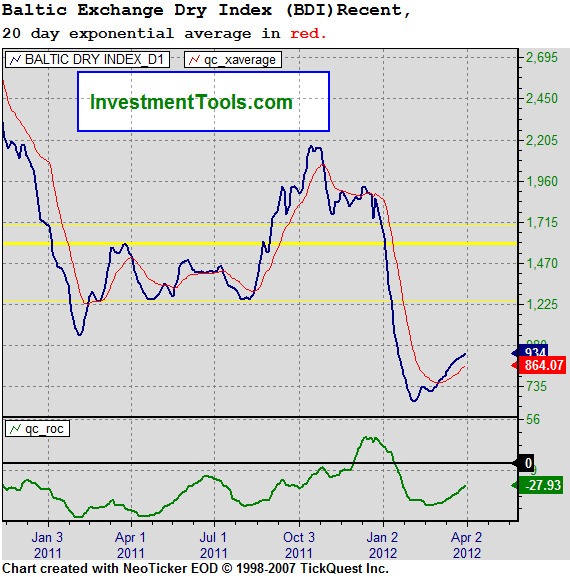

Baltic Dry Index chart:

Input:

- Shipment index is still in positive trend.

- Shipping stocks have also shown rebound activity.

No comments:

Post a Comment